Evotec Results Presentation Deck

in € m¹)

evotec

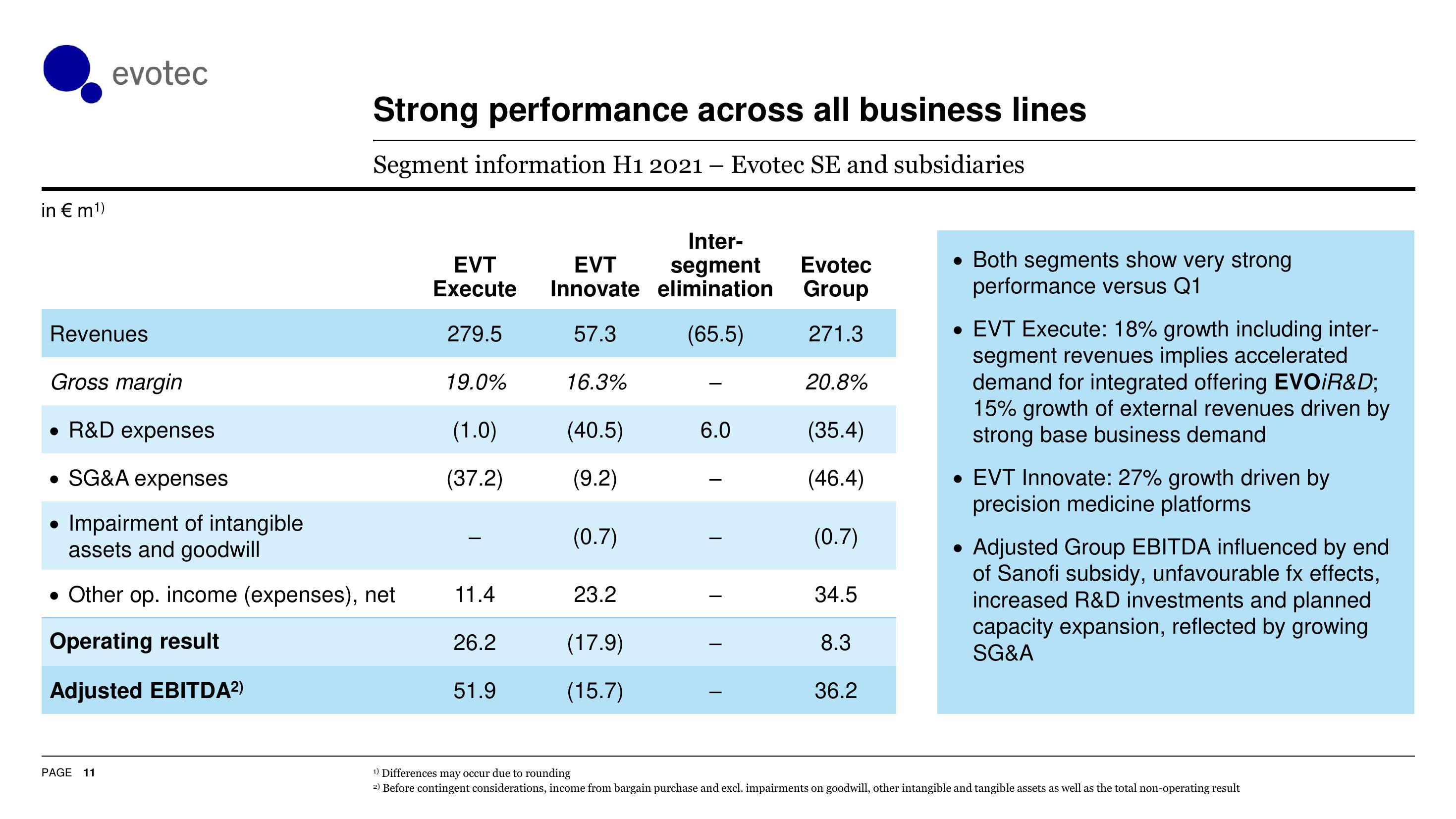

Revenues

PAGE 11

Strong performance across all business lines

Segment information H1 2021- Evotec SE and subsidiaries

Gross margin

• R&D expenses

• SG&A expenses

Impairment of intangible

assets and goodwill

• Other op. income (expenses), net

Operating result

Adjusted EBITDA²)

Inter-

EVT

EVT

segment

Execute Innovate elimination

279.5

57.3

(65.5)

19.0%

(1.0)

(37.2)

11.4

26.2

51.9

16.3%

(40.5)

(9.2)

(0.7)

23.2

(17.9)

(15.7)

6.0

T

Evotec

Group

271.3

20.8%

(35.4)

(46.4)

(0.7)

34.5

8.3

36.2

. Both segments show very strong

performance versus Q1

• EVT Execute: 18% growth including inter-

segment revenues implies accelerated

demand for integrated offering EVOIR&D;

15% growth of external revenues driven by

strong base business demand

• EVT Innovate: 27% growth driven by

precision medicine platforms

Adjusted Group EBITDA influenced by end

of Sanofi subsidy, unfavourable fx effects,

increased R&D investments and planned

capacity expansion, reflected by growing

SG&A

¹) Differences may occur due to rounding

2) Before contingent considerations, income from bargain purchase and excl. impairments on goodwill, other intangible and tangible assets as well as the total non-operating resultView entire presentation