HSBC Investor Day Presentation Deck

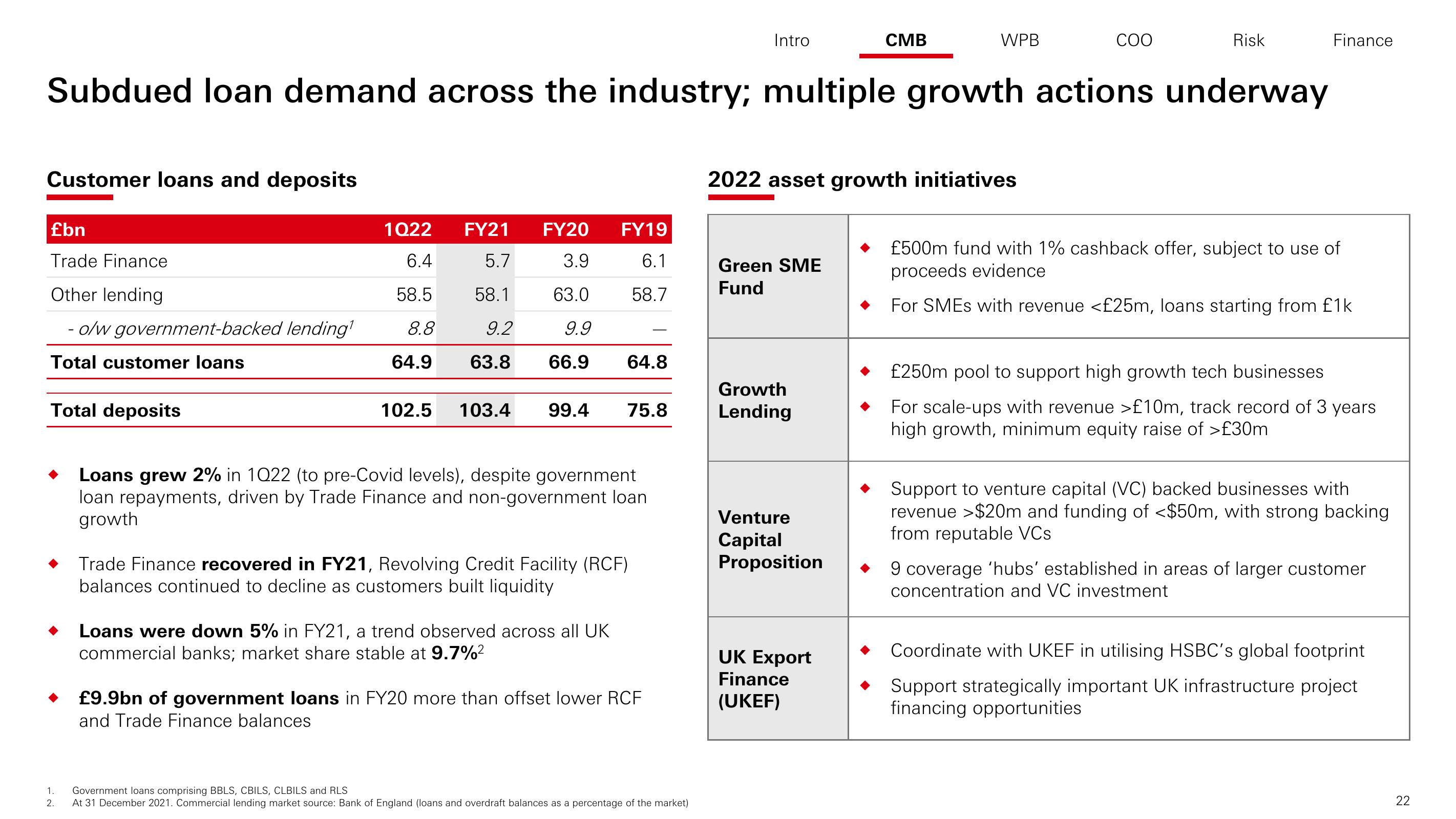

Customer loans and deposits

£bn

Trade Finance

Other lending

o/w government-backed lending¹

Total customer loans

Subdued loan demand across the industry; multiple growth actions underway

Total deposits

1.

2.

1022

6.4

58.5

8.8

64.9

FY21 FY20 FY19

5.7

3.9

6.1

58.1

63.0

58.7

9.2

9.9

63.8 66.9 64.8

102.5 103.4 99.4 75.8

Loans grew 2% in 1022 (to pre-Covid levels), despite government

loan repayments, driven by Trade Finance and non-government loan

growth

Trade Finance recovered in FY21, Revolving Credit Facility (RCF)

balances continued to decline as customers built liquidity

Loans were down 5% in FY21, a trend observed across all UK

commercial banks; market share stable at 9.7%²

£9.9bn of government loans in FY20 more than offset lower RCF

and Trade Finance balances

Intro

Government loans comprising BBLS, CBILS, CLBILS and RLS

At 31 December 2021. Commercial lending market source: Bank of England (loans and overdraft balances as a percentage of the market)

Green SME

Fund

2022 asset growth initiatives

Growth

Lending

CMB

Venture

Capital

Proposition

WPB

UK Export

Finance

(UKEF)

COO

Risk

Finance

£500m fund with 1% cashback offer, subject to use of

proceeds evidence

For SMEs with revenue <£25m, loans starting from £1k

£250m pool to support high growth tech businesses

For scale-ups with revenue >£10m, track record of 3 years

high growth, minimum equity raise of >£30m

Support to venture capital (VC) backed businesses with

revenue >$20m and funding of <$50m, with strong backing

from reputable VCs

9 coverage 'hubs' established in areas of larger customer

concentration and VC investment

Coordinate with UKEF in utilising HSBC's global footprint

◆ Support strategically important UK infrastructure project

financing opportunities

22View entire presentation