J.P.Morgan Results Presentation Deck

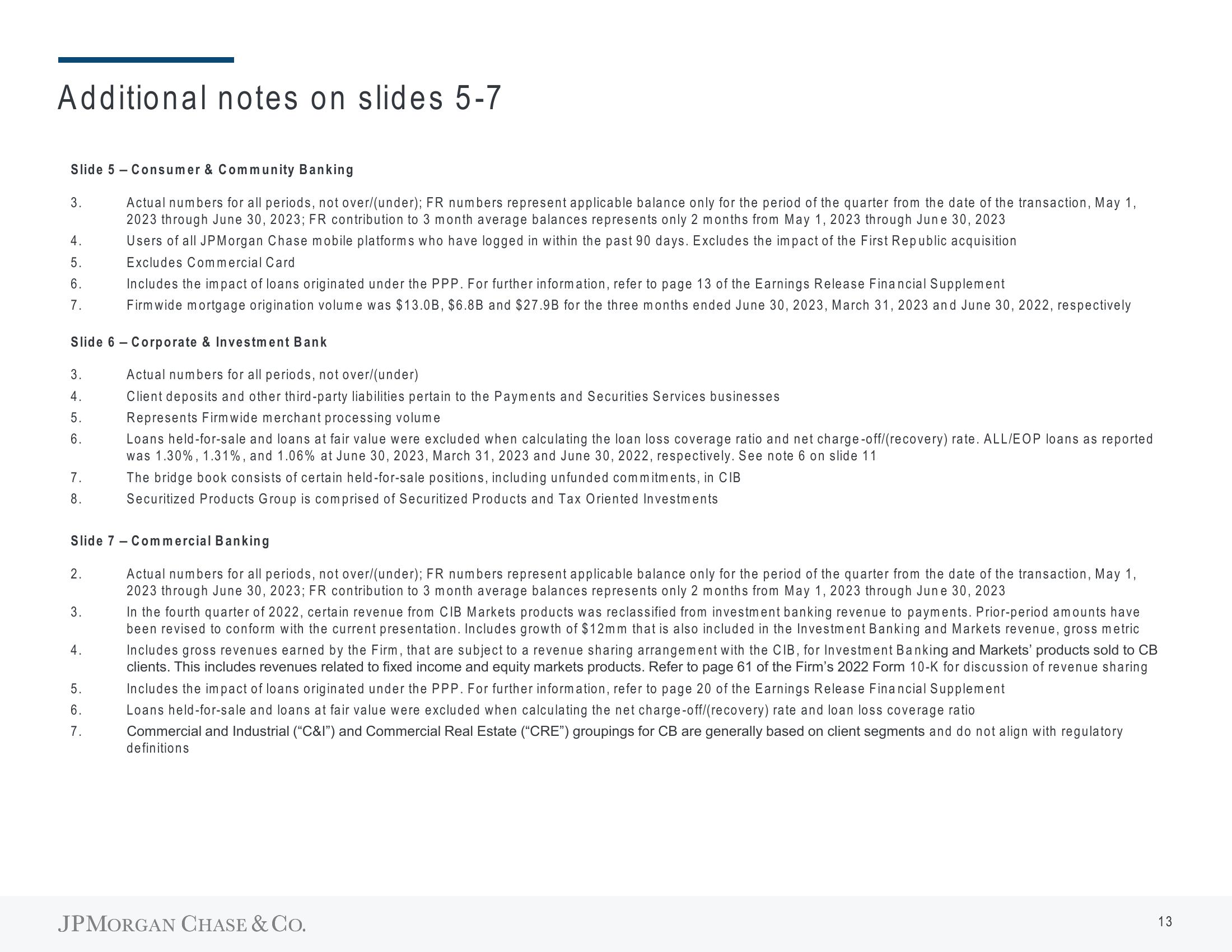

Additional notes on slides 5-7

Slide 5 Consumer & Community Banking

Actual numbers for all periods, not over/(under); FR numbers represent applicable balance only for the period of the quarter from the date of the transaction, May 1,

2023 through June 30, 2023; FR contribution to 3 month average balances represents only 2 months from May 1, 2023 through June 30, 2023

Users of all JPMorgan Chase mobile platforms who have logged in within the past 90 days. Excludes the impact of the First Republic acquisition

Excludes Commercial Card

3.

4.

5.

6.

7.

Includes the impact of loans originated under the PPP. For further information, refer to page 13 of the Earnings Release Financial Supplement

Firmwide mortgage origination volume was $13.0B, $6.8B and $27.9B for the three months ended June 30, 2023, March 31, 2023 and June 30, 2022, respectively

Slide 6 - Corporate & Investment Bank

Actual numbers for all periods, not over/(under)

Client deposits and other third-party liabilities pertain to the Payments and Securities Services businesses

3.

4.

5.

6.

7.

8.

Slide 7 - Commercial Banking

Actual numbers for all periods, not over/(under); FR numbers represent applicable balance only for the period of the quarter from the date of the transaction, May 1,

2023 through June 30, 2023; FR contribution to 3 month average balances represents only 2 months from May 1, 2023 through June 30, 2023

2.

3.

4.

Represents Firm wide merchant processing volume

Loans held-for-sale and loans at fair value were excluded when calculating the loan loss coverage ratio and net charge-off/(recovery) rate. ALL/EOP loans as reported

was 1.30%, 1.31%, and 1.06% at June 30, 2023, March 31, 2023 and June 30, 2022, respectively. See note 6 on slide 11

The bridge book consists of certain held-for-sale positions, including unfunded commitments, in CIB

Securitized Products Group is comprised of Securitized Products and Tax Oriented Investments

5.

6.

7.

In the fourth quarter of 2022, certain revenue from CIB Markets products was reclassified from investment banking revenue to payments. Prior-period amounts have

been revised to conform with the current presentation. Includes growth of $12mm that is also included in the Investment Banking and Markets revenue, gross metric

Includes gross revenues earned by the Firm, that are subject to a revenue sharing arrangement with the CIB, for Investment Banking and Markets' products sold to CB

clients. This includes revenues related to fixed income and equity markets products. Refer to page 61 of the Firm's 2022 Form 10-K for discussion of revenue sharing

Includes the impact of loans originated under the PPP. For further information, refer to page 20 of the Earnings Release Financial Supplement

Loans held-for-sale and loans at fair value were excluded when calculating the net charge-off/(recovery) rate and loan loss coverage ratio

Commercial and Industrial ("C&I") and Commercial Real Estate ("CRE") groupings for CB are generally based on client segments and do not align with regulatory

definitions

JPMORGAN CHASE & CO.

13View entire presentation