Embracer Group Mergers and Acquisitions Presentation Deck

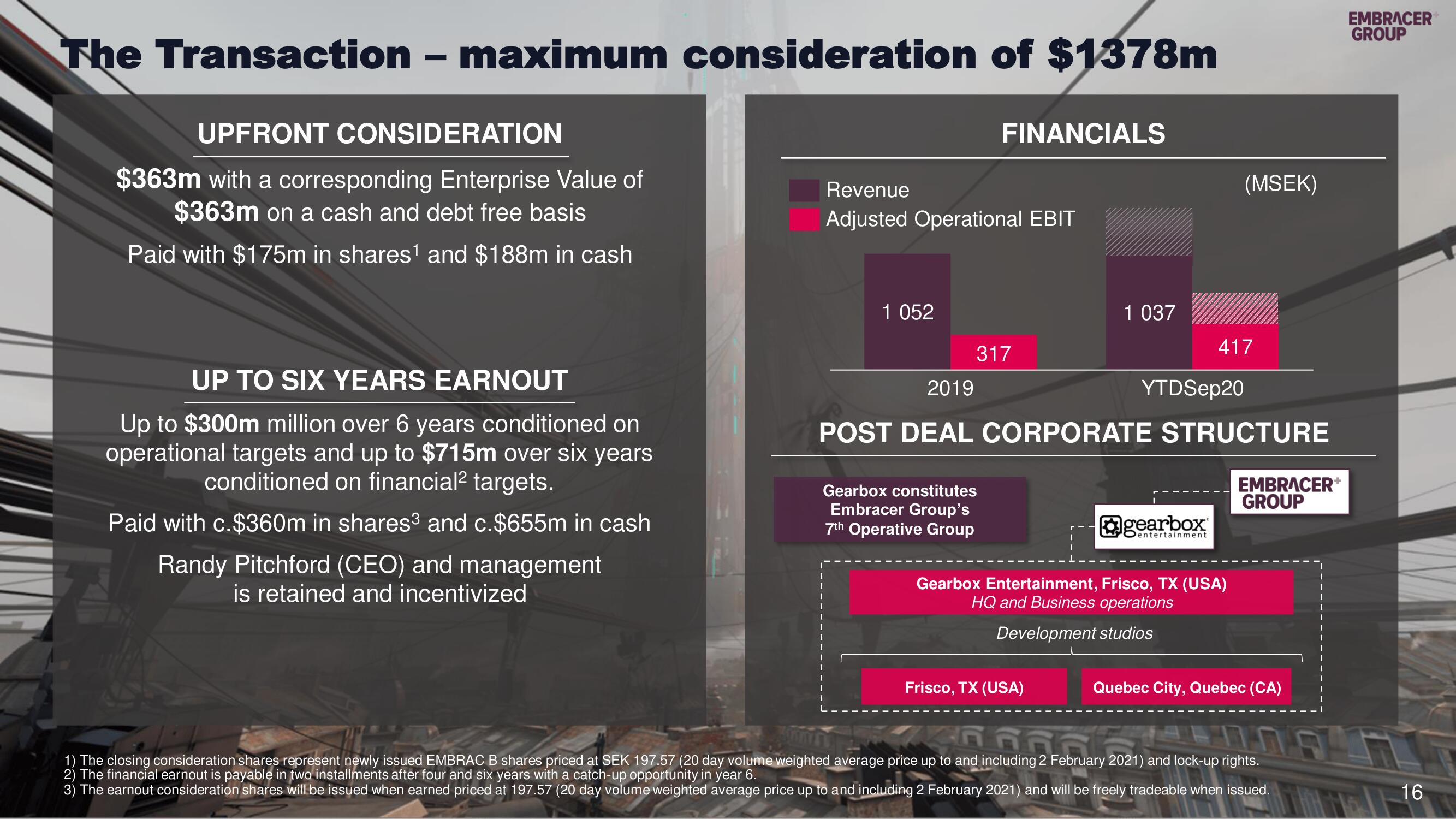

The Transaction maximum consideration of $1378m

UPFRONT CONSIDERATION

$363m with a corresponding Enterprise Value of

$363m on a cash and debt free basis

Paid with $175m in shares¹ and $188m in cash

UP TO SIX YEARS EARNOUT

Up to $300m million over 6 years conditioned on

operational targets and up to $715m over six years

conditioned on financial² targets.

Paid with c.$360m in shares³ and c.$655m in cash

Randy Pitchford (CEO) and management

is retained and incentivized

Revenue

Adjusted Operational EBIT

1 052

FINANCIALS

317

Gearbox constitutes

Embracer Group's

7th Operative Group

1 037

Frisco, TX (USA)

2019

POST DEAL CORPORATE STRUCTURE

YTDSep20

417

gearbox

entertainment.

(MSEK)

Gearbox Entertainment, Frisco, TX (USA)

HQ and Business operations

Development studios

EMBRACER+

GROUP

Quebec City, Quebec (CA)

nd including 2 February 2021

February

1) The closing consideration shares represent newly issued EMBRAC B shares priced at SEK 197.57 (20 day volume weighted average price up to and including 2

2) The financial earnout is payable in two installments after four and six years with a catch-up opportunity in year 6.

3) The earnout consideration shares will be issued when earned priced at 197.57 (20 day volume weighted average price up to and including 2 February 2021) and will be freely tradeable when issued.

2021) and lock-up rights.

EMBRACER

GROUP

16View entire presentation