Silicon Valley Bank Results Presentation Deck

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

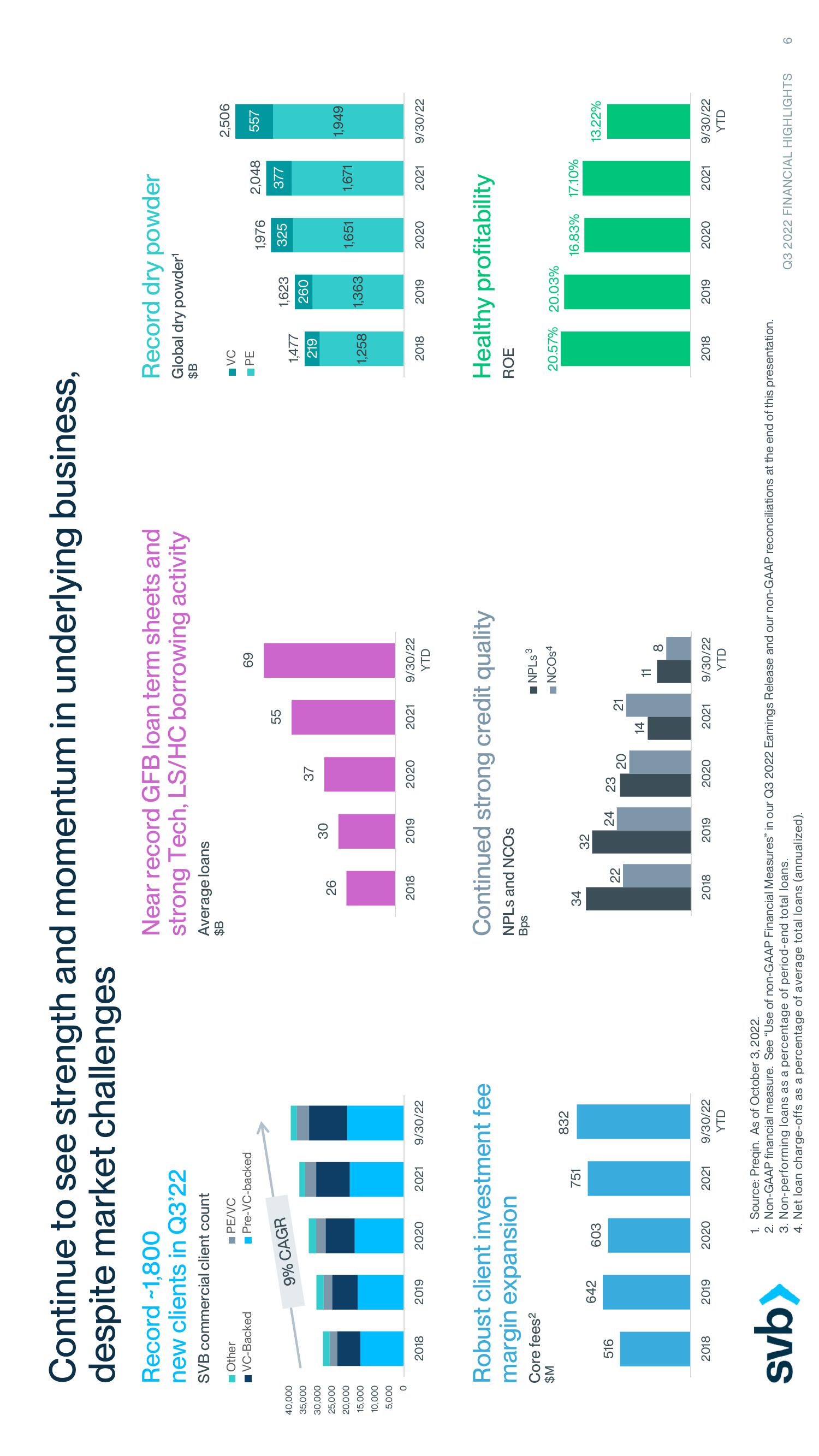

Continue to see strength and momentum in underlying business,

despite market challenges

Record -1,800

new clients in Q3'22

SVB commercial client count

PE/VC

■ Other

■VC-Backed

2018

Core fees²

$M

516

2018

9% CAGR

2019

Robust client investment fee

margin expansion

642

Pre-VC-backed

2019

svb>

2020

603

2021 9/30/22

2020

751

2021

832

9/30/22

YTD

Near record GFB loan term sheets and

strong Tech, LS/HC borrowing activity

Average loans

$B

26

2018

34

22

30

2018

2019

32

24

37

Continued strong credit quality

NPLs and NCOS

Bps

2019

2020

23

20

55

2020

2021

14

21

69

2021

9/30/22

YTD

NPLs ³

■NCOS4

11

8

9/30/22

YTD

Record dry powder

Global dry powder¹

$B

■VC

■PE

1,477

219

1,258

2018

1,623

260

2018

1,363

1. Source: Preqin. As of October 3, 2022.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q3 2022 Earnings Release and our non-GAAP reconciliations at the end of this presentation.

3. Non-performing loans as a percentage of period-end total loans.

4. Net loan charge-offs as a percentage of average total loans (annualized).

2019

1,976

325

2019

1,651 1,671

2020

Healthy profitability

ROE

2,048 557

377

2,506

20.57% 20.03%

16.83% 17.10%

Ilmi

2020

1,949

2021 9/30/22

13.22%

2021 9/30/22

YTD

Q3 2022 FINANCIAL HIGHLIGHTS 6View entire presentation