Bridge Investment Group Results Presentation Deck

Appendix

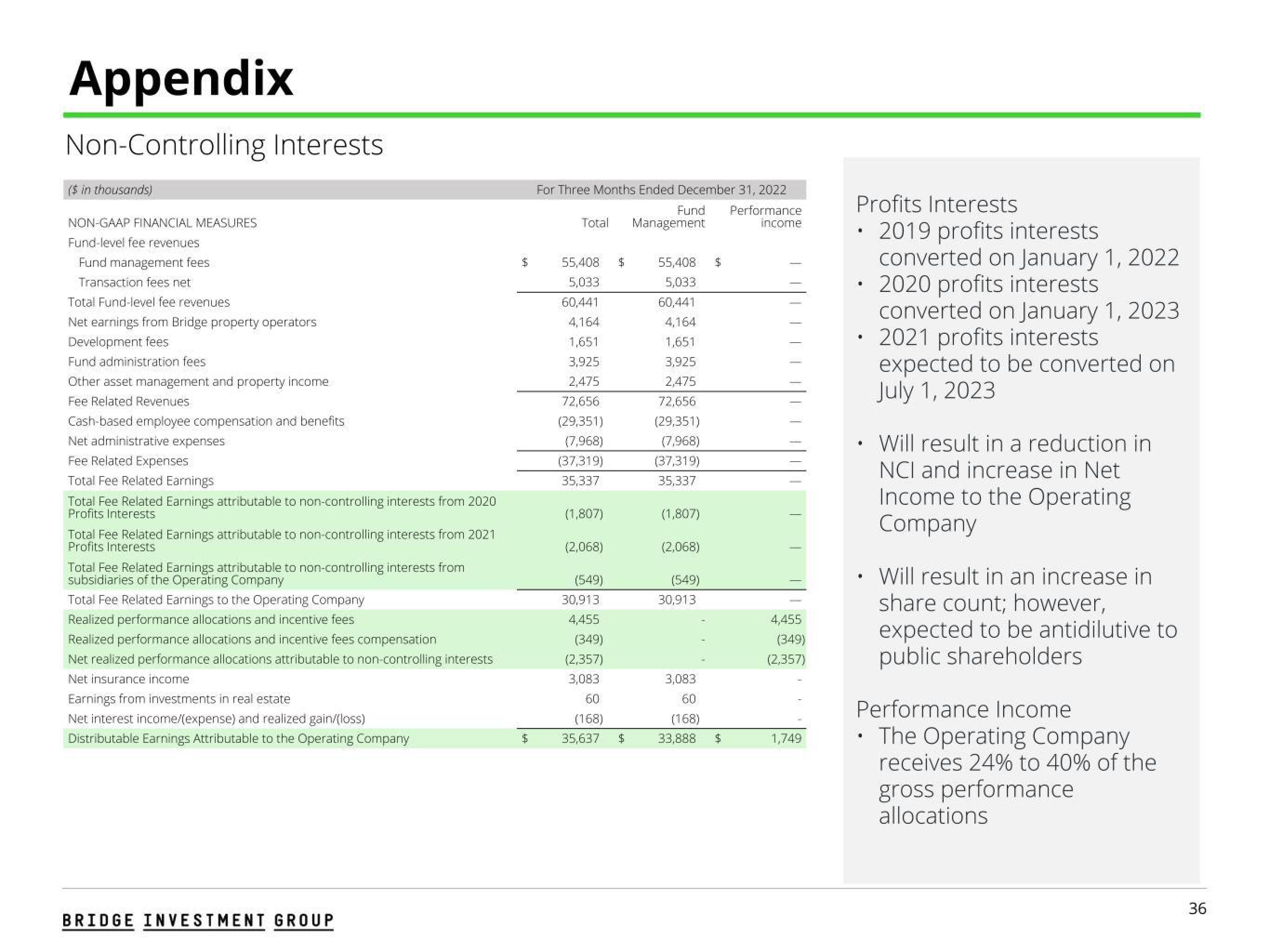

Non-Controlling Interests

($ in thousands)

NON-GAAP FINANCIAL MEASURES

Fund-level fee revenues

Fund management fees

Transaction fees net

Total Fund-level fee revenues

Net earnings from Bridge property operators

Development fees

Fund administration fees

Other asset management and property income

Fee Related Revenues

Cash-based employee compensation and benefits

Net administrative expenses

Fee Related Expenses

Total Fee Related Earnings

Total Fee Related Earnings attributable to non-controlling interests from 2020

Profits Interests

Total Fee Related Earnings attributable to non-controlling interests from 2021

Profits Interests

Total Fee Related Earnings attributable to non-controlling interests from

subsidiaries of the Operating Company

Total Fee Related Earnings to the Operating Company

Realized performance allocations and incentive fees

Realized performance allocations and incentive fees compensation

Net realized performance allocations attributable to non-controlling interests

Net insurance income

Earnings from investments in real estate

Net interest income/(expense) and realized gain/(loss)

Distributable Earnings Attributable to the Operating Company

BRIDGE INVESTMENT GROUP

$

$

For Three Months Ended December 31, 2022

Fund Performance

Management

income

Total

55,408 $

5,033

60,441

4,164

1,651

3,925

2,475

72,656

(29,351)

(7,968)

(37,319)

35,337

(1,807)

(2,068)

(549)

30,913

4,455

(349)

(2,357)

3,083

60

(168)

35,637

$

55,408 $

5,033

60,441

4,164

1,651

3,925

2,475

72,656

(29,351)

(7,968)

(37,319)

35,337

(1,807)

(2,068)

(549)

30,913

3,083

60

(168)

33,888 $

4,455

(349)

(2,357)

1,749

Profits Interests

2019 profits interests

converted on January 1, 2022

• 2020 profits interests

converted on January 1, 2023

• 2021 profits interests

.

expected to be converted on

July 1, 2023

Will result in a reduction in

NCI and increase in Net

Income to the Operating

Company

Will result in an increase in

share count; however,

expected to be antidilutive to

public shareholders

Performance Income

The Operating Company

receives 24% to 40% of the

gross performance.

allocations

36View entire presentation