Orbia Results Presentation Deck

4

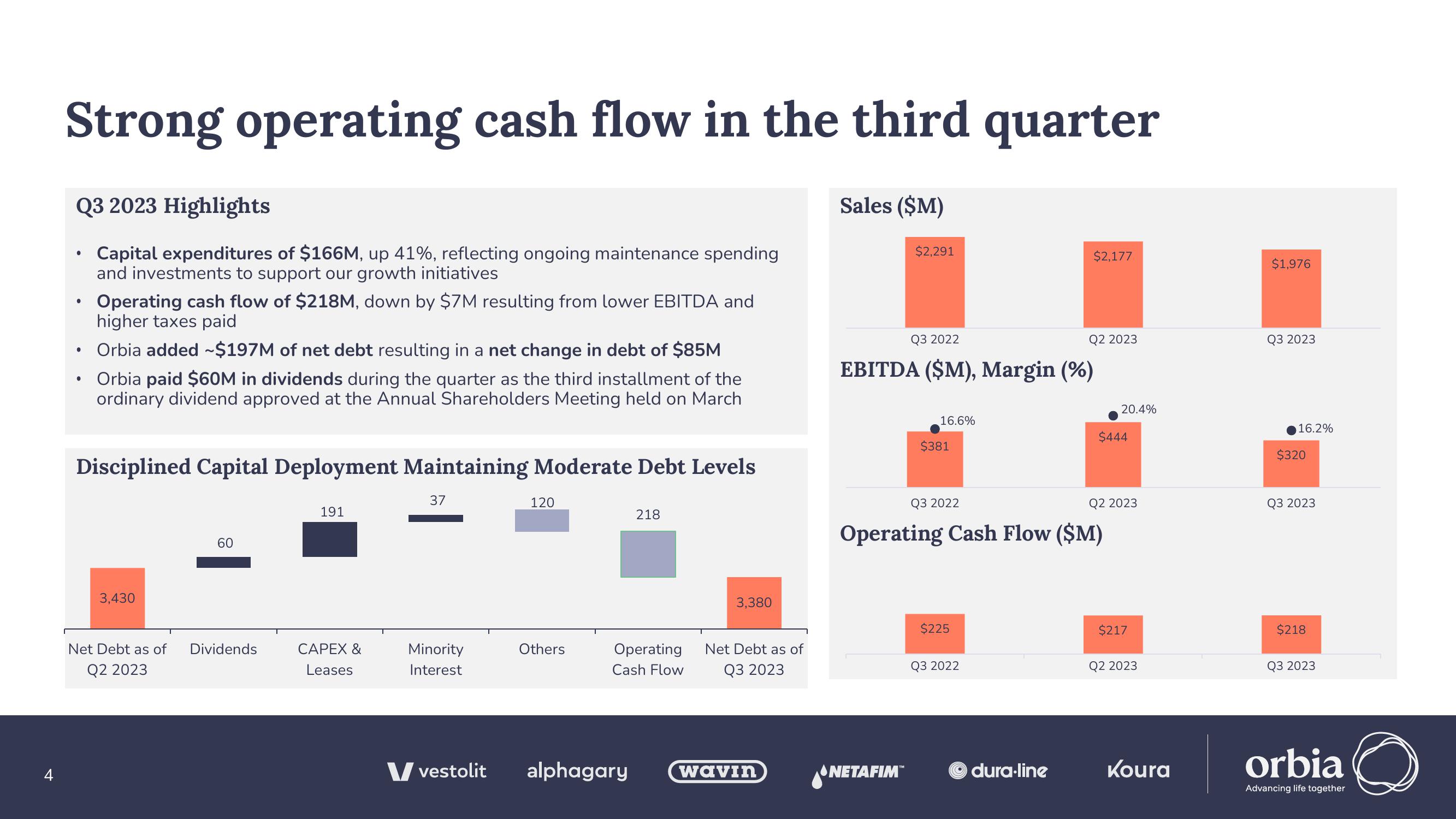

Strong operating cash flow in the third quarter

Q3 2023 Highlights

Capital expenditures of $166M, up 41%, reflecting ongoing maintenance spending

and investments to support our growth initiatives

●

●

Operating cash flow of $218M, down by $7M resulting from lower EBITDA and

higher taxes paid

●

• Orbia added ~$197M of net debt resulting in a net change in debt of $85M

Orbia paid $60M in dividends during the quarter as the third installment of the

ordinary dividend approved at the Annual Shareholders Meeting held on March

Disciplined Capital Deployment Maintaining Moderate Debt Levels

3,430

Net Debt as of

Q2 2023

60

Dividends

191

CAPEX &

Leases

37

Minority

Interest

V vestolit

120

Others

218

Operating

Cash Flow

alphagary

3,380

Net Debt as of

Q3 2023

wavin

Sales ($M)

$2,291

Q3 2022

EBITDA ($M), Margin (%)

NETAFIM™

16.6%

$381

Q3 2022

$225

Q3 2022

$2,177

Operating Cash Flow ($M)

O

dura-line

Q2 2023

20.4%

$444

Q2 2023

$217

Q2 2023

Koura

$1,976

Q3 2023

16.2%

$320

Q3 2023

$218

Q3 2023

orbia

Advancing life together

QView entire presentation