Federal Signal Investor Presentation Deck

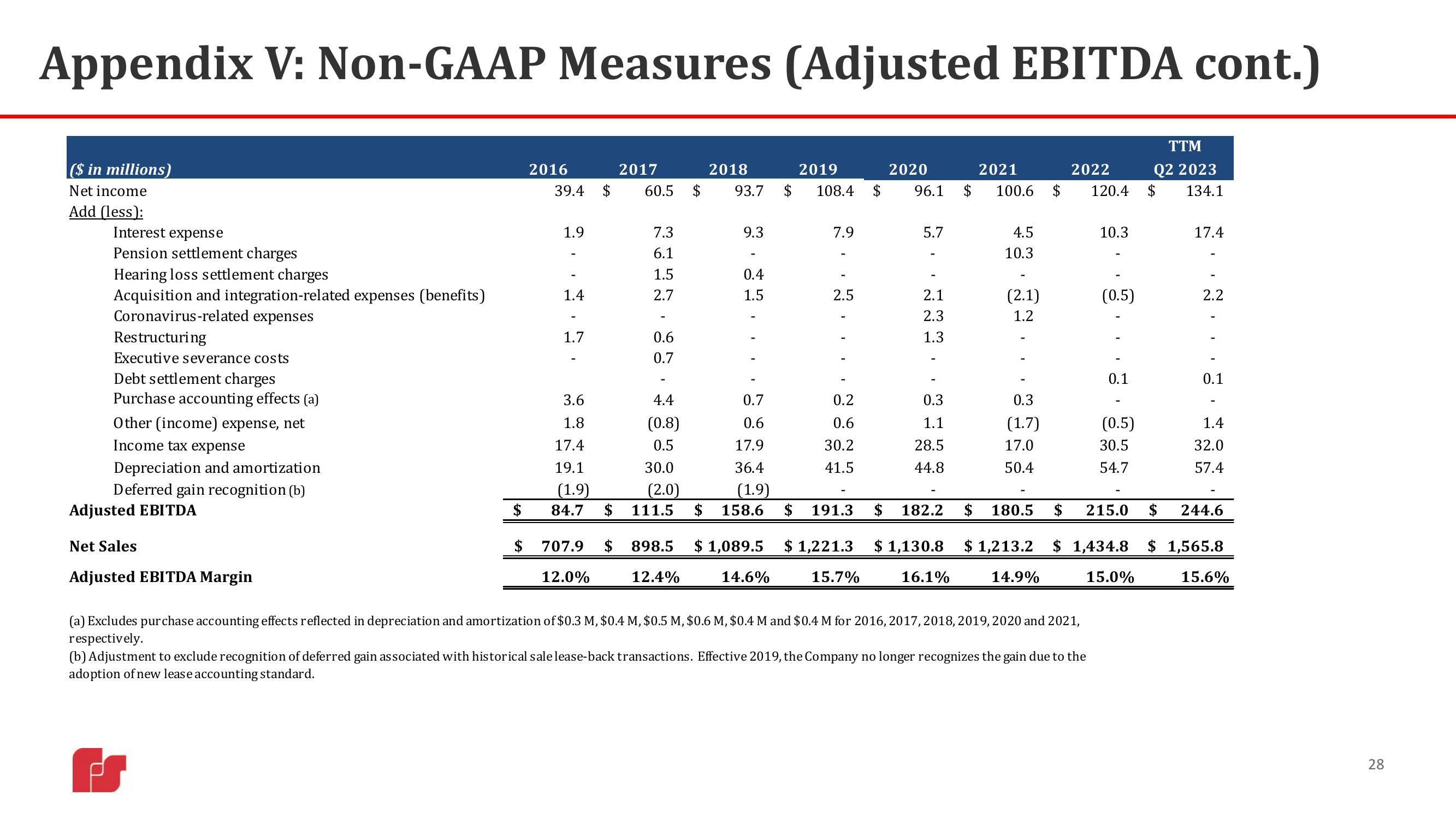

Appendix V: Non-GAAP Measures (Adjusted EBITDA cont.)

($ in millions)

Net income

Add (less):

Interest expense

Pension settlement charges

Hearing loss settlement charges

Acquisition and integration-related expenses (benefits)

Coronavirus-related expenses

Restructuring

Executive severance costs

Debt settlement charges

Purchase accounting effects (a)

Other (income) expense, net

Income tax expense

Depreciation and amortization

Deferred gain recognition (b)

Adjusted EBITDA

Net Sales

Adjusted EBITDA Margin

n

$

$

2016

39.4 $

1.9

1.4

1.7

2017

60.5

7.3

6.1

1.5

2.7

0.6

0.7

1

3.6

1.8

17.4

19.1

30.0

(1.9)

(2.0)

84.7 $ 111.5

4.4

(0.8)

0.5

$

2018

93.7

9.3

0.4

1.5

0.7

0.6

17.9

36.4

(1.9)

$ 158.6

707.9 $ 898.5 $ 1,089.5

14.6%

12.0%

12.4%

2019

$ 108.4 $

7.9

2.5

0.2

0.6

30.2

41.5

-

$ 191.3

$1,221.3

15.7%

2020

2021

96.1 $ 100.6

5.7

2.1

2.3

1.3

0.3

1.1

28.5

44.8

$1,130.8

4.5

10.3

16.1%

(2.1)

1.2

0.3

(1.7)

17.0

50.4

$ 182.2 $ 180.5 $

$ 1,213.2

14.9%

$

2022

(a) Excludes purchase accounting effects reflected in depreciation and amortization of $0.3 M, $0.4 M, $0.5 M, $0.6 M, $0.4 M and $0.4 M for 2016, 2017, 2018, 2019, 2020 and 2021,

respectively.

TTM

Q2 2023

120.4 $ 134.1

(b) Adjustment to exclude recognition of deferred gain associated with historical sale lease-back transactions. Effective 2019, the Company no longer recognizes the gain due to the

adoption of new lease accounting standard.

10.3

(0.5)

0.1

(0.5)

30.5

54.7

17.4

2.2

0.1

1.4

32.0

57.4

215.0 $ 244.6

1,434.8 $ 1,565.8

15.6%

15.0%

28View entire presentation