Energy Vault SPAC Presentation Deck

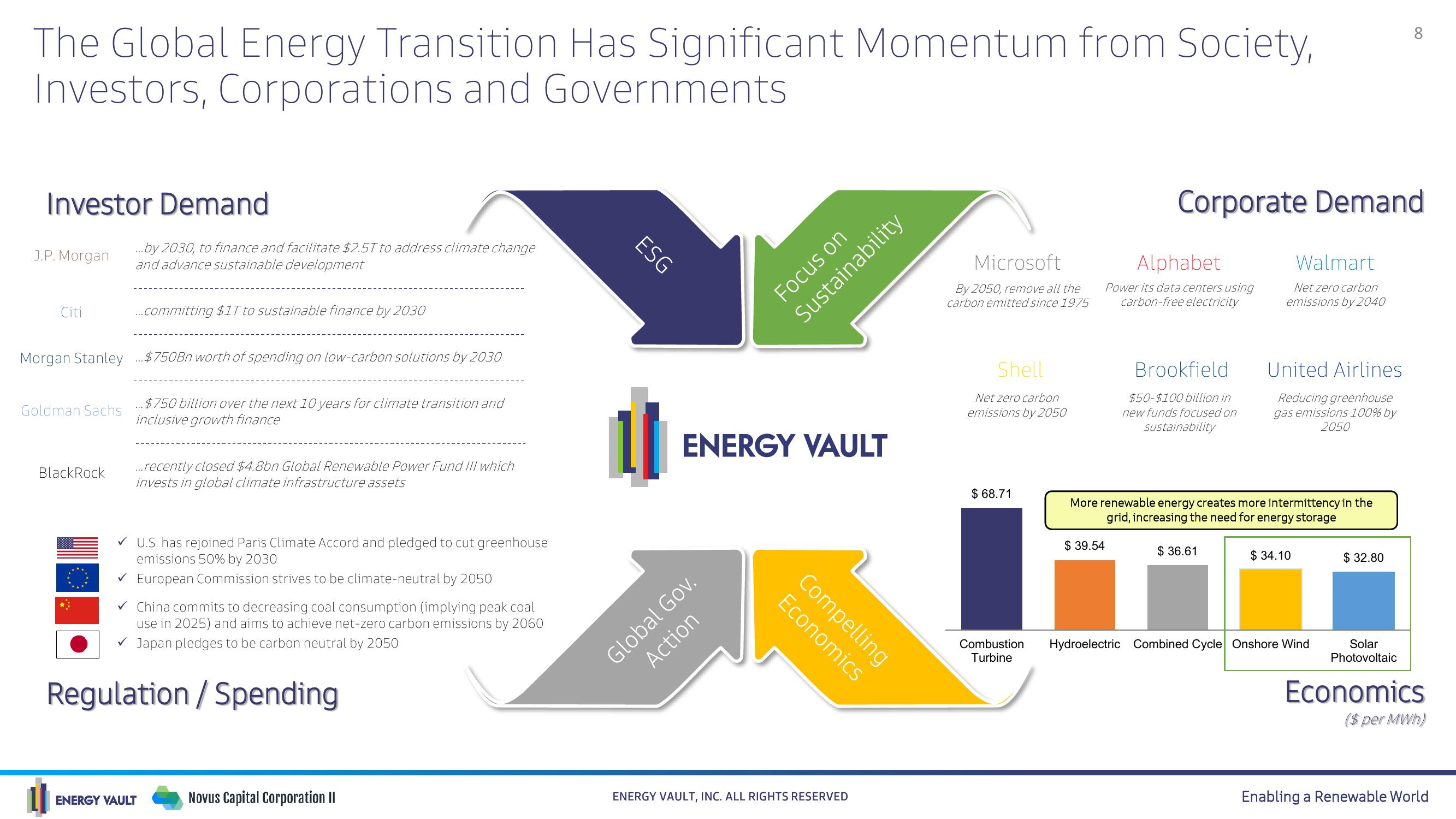

The Global Energy Transition Has Significant Momentum from Society,

Investors, Corporations and Governments

Investor Demand

J.P. Morgan

Citi

Goldman Sachs

...by 2030, to finance and facilitate $2.5T to address climate change

and advance sustainable development

Morgan Stanley ...$750Bn worth of spending on low-carbon solutions by 2030

BlackRock

...committing $1T to sustainable finance by 2030

...$750 billion over the next 10 years for climate transition and

inclusive growth finance

...recently closed $4.8bn Global Renewable Power Fund III which

invests in global climate infrastructure assets

✓ U.S. has rejoined Paris Climate Accord and pledged to cut greenhouse

emissions 50% by 2030

✓ European Commission strives to be climate-neutral by 2050

China commits to decreasing coal consumption (implying peak coal

use in 2025) and aims to achieve net-zero carbon emissions by 2060

Japan pledges to be carbon neutral by 2050

Regulation / Spending

ENERGY VAULT

Novus Capital Corporation II

ESG

Focus on

Sustainability

ENERGY VAULT

Global Gov.

Action

Economics

Compelling

ENERGY VAULT, INC. ALL RIGHTS RESERVED

Microsoft

By 2050, remove all the

carbon emitted since 1975

Shell

Net zero carbon

emissions by 2050

$68.71

Combustion

Turbine

Alphabet

Power its data centers using

carbon-free electricity

Corporate Demand

$39.54

Brookfield

$50-$100 billion in

new funds focused on

sustainability

Walmart

Net zero carbon

emissions by 2040

More renewable energy creates more intermittency in the

grid, increasing the need for energy storage

$36.61

United Airlines

Reducing greenhouse

gas emissions 100% by

2050

$34.10

Hydroelectric Combined Cycle Onshore Wind

$32.80

∞

Solar

Photovoltaic

Economics

($ per MWh)

Enabling a Renewable WorldView entire presentation