Investor Presentation

High-Quality Balance Sheet and Cash Flow Management

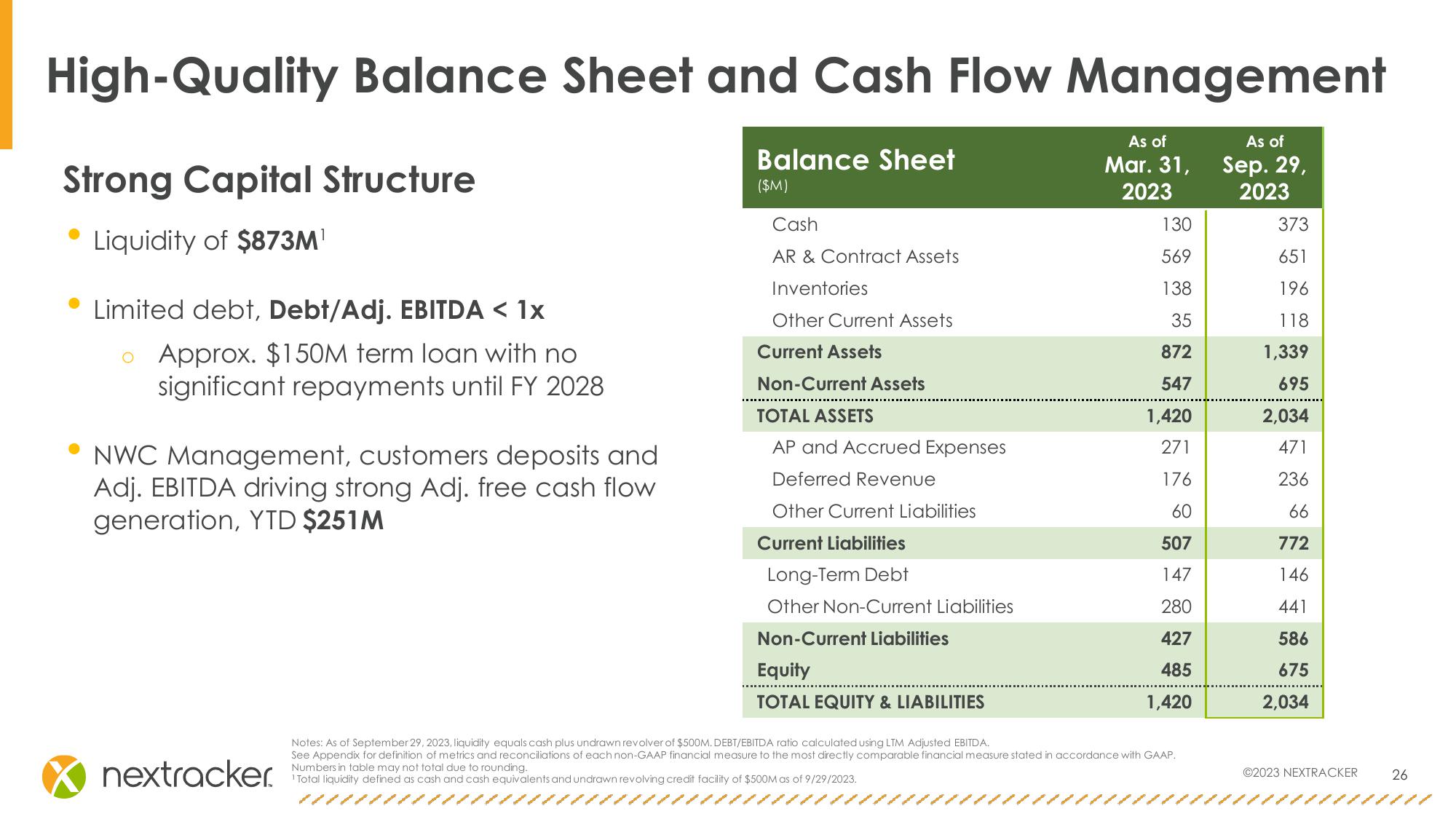

Strong Capital Structure

Balance Sheet

($M)

Cash

Liquidity of $873M¹

Limited debt, Debt/Adj. EBITDA < 1x

Approx. $150M term loan with no

significant repayments until FY 2028

NWC Management, customers deposits and

Adj. EBITDA driving strong Adj. free cash flow

generation, YTD $251M

As of

Mar. 31,

As of

Sep. 29,

2023

2023

130

373

AR & Contract Assets

569

651

Inventories

138

196

Other Current Assets

35

118

Current Assets

872

1,339

Non-Current Assets

547

695

TOTAL ASSETS

1,420

2,034

AP and Accrued Expenses

271

471

Deferred Revenue

176

236

Other Current Liabilities

60

66

Current Liabilities

507

772

Long-Term Debt

147

146

Other Non-Current Liabilities

280

441

Non-Current Liabilities

427

586

Equity

485

675

TOTAL EQUITY & LIABILITIES

1,420

2,034

Notes: As of September 29, 2023, liquidity equals cash plus undrawn revolver of $500M. DEBT/EBITDA ratio calculated using LTM Adjusted EBITDA.

See Appendix for definition of metrics and reconciliations of each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP.

Numbers in table may not total due to rounding..

nextracker.

1 Total liquidity defined as cash and cash equivalents and undrawn revolving credit facility of $500M as of 9/29/2023.

©2023 NEXTRACKER

26View entire presentation