Goldman Sachs Results Presentation Deck

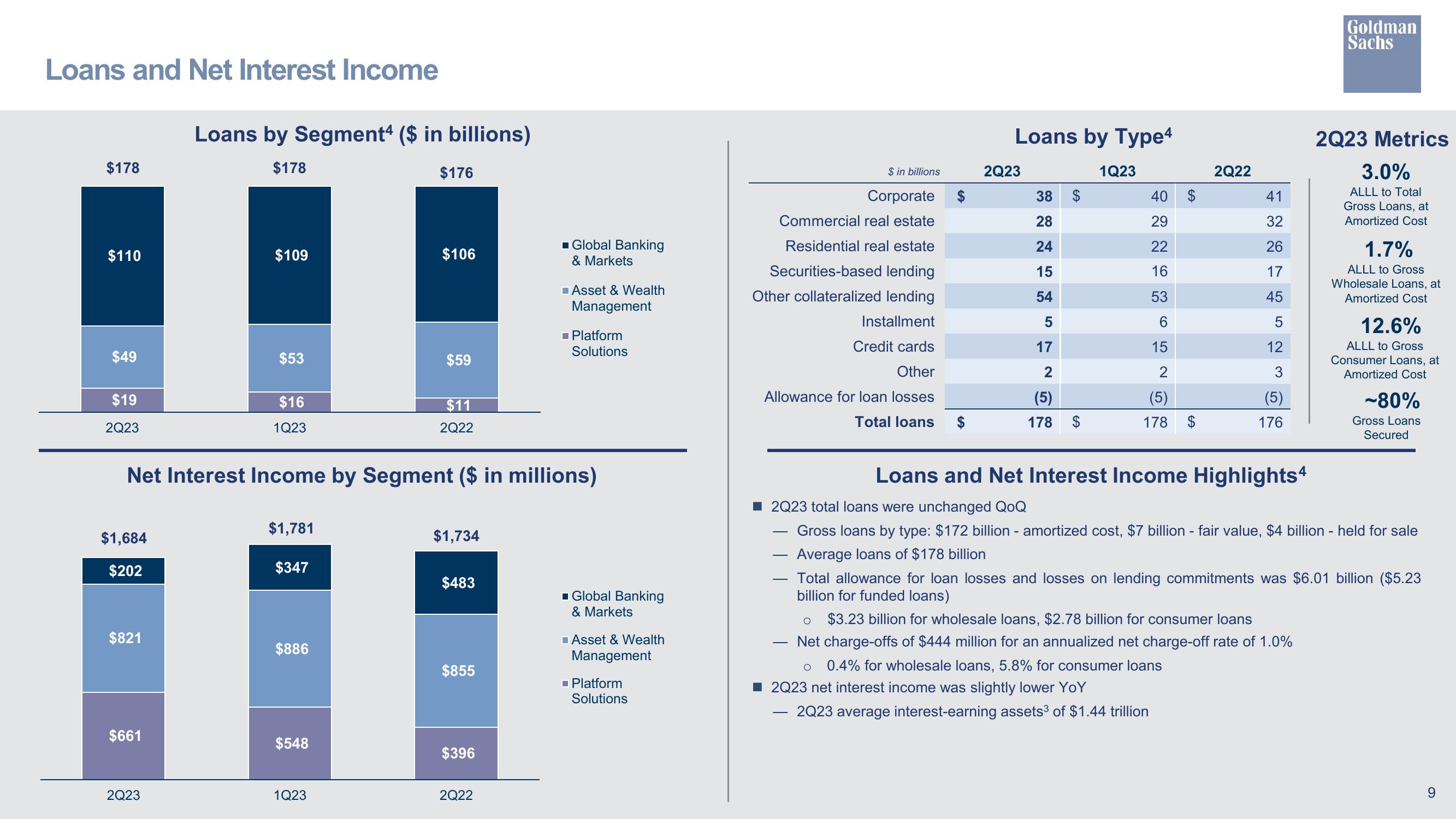

Loans and Net Interest Income

$178

$110

$49

$19

2Q23

$1,684

$202

$821

$661

Loans by Segment4 ($ in billions)

$178

2Q23

$109

$53

$16

1Q23

$1,781

$347

Net Interest Income by Segment ($ in millions)

$886

$548

$176

1Q23

$106

$59

$11

2Q22

$1,734

$483

$855

$396

■ Global Banking

& Markets

2Q22

Asset & Wealth

Management

■Platform

Solutions

■ Global Banking

& Markets

Asset & Wealth

Management

■ Platform

Solutions

$ in billions

Corporate

Commercial real estate

Residential real estate

Securities-based lending

Other collateralized lending

Installment

Credit cards

Other

Allowance for loan losses

Total loans

—

Loans by Type4

2Q23

O

38

28

24

15

54

17

2

(5)

178

$

1Q23

40

29

22

16

53

6

15

2

(5)

178

SA

$

2Q22

41

32

26

17

45

5

12

3

(5)

176

Loans and Net Interest Income Highlights4

O $3.23 billion for wholesale loans, $2.78 billion for consumer loans

Net charge-offs of $444 million for an annualized net charge-off rate of 1.0%

0.4% for wholesale loans, 5.8% for consumer loans

■2Q23 net interest income was slightly lower YoY

2Q23 average interest-earning assets³ of $1.44 trillion

Goldman

Sachs

2Q23 Metrics

3.0%

ALLL to Total

Gross Loans, at

Amortized Cost

1.7%

ALLL to Gross

Wholesale Loans, at

Amortized Cost

■2Q23 total loans were unchanged QoQ

Gross loans by type: $172 billion - amortized cost, $7 billion - fair value, $4 billion - held for sale

Average loans of $178 billion

Total allowance for loan losses and losses on lending commitments was $6.01 billion ($5.23

billion for funded loans)

12.6%

ALLL to Gross

Consumer Loans, at

Amortized Cost

-80%

Gross Loans

Secured

9View entire presentation