HireRight Results Presentation Deck

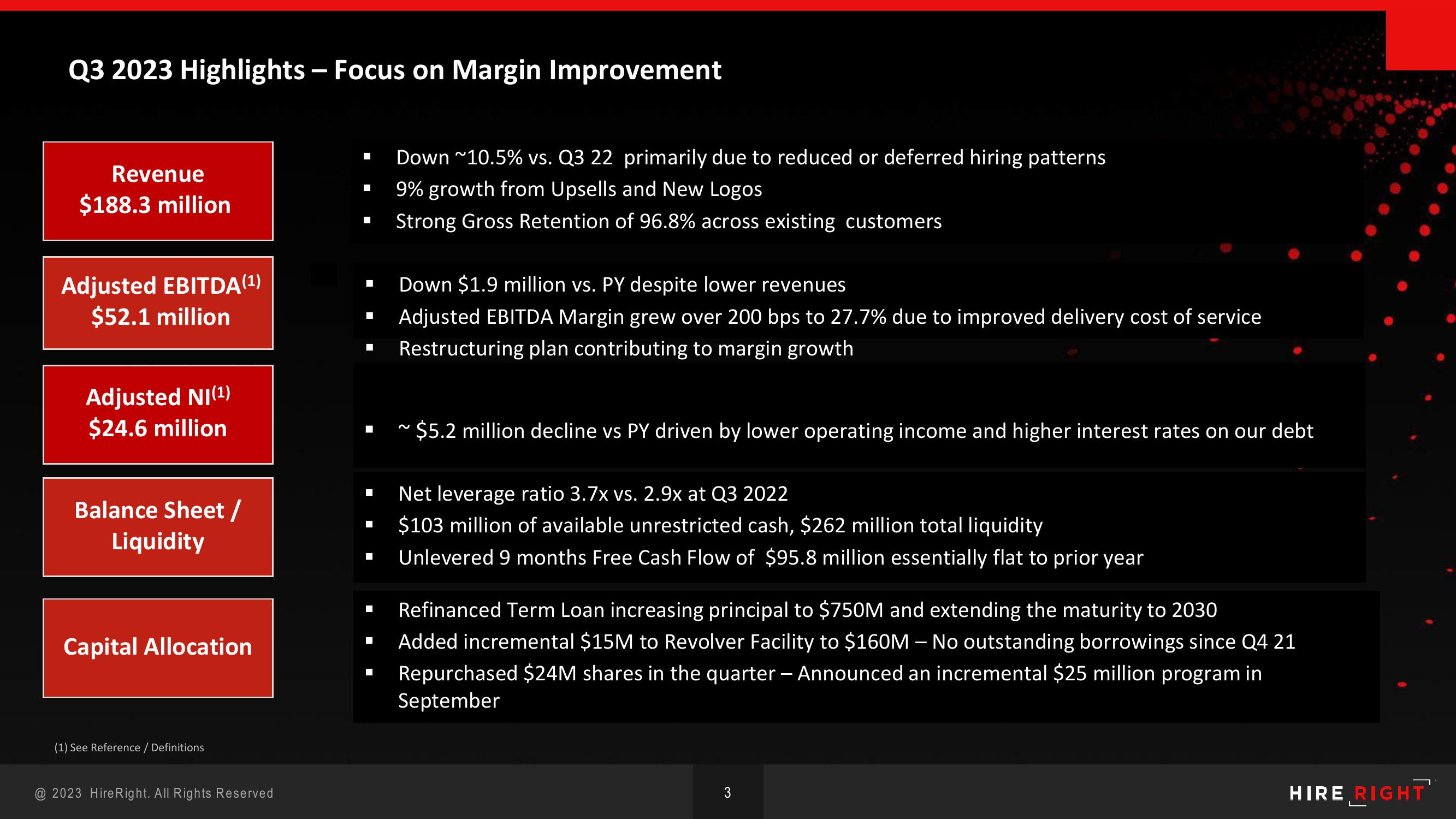

Q3 2023 Highlights - Focus on Margin Improvement

Revenue

$188.3 million

Adjusted EBITDA (¹)

$52.1 million

Adjusted NI(¹)

$24.6 million

Balance Sheet/

Liquidity

Capital Allocation

(1) See Reference / Definitions

@ 2023 Hire Right. All Rights Reserved

■

■

■

■

■

▬

■

■

■

Down ~10.5% vs. Q3 22 primarily due to reduced or deferred hiring patterns

9% growth from Upsells and New Logos

Strong Gross Retention of 96.8% across existing customers

Down $1.9 million vs. PY despite lower revenues

Adjusted EBITDA Margin grew over 200 bps to 27.7% due to improved delivery cost of service

Restructuring plan contributing to margin growth

~$5.2 million decline vs PY driven by lower operating income and higher interest rates on our debt

Net leverage ratio 3.7x vs. 2.9x at Q3 2022

$103 million of available unrestricted cash, $262 million total liquidity

Unlevered 9 months Free Cash Flow of $95.8 million essentially flat to prior year

Refinanced Term Loan increasing principal to $750M and extending the maturity to 2030

Added incremental $15M to Revolver Facility to $160M - No outstanding borrowings since Q4 21

Repurchased $24M shares in the quarter - Announced an incremental $25 million program in

September

3

HIRE RIGHTView entire presentation