Bank of America Investment Banking Pitch Book

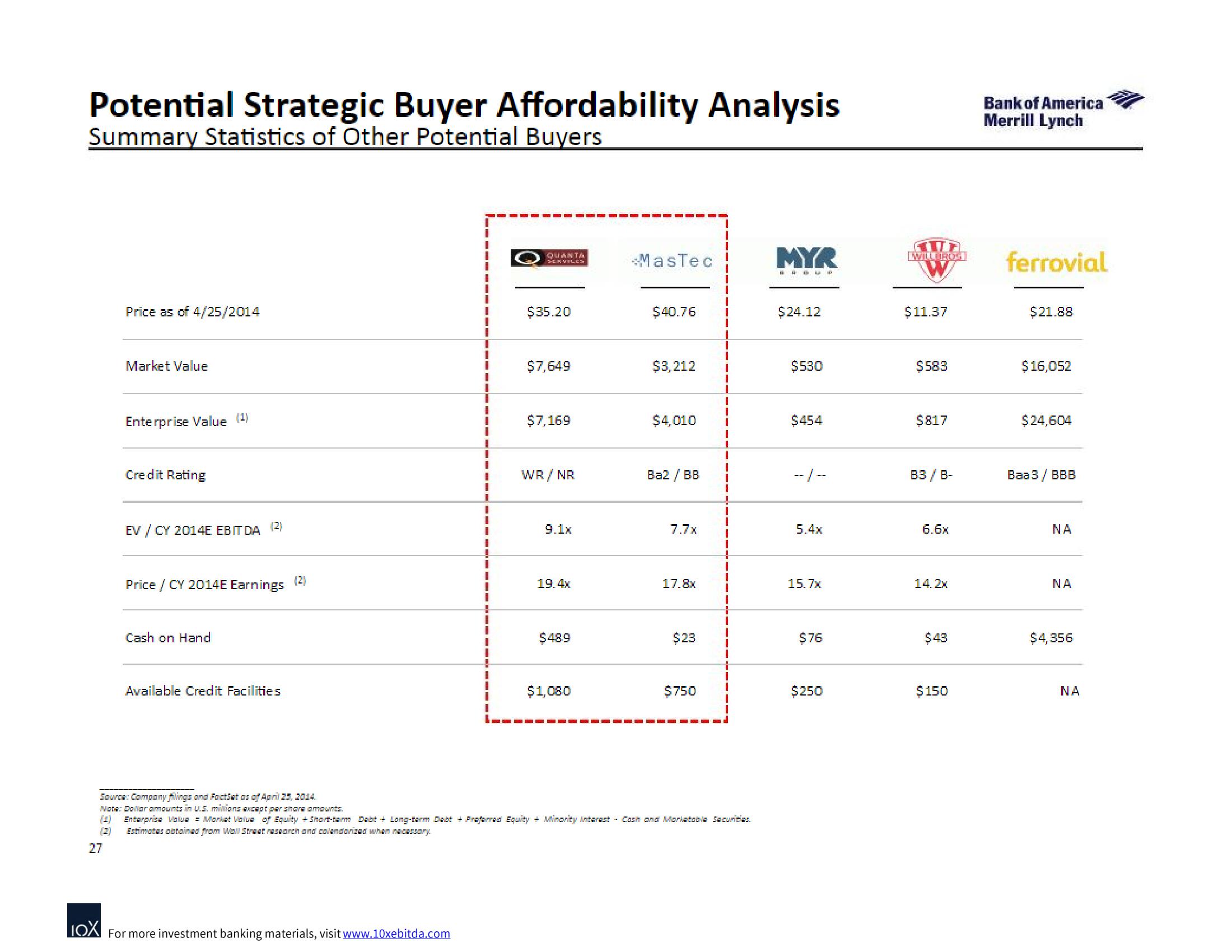

Potential Strategic Buyer Affordability Analysis

Summary Statistics of Other Potential Buyers

Price as of 4/25/2014

27

Market Value

Enterprise Value (¹)

Credit Rating

EV / CY 2014E EBITDA (2)

Price / CY 2014E Earnings (2)

Cash on Hand

Available Credit Facilities

QUANTA

SERVILES

LOX For more investment banking materials, visit www.10xebitda.com

$35.20

$7,649

$7,169

WR/NR

9.1x

19.4x

$489

$1,080

MasTec

$40.76

$3,212 1

$4,010

Ba2 / BB

7.7x

17.8x

$23

I

$750

1

1

1

1

1

Source: Company filings and FactSet as of April 25, 2014.

Note: Dollar amounts in U.S. milions except per share amounts.

(1) Enterprise Value = Market value of Equity +Short-term Debt + Long-term Debt + Preferred Equity + Minority Interest - Cash and Marktobla Securities.

Estimates obtained from Wall Street research and colendorized when necessary

(3)

1

MYR

GROUP

$24.12

$530

$454

--/--

5.4x

15.7x

$76

$250

TE

WILLURDS

W

$11.37

$583

$817

B3/B-

6.6x

14.2x

$43

$150

Bank of America

Merrill Lynch

ferrovial

$21.88

$16,052

$24,604

Baa 3 / BBB

ΝΑ

ΝΑ

$4,356

ΝΑView entire presentation