Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

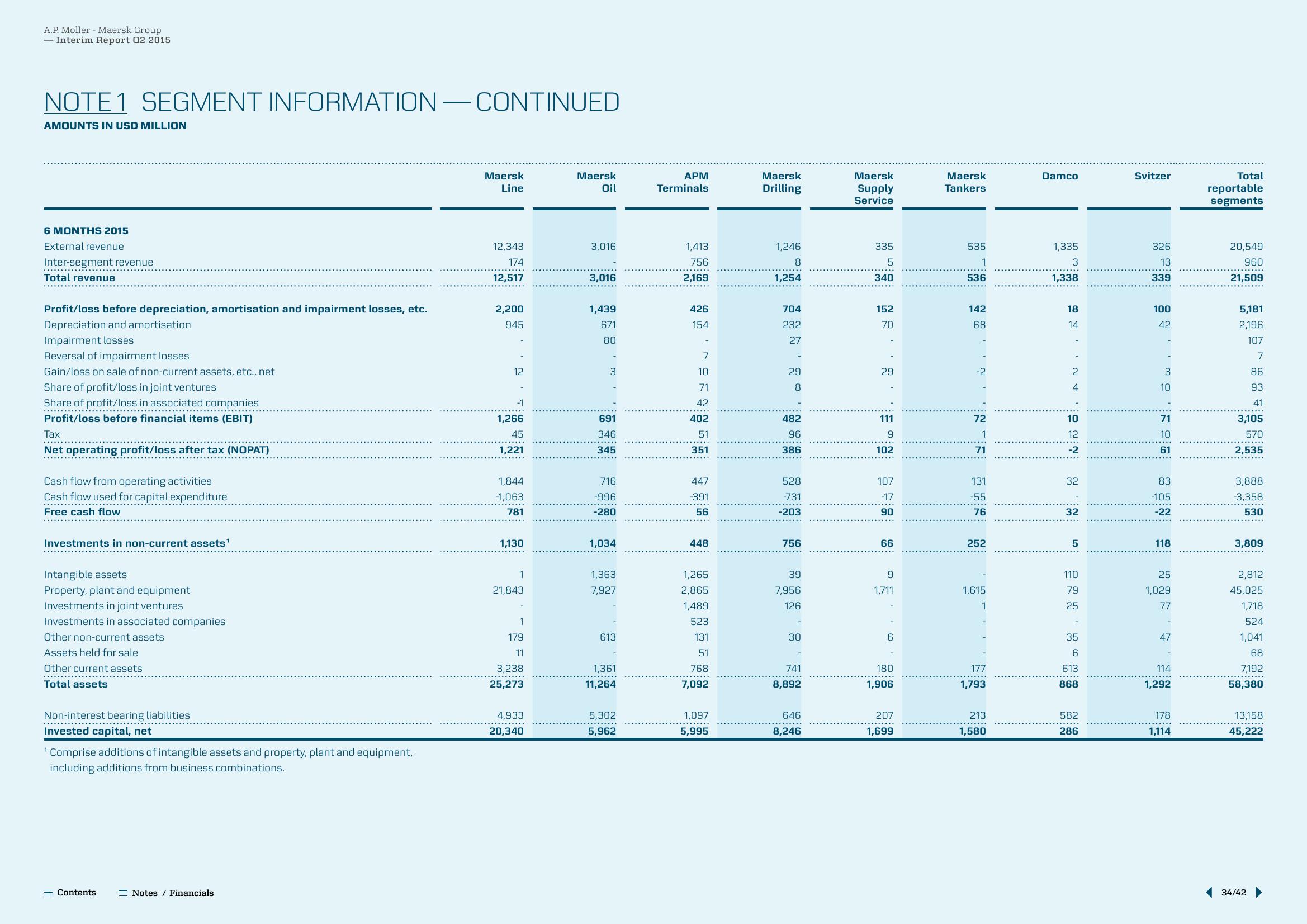

NOTE 1 SEGMENT INFORMATION - CONTINUED

AMOUNTS IN USD MILLION

6 MONTHS 2015

External revenue

Inter-segment revenue

Total revenue

Profit/loss before depreciation, amortisation and impairment losses, etc.

Depreciation and amortisation

Impairment losses

Reversal of impairment losses

Gain/loss on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

..……..…….....

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Free cash flow

Investments in non-current assets¹

Intangible assets

Property, plant and equipment

Investments in joint ventures

Investments in associated companies

Other non-current assets

Assets held for sale

Other current assets

Total assets

Non-interest bearing liabilities

Invested capital, net

¹ Comprise additions of intangible assets and property, plant and equipment,

including additions from business combinations.

= Contents

Notes / Financials

Maersk

Line

12,343

174

12,517

2,200

945

12

-1

1,266

45

1,221

1,844

-1,063

781

1,130

1

21,843

1

179

11

3,238

25,273

4,933

20,340

Maersk

Oil

3,016

3,016

1,439

671

80

3

691

346

345

716

-996

-280

1,034

1,363

7,927

613

1,361

11,264

5,302

5,962

APM

Terminals

1,413

756

2,169

426

154

7

10

71

42

402

51

351

447

-391

56

448

1,265

2,865

1,489

523

131

51

768

7,092

1,097

5,995

Maersk

Drilling

1,246

8

1,254

704

232

27

29

8

482

96

386

528

-731

-203

756

39

7,956

126

30

741

8,892

646

8,246

Maersk

Supply

Service

335

5

340

152

70

29

111

9

102

107

-17

90

66

9

1,711

6

180

1,906

207

1,699

Maersk

Tankers

535

536

142

68

-2

72

1

71

131

-55

76

252

1,615

177

1,793

213

1,580

Damco

1,335

3

1,338

18

14

2

4

10

12

-2

32

32

5

110

79

25

35

6

613

868

582

286

Svitzer

326

13

339

100

42

3

10

71

10

61

83

-105

-22

118

25

1,029

77

47

114

1,292

178

1,114

Total

reportable

segments

20,549

960

21,509

5,181

2,196

107

7

86

93

41

3,105

570

2,535

3,888

-3,358

530

3,809

2,812

45,025

1,718

524

1,041

68

7,192

58,380

13,158

45,222

34/42 ▶View entire presentation