Babylon SPAC Presentation Deck

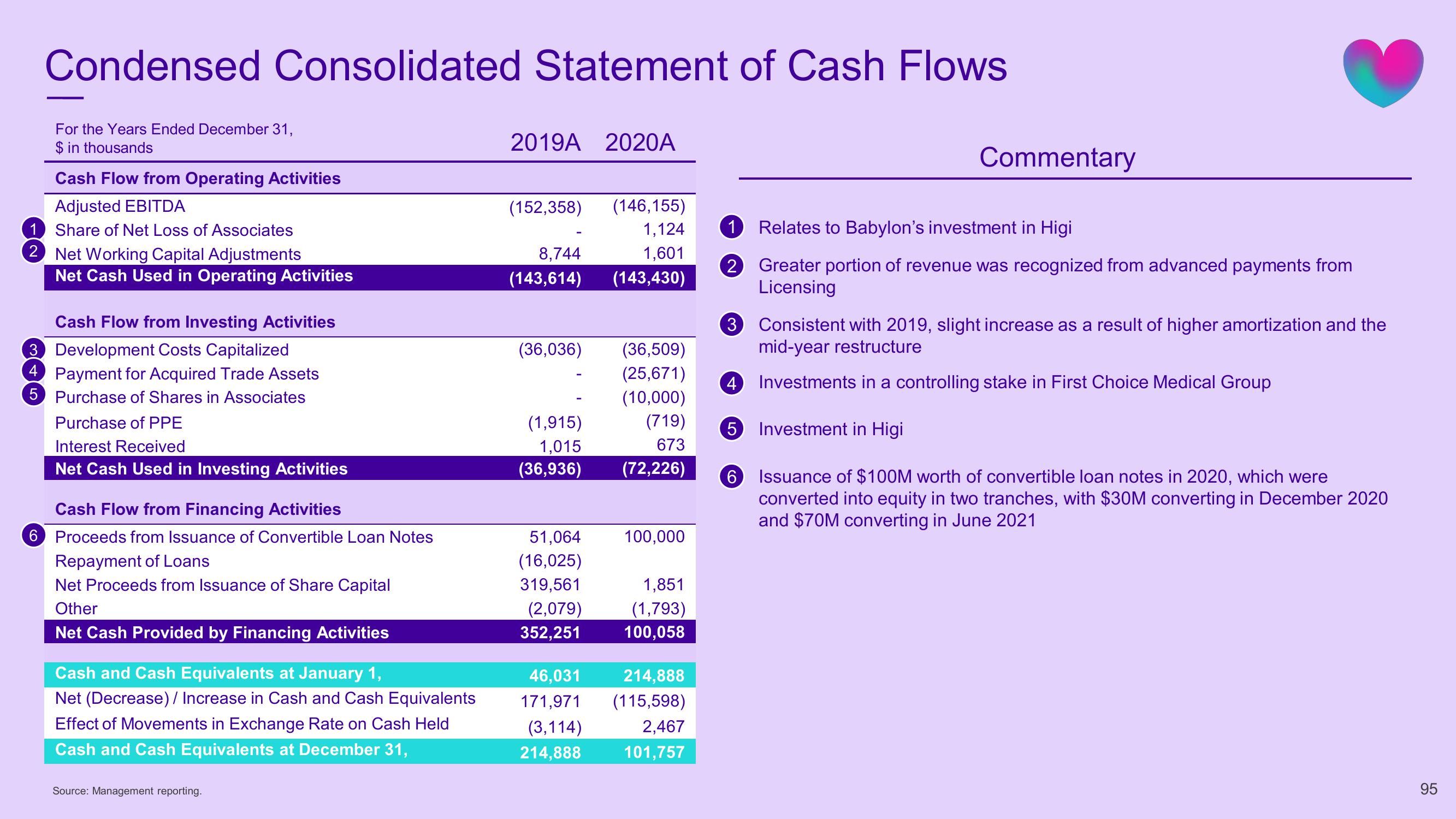

Condensed Consolidated Statement of Cash Flows

For the Years Ended December 31,

$ in thousands

Cash Flow from Operating Activities

Adjusted EBITDA

1 Share of Net Loss of Associates

2

Net Working Capital Adjustments

Net Cash Used in Operating Activities

Cash Flow from Investing Activities

3

Development Costs Capitalized

4 Payment for Acquired Trade Assets

5 Purchase of Shares in Associates

Purchase of PPE

Interest Received

Net Cash Used in Investing Activities

6

Cash Flow from Financing Activities

Proceeds from Issuance of Convertible Loan Notes

Repayment of Loans

Net Proceeds from Issuance of Share Capital

Other

Net Cash Provided by Financing Activities

Cash and Cash Equivalents at January 1,

Net (Decrease) / Increase in Cash and Cash Equivalents

Effect of Movements in Exchange Rate on Cash Held

Cash and Cash Equivalents at December 31,

Source: Management reporting.

2019A 2020A

(152,358)

8,744

(143,614)

(36,036)

(1,915)

1,015

(36,936)

51,064

(16,025)

319,561

(2,079)

352,251

46,031

171,971

(3,114)

214,888

(146,155)

1,124

1,601

(143,430)

(36,509)

(25,671)

(10,000)

(719)

673

(72,226)

100,000

1,851

(1,793)

100,058

214,888

(115,598)

2,467

101,757

Commentary

1 Relates to Babylon's investment in Higi

2 Greater portion of revenue was recognized from advanced payments from

Licensing

3 Consistent with 2019, slight increase as a result of higher amortization and the

mid-year restructure

4 Investments in a controlling stake in First Choice Medical Group

5 Investment in Higi

6 Issuance of $100M worth of convertible loan notes in 2020, which were

converted into equity in two tranches, with $30M converting in December 2020

and $70M converting in June 2021

95View entire presentation