Credit Suisse Credit Presentation Deck

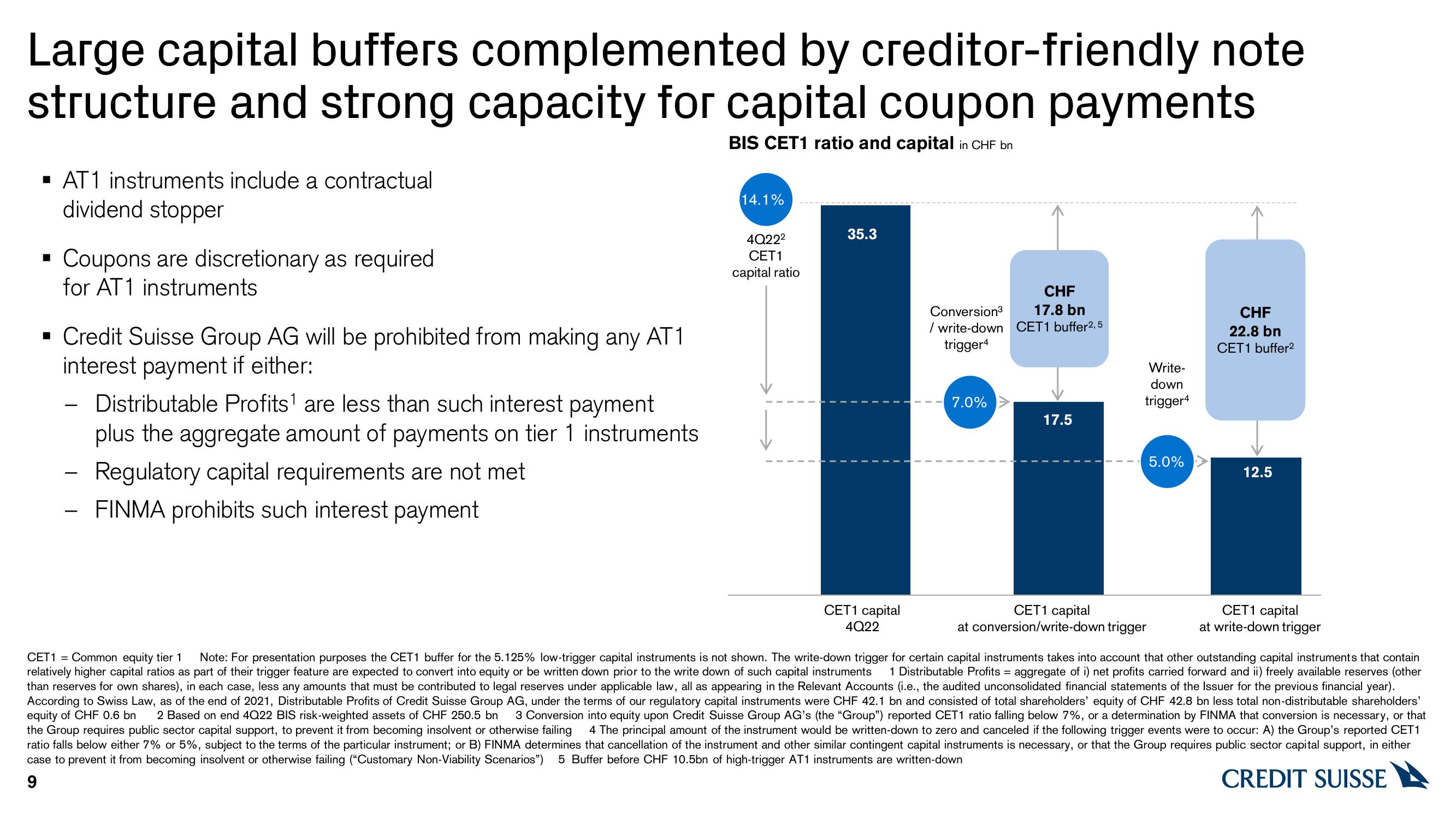

Large capital buffers complemented by creditor-friendly note

structure and strong capacity for capital coupon payments

BIS CET1 ratio and capital in CHF bn

■

AT1 instruments include a contractual

dividend stopper

Coupons are discretionary as required

for AT1 instruments

▪ Credit Suisse Group AG will be prohibited from making any AT1

interest payment if either:

- Distributable Profits¹ are less than such interest payment

plus the aggregate amount of payments on tier 1 instruments

Regulatory capital requirements are not met

FINMA prohibits such interest payment

14.1%

4Q22²

CET1

capital ratio

35.3

CET1 capital

4Q22

Conversion³

/ write-down

trigger4

7.0%

CHF

17.8 bn

CET1 buffer2,5

17.5

Write-

down

trigger4

CET1 capital

at conversion/write-down trigger

5.0%

CHF

22.8 bn

CET1 buffer²

12.5

CET1 capital

at write-down trigger

CET1 = Common equity tier 1 Note: For presentation purposes the CET1 buffer for the 5.125% low-trigger capital instruments is not shown. The write-down trigger for certain capital instruments takes into account that other outstanding capital instruments that contain

relatively higher capital ratios as part of their trigger feature are expected to convert into equity or be written down prior to the write down of such capital instruments 1 Distributable Profits = aggregate of i) net profits carried forward and ii) freely available reserves (other

than reserves for own shares), in each case, less any amounts that must be contributed to legal reserves under applicable law, all as appearing in the Relevant Accounts (i.e., the audited unconsolidated financial statements of the Issuer for the previous financial year).

According to Swiss Law, as of the end of 2021, Distributable Profits of Credit Suisse Group AG, under the terms of our regulatory capital instruments were CHF 42.1 bn and consisted of total shareholders' equity of CHF 42.8 bn less total non-distributable shareholders'

equity of CHF 0.6 bn 2 Based on end 4Q22 BIS risk-weighted assets of CHF 250.5 bn 3 Conversion into equity upon Credit Suisse Group AG's (the "Group") reported CET1 ratio falling below 7%, or a determination by FINMA that conversion is necessary, or that

the Group requires public sector capital support, to prevent it from becoming insolvent or otherwise failing 4 The principal amount of the instrument would be written-down to zero and canceled if the following trigger events were to occur: A) the Group's reported CET1

ratio falls below either 7% or 5%, subject to the terms of the particular instrument; or B) FINMA determines that cancellation of the instrument and other similar contingent capital instruments is necessary, or that the Group requires public sector capital support, in either

case to prevent it from becoming insolvent or otherwise failing ("Customary Non-Viability Scenarios") 5 Buffer before CHF 10.5bn of high-trigger AT1 instruments are written-down

9

CREDIT SUISSEView entire presentation