Asos Results Presentation Deck

© 2023 asos

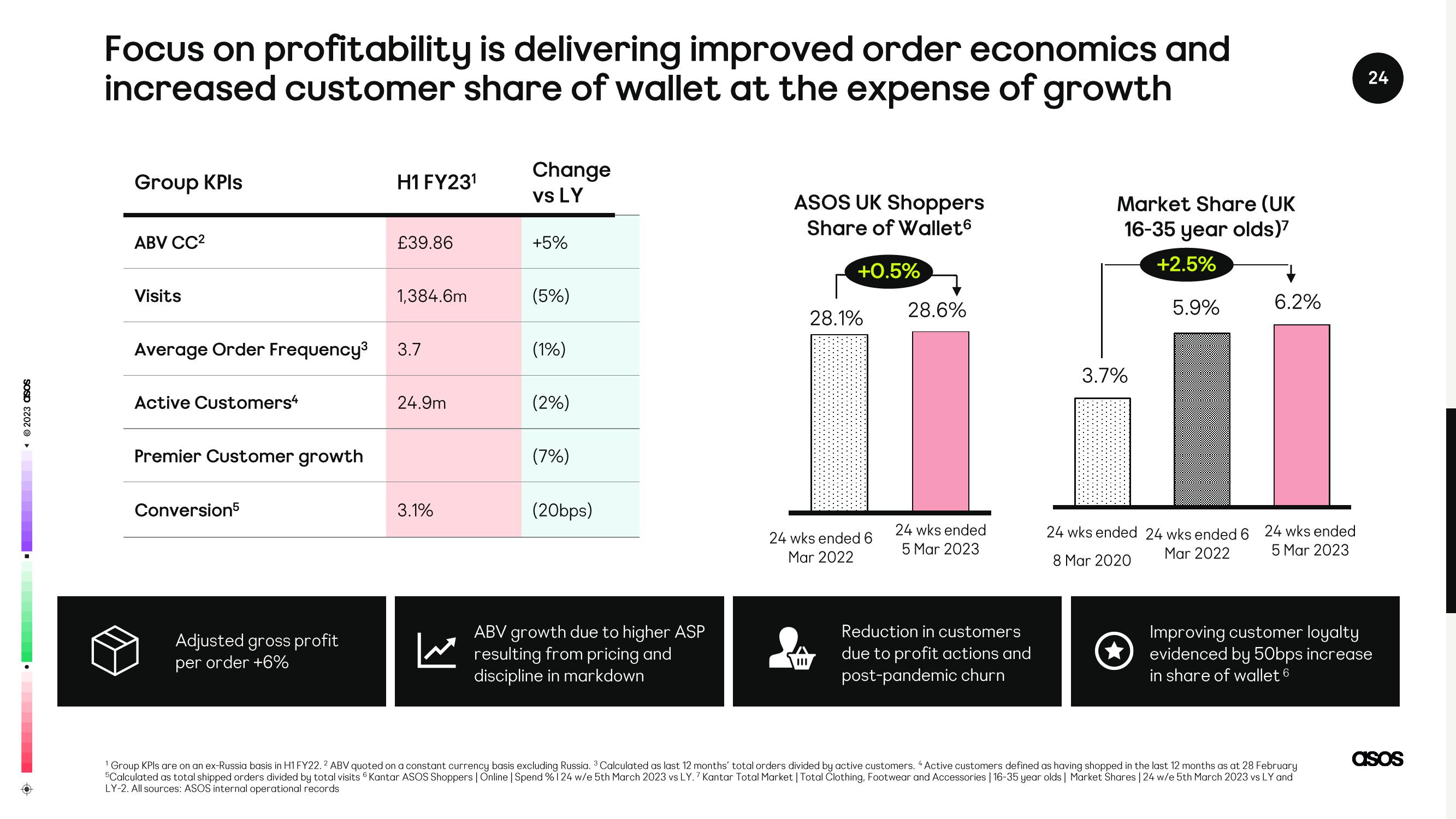

Focus on profitability is delivering improved order economics and

increased customer share of wallet at the expense of growth

Group KPIs

ABV CC²

Visits

Average Order Frequency³

Active Customers4

Premier Customer growth

Conversion5

Adjusted gross profit

per order +6%

H1 FY23¹

£39.86

1,384.6m

3.7

24.9m

3.1%

Change

vs LY

+5%

(5%)

(1%)

(2%)

(7%)

(20bps)

ABV growth due to higher ASP

resulting from pricing and

discipline in markdown

ASOS UK Shoppers

Share of Wallet6

+0.5%

28.1%

24 wks ended 6

Mar 2022

28.6%

24 wks ended

5 Mar 2023

Reduction in customers

due to profit actions and

post-pandemic churn

Market Share (UK

16-35 year olds)

+2.5%

5.9%

3.7%

6.2%

24 wks ended 24 wks ended 6 24 wks ended

Mar 2022

8 Mar 2020

5 Mar 2023

24

Improving customer loyalty

evidenced by 50bps increase

in share of wallet 6

1 Group KPIs are on an ex-Russia basis in H1 FY22. 2 ABV quoted on a constant currency basis excluding Russia. 3 Calculated as last 12 months' total orders divided by active customers. 4 Active customers defined as having shopped in the last 12 months as at 28 February

5Calculated as total shipped orders divided by total visits Kantar ASOS Shoppers | Online | Spend % 124 w/e 5th March 2023 vs LY. 7 Kantar Total Market | Total Clothing, Footwear and Accessories | 16-35 year olds | Market Shares | 24 w/e 5th March 2023 vs LY and

LY-2. All sources: ASOS internal operational records

asosView entire presentation