jetBlue Results Presentation Deck

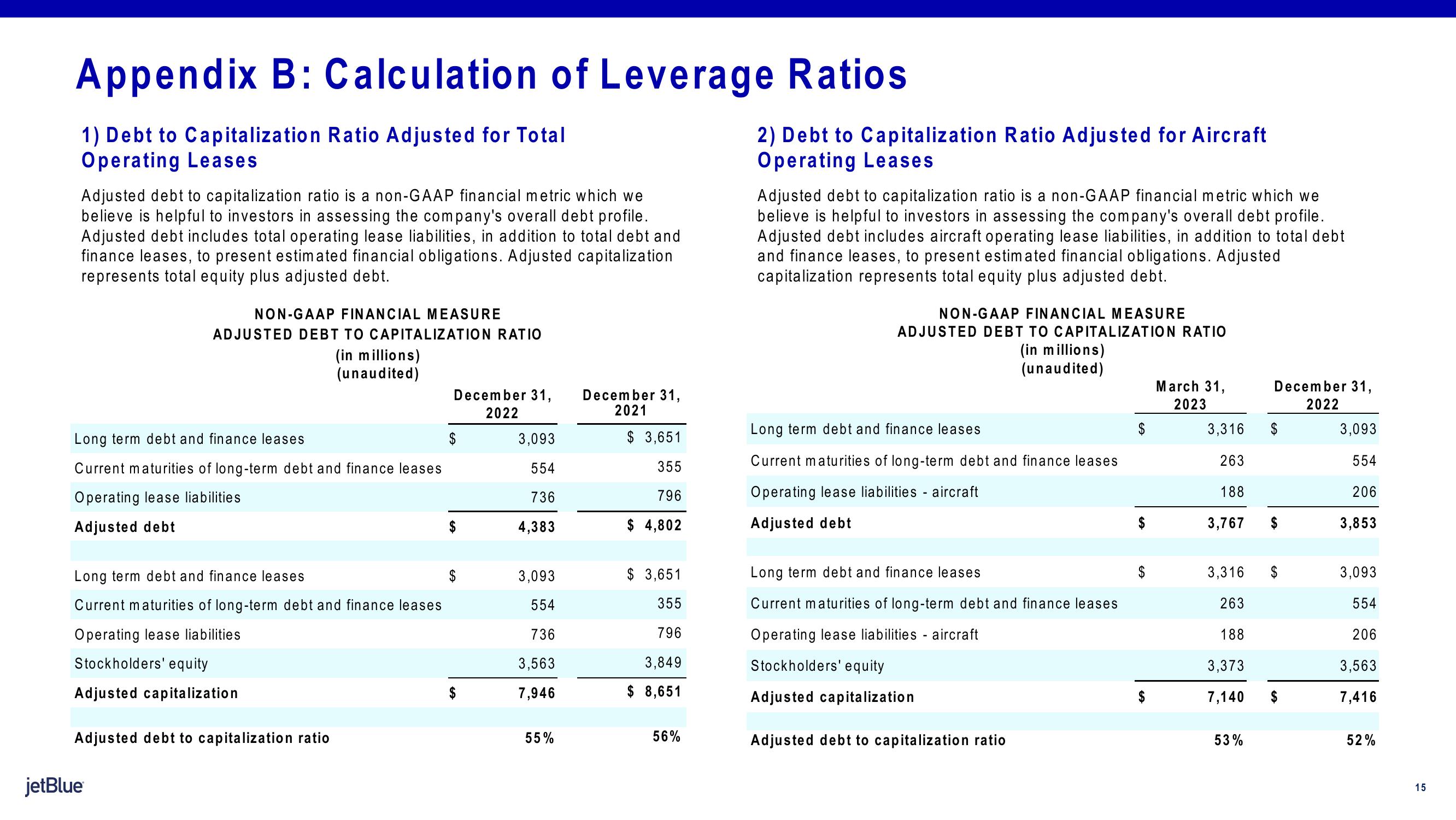

Appendix B: Calculation of Leverage Ratios

1) Debt to Capitalization Ratio Adjusted for Total

Operating Leases

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we

believe is helpful to investors in assessing the company's overall debt profile.

Adjusted debt includes total operating lease liabilities, in addition to total debt and

finance leases, to present estimated financial obligations. Adjusted capitalization

represents total equity plus adjusted debt.

NON-GAAP FINANCIAL MEASURE

ADJUSTED DEBT TO CAPITALIZATION RATIO

(in millions)

(unaudited)

Long term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities

Adjusted debt

Long term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities

Stockholders' equity

Adjusted capitalization

Adjusted debt to capitalization ratio

jetBlue

December 31,

2022

$

3,093

554

736

4,383

3,093

554

736

3,563

7,946

55%

December 31,

2021

$ 3,651

355

796

$ 4,802

$ 3,651

355

796

3,849

$ 8,651

56%

2) Debt to Capitalization Ratio Adjusted for Aircraft

Operating Leases

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we

believe is helpful to investors in assessing the company's overall debt profile.

Adjusted debt includes aircraft operating lease liabilities, in addition to total debt

and finance leases, to present estimated financial obligations. Adjusted

capitalization represents total equity plus adjusted debt.

NON-GAAP FINANCIAL MEASURE

ADJUSTED DEBT TO CAPITALIZATION RATIO

(in millions)

(unaudited)

Long term debt and finance leases.

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Adjusted debt

Long term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Stockholders' equity

Adjusted capitalization

Adjusted debt to capitalization ratio

$

March 31,

2023

3,316

263

188

3,767

3,316

263

188

3,373

7,140

53%

December 31,

2022

$

3,093

554

206

3,853

3,093

554

206

3,563

7,416

52%

15View entire presentation