Better SPAC Presentation Deck

We deliver a lower

rate and better

experience for our

customers

●

●

●

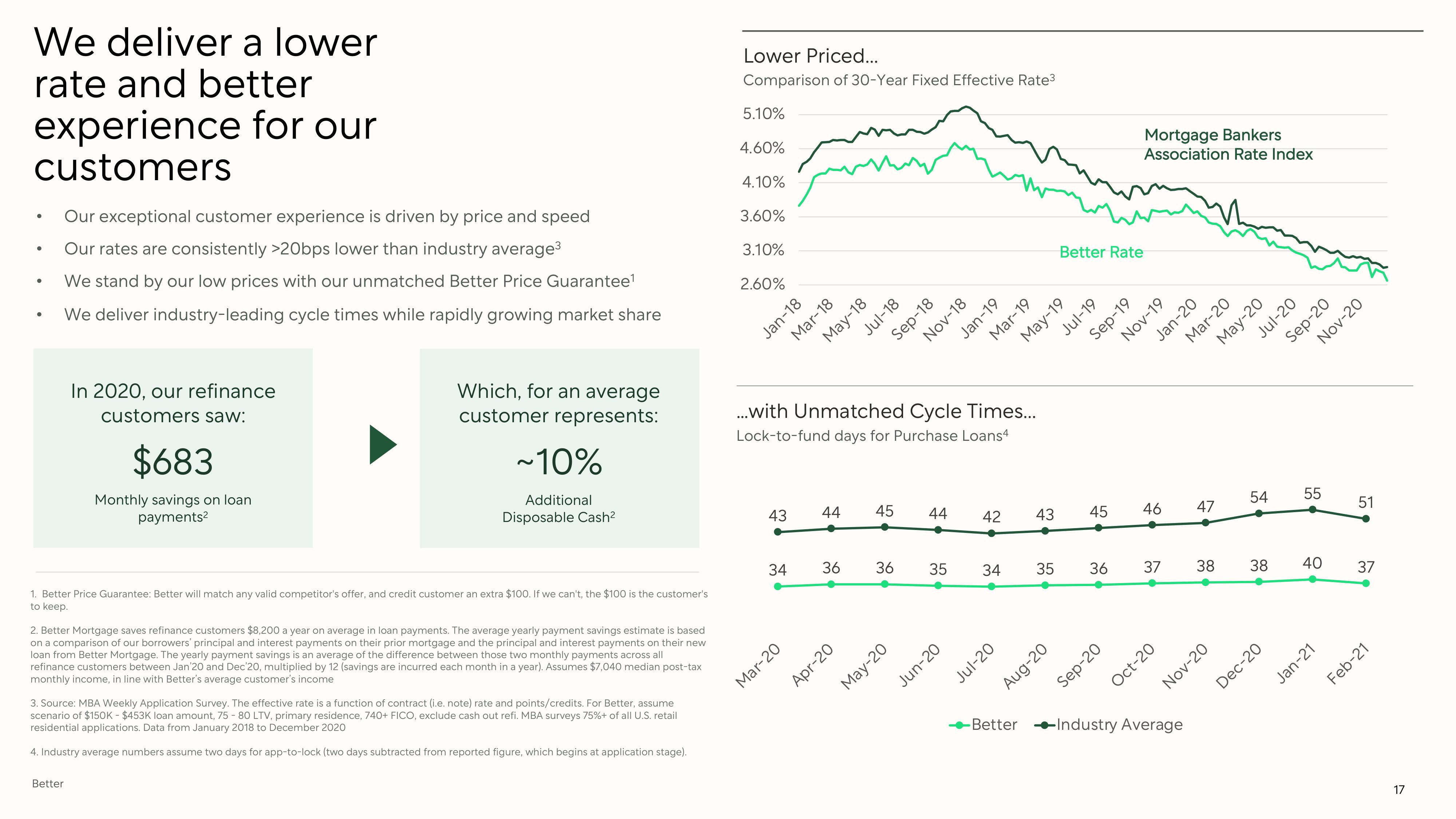

Our exceptional customer experience is driven by price and speed

Our rates are consistently >20bps lower than industry average³

We stand by our low prices with our unmatched Better Price Guarantee¹

We deliver industry-leading cycle times while rapidly growing market share

In 2020, our refinance

customers saw:

$683

Monthly savings on loan

payments²

Which, for an average

customer represents:

Better

~10%

Additional

Disposable Cash²

1. Better Price Guarantee: Better will match any valid competitor's offer, and credit customer an extra $100. If we can't, the $100 is the customer's

to keep.

2. Better Mortgage saves refinance customers $8,200 a year on average in loan payments. The average yearly payment savings estimate is based

on a comparison of our borrowers' principal and interest payments on their prior mortgage and the principal and interest payments on their new

loan from Better Mortgage. The yearly payment savings is an average of the difference between those two monthly payments across all

refinance customers between Jan'20 and Dec'20, multiplied by 12 (savings are incurred each month in a year). Assumes $7,040 median post-tax

monthly income, in line with Better's average customer's income

3. Source: MBA Weekly Application Survey. The effective rate is a function of contract (i.e. note) rate and points/credits. For Better, assume

scenario of $150K - $453K loan amount, 75-80 LTV, primary residence, 740+ FICO, exclude cash out refi. MBA surveys 75%+ of all U.S. retail

residential applications. Data from January 2018 to December 2020

4. Industry average numbers assume two days for app-to-lock (two days subtracted from reported figure, which begins at application stage).

Lower Priced...

Comparison of 30-Year Fixed Effective Rate³

5.10%

4.60%

4.10%

3.60%

3.10%

2.60%

43

34

Jan-18

Mar-18

Mar-20

May-18

44

36

Jul-18

...with Unmatched Cycle Times...

Lock-to-fund days for Purchase Loans4

Apr-20

45

36

Sep-18

May-20

44

35

Nov-18

Jun-20

Jan-19

42

34

Jul-20

Mar-19

May-19

Better

43

Better Rate

Aug-20

6L-Inr

45

35 36

Sep-20

Sep-19

Mortgage Bankers

Association Rate Index

46

Nov-19

Jan-20

Oct-20

Mar-20

37 38

May-20

47

→Industry Average

Nov-20

Jul-20

54

38

Dec-20

Sep-20

55

40

Jan-21

Nov-20

51

37

Feb-21

17View entire presentation