Deutsche Bank Results Presentation Deck

Net interest margin (NIM)

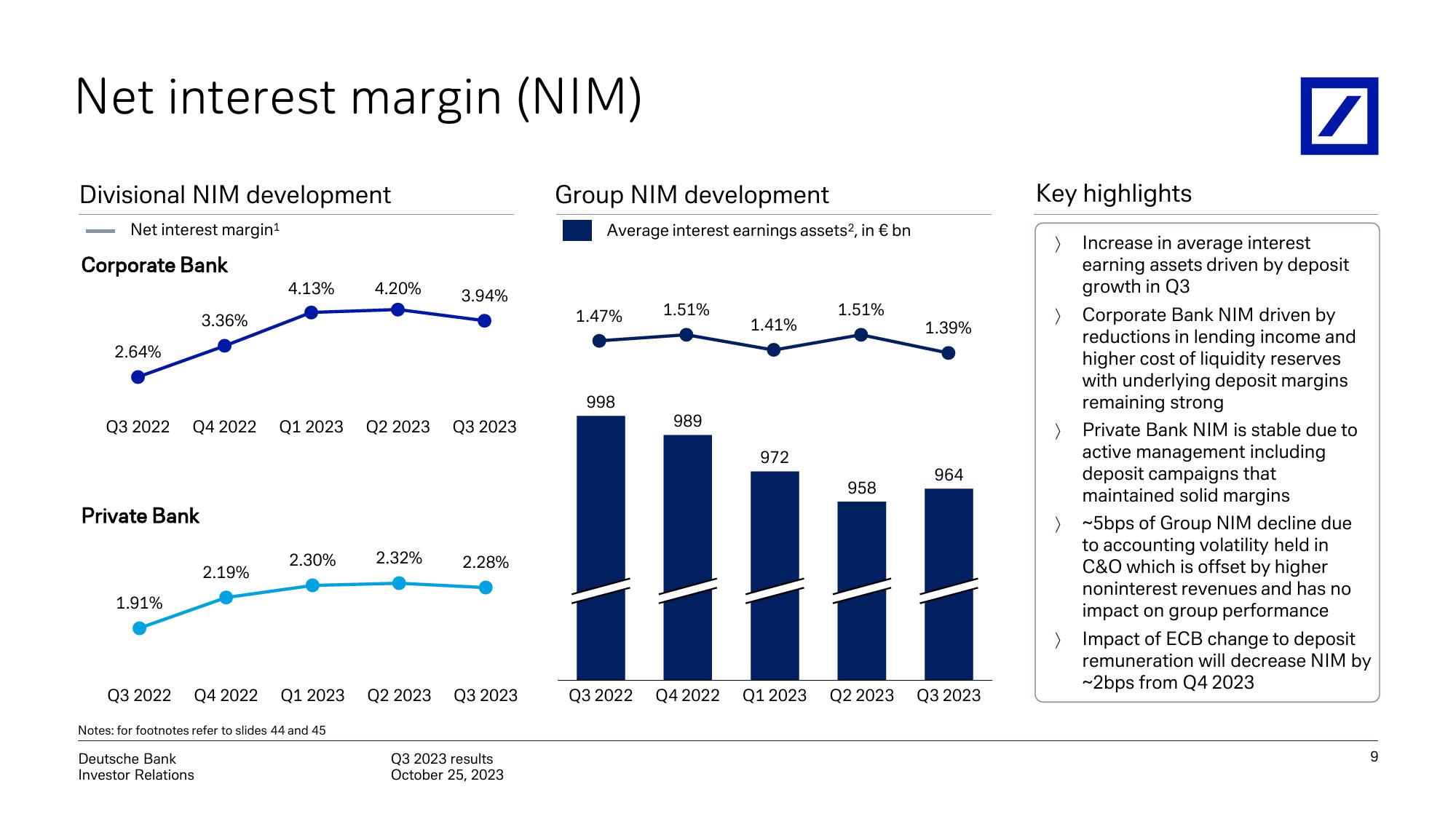

Divisional NIM development

Net interest margin¹

Corporate Bank

2.64%

Private Bank

3.36%

1.91%

Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

2.19%

4.13%

Q3 2022 Q4 2022

2.30%

Q1 2023

4.20%

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

3.94%

2.32%

2.28%

Q2 2023 Q3 2023

Q3 2023 results

October 25, 2023

Group NIM development

Average interest earnings assets², in € bn

1.47%

998

Q3 2022

1.51%

989

Q4 2022

1.41%

972

Q1 2023

1.51%

958

Q2 2023

1.39%

964

Q3 2023

Key highlights

/

Increase in average interest

earning assets driven by deposit

growth in Q3

> Corporate Bank NIM driven by

reductions in lending income and

higher cost of liquidity reserves

with underlying deposit margins

remaining strong

> Private Bank NIM is stable due to

active management including

deposit campaigns that

maintained solid margins

~5bps of Group NIM decline due

to accounting volatility held in

C&O which is offset by higher

noninterest revenues and has no

impact on group performance

> Impact of ECB change to deposit

remuneration will decrease NIM by

~2bps from Q4 2023

9View entire presentation