Deutsche Bank Results Presentation Deck

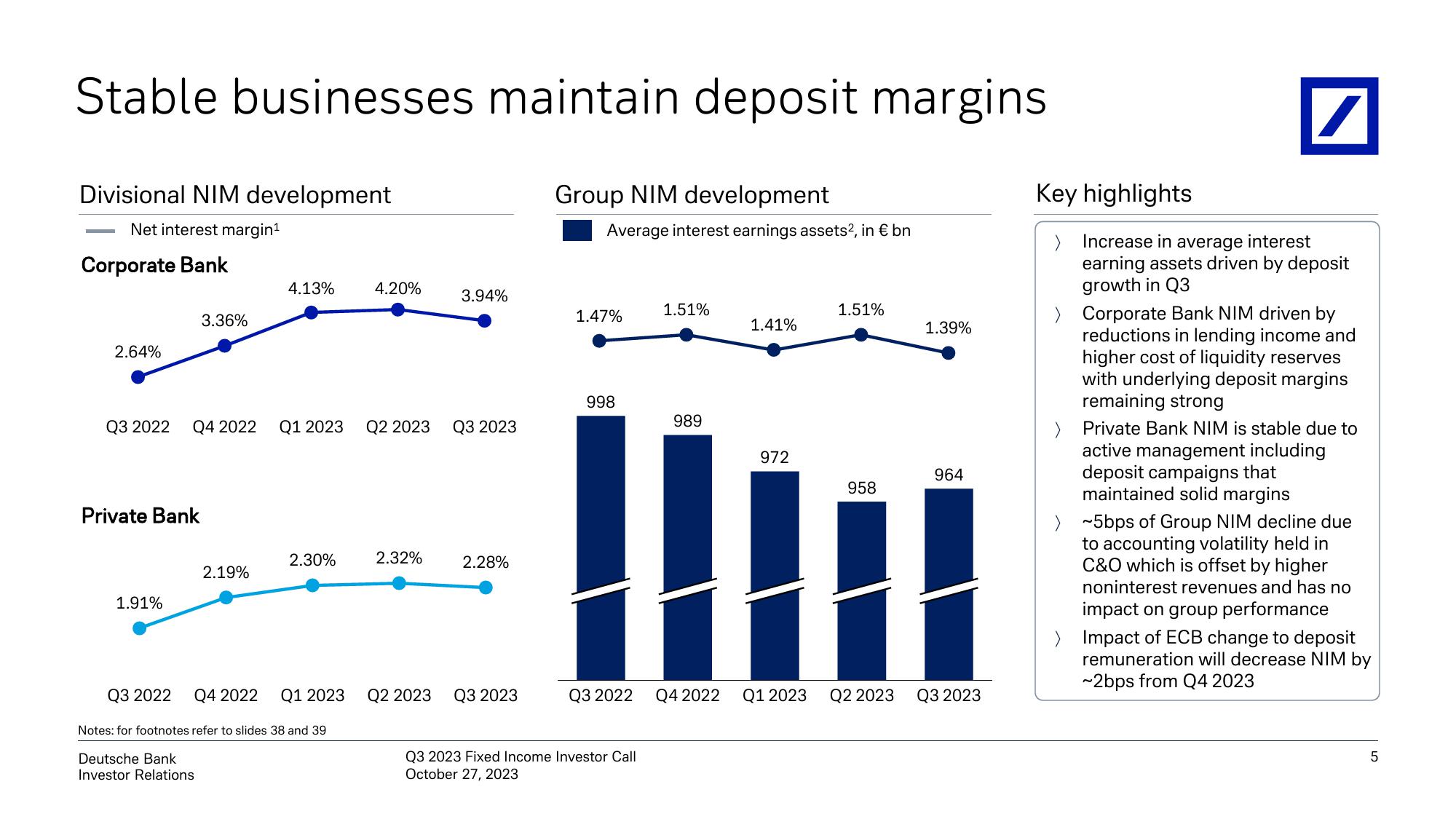

Stable businesses maintain deposit margins

Divisional NIM development

Net interest margin¹

Corporate Bank

2.64%

Private Bank

3.36%

1.91%

Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

2.19%

4.13%

Q3 2022 Q4 2022

2.30%

Q1 2023

4.20%

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

3.94%

2.32%

2.28%

Q2 2023 Q3 2023

Group NIM development

Average interest earnings assets², in € bn

1.47%

998

Q3 2022

Q3 2023 Fixed Income Investor Call

October 27, 2023

1.51%

989

Q4 2022

1.41%

972

Q1 2023

1.51%

958

Q2 2023

1.39%

964

Q3 2023

Key highlights

/

Increase in average interest

earning assets driven by deposit

growth in Q3

Corporate Bank NIM driven by

reductions in lending income and

higher cost of liquidity reserves

with underlying deposit margins

remaining strong

> Private Bank NIM is stable due to

active management including

deposit campaigns that

maintained solid margins

~5bps of Group NIM decline due

to accounting volatility held in

C&O which is offset by higher

noninterest revenues and has no

impact on group performance

> Impact ECB change to deposit

remuneration will decrease NIM by

~2bps from Q4 2023

5View entire presentation