Inovalon Results Presentation Deck

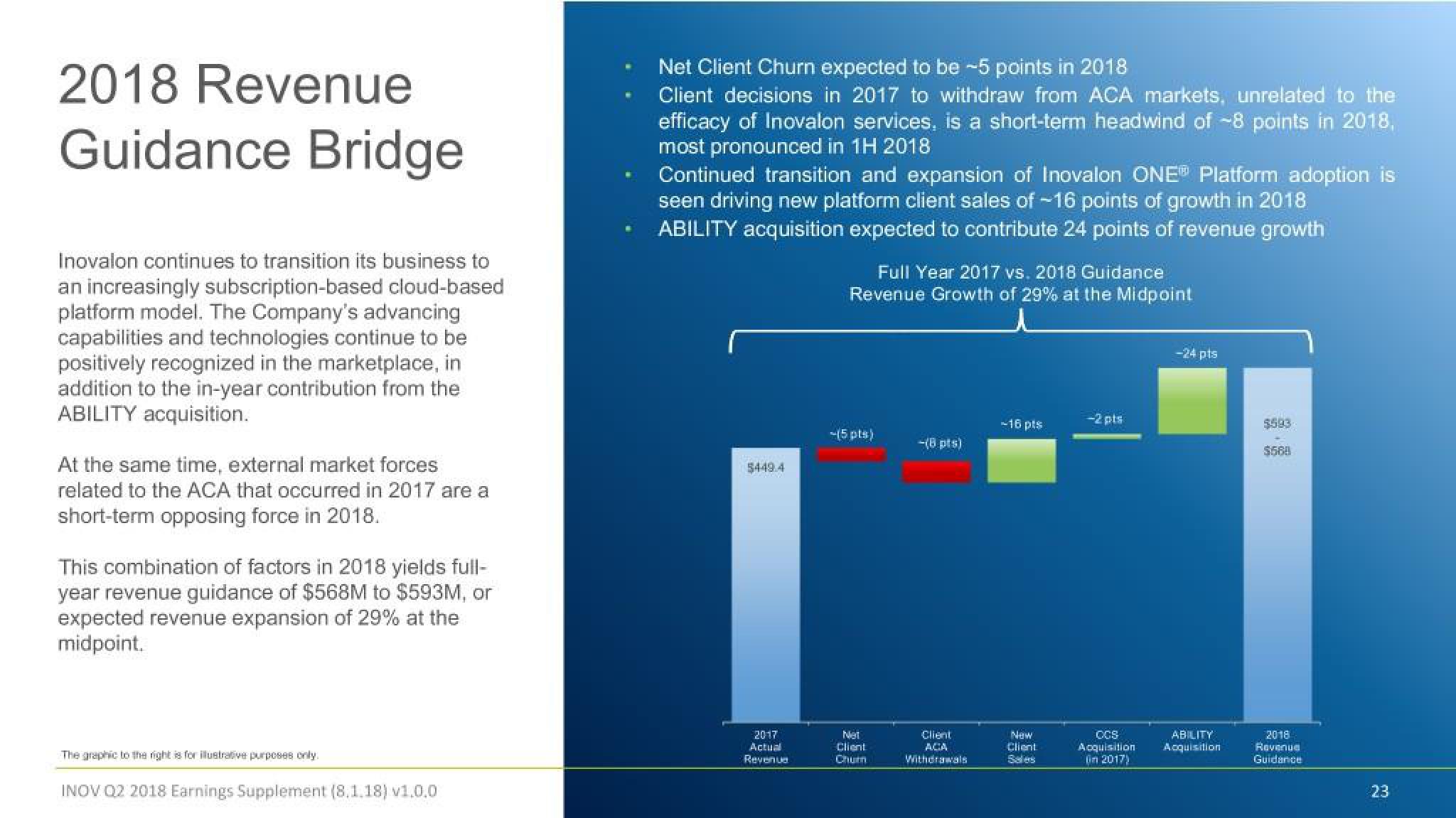

2018 Revenue

Guidance Bridge

Inovalon continues to transition its business to

an increasingly subscription-based cloud-based

platform model. The Company's advancing

capabilities and technologies continue to be

positively recognized in the marketplace, in

addition to the in-year contribution from the

ABILITY acquisition.

At the same time, external market forces

related to the ACA that occurred in 2017 are a

short-term opposing force in 2018.

This combination of factors in 2018 yields full-

year revenue guidance of $568M to $593M, or

expected revenue expansion of 29% at the

midpoint.

The graphic to the right is for illustrative purposes only.

INOV Q2 2018 Earnings Supplement (8.1.18) v1.0.0

Net Client Churn expected to be -5 points in 2018

Client decisions in 2017 to withdraw from ACA markets, unrelated to the

efficacy of Inovalon services, is a short-term headwind of -8 points in 2018,

most pronounced in 1H 2018

Continued transition and expansion of Inovalon ONE® Platform adoption is

seen driving new platform client sales of -16 points of growth in 2018

ABILITY acquisition expected to contribute 24 points of revenue growth

5449.4

2017

Actual

Revenue

Full Year 2017 vs. 2018 Guidance

Revenue Growth of 29% at the Midpoint

--(5 pts)

Net

Client

Chum

-(8 pts)

Client

ACA

Withdrawals

-16 pts

New

Client

Sales

-2 pts

CCS

Acquisition

in 2017)

-24 pts

ABILITY

Acquisition

$593

$588

2018

Revenue

Guidance

23

2210View entire presentation