Truist Financial Corp Results Presentation Deck

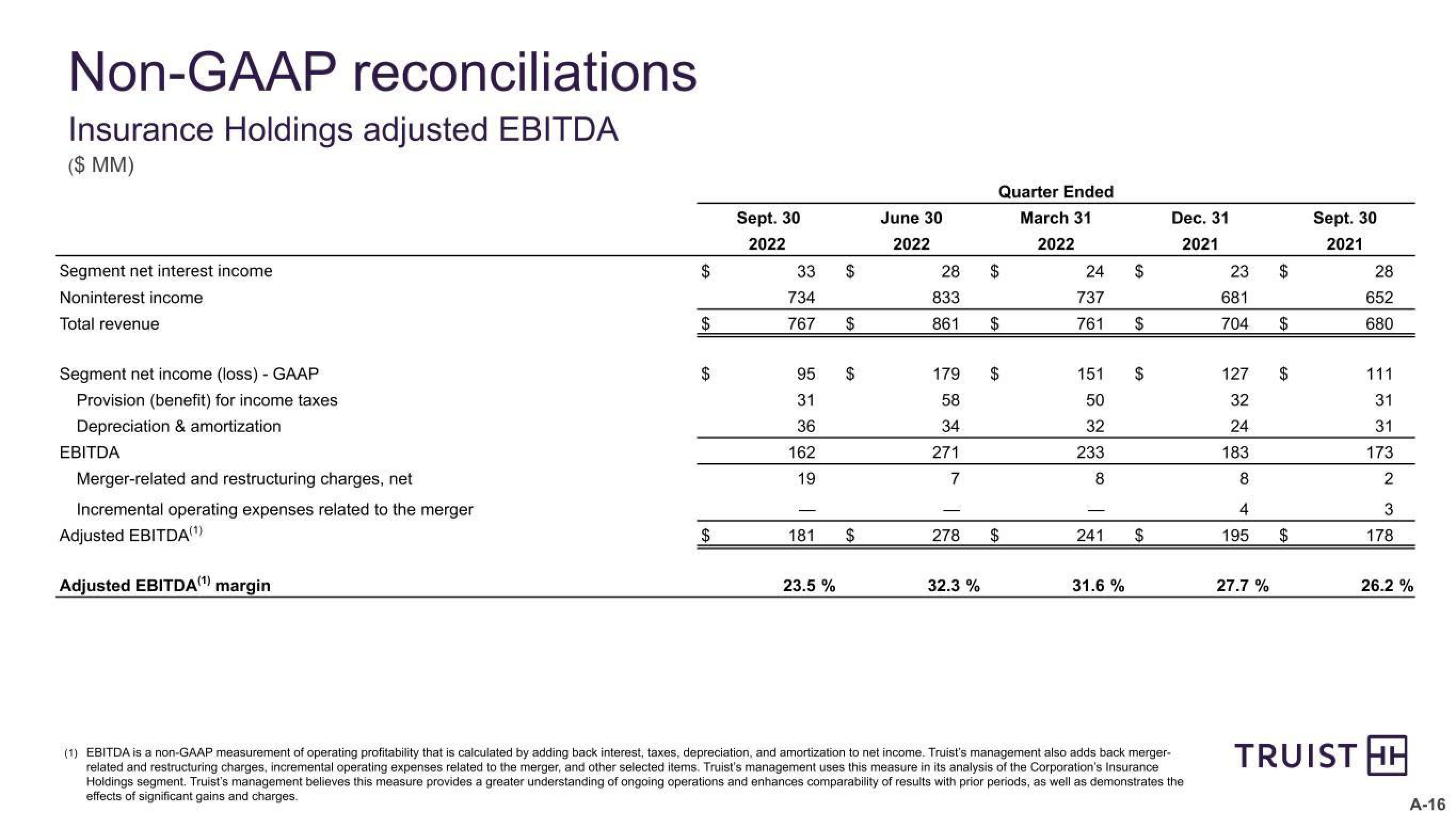

Non-GAAP reconciliations

Insurance Holdings adjusted EBITDA

($ MM)

Segment net interest income

Noninterest income

Total revenue

Segment net income (loss) - GAAP

Provision (benefit) for income taxes

Depreciation & amortization

EBITDA

Merger-related and restructuring charges, net

Incremental operating expenses related to the merger

Adjusted EBITDA(¹)

Adjusted EBITDA(¹) margin

$

EA

$

Sept. 30

2022

33

734

767

95

31

36

162

19

181

23.5 %

$

$

$

$

June 30

2022

28

833

861

179

58

34

271

7

278

32.3 %

Quarter Ended

March 31

2022

$

69

24

737

761

151

50

32

233

8

241

31.6%

$

$

Dec. 31

2021

(1) EBITDA is a non-GAAP measurement of operating profitability that is calculated by adding back interest, taxes, depreciation, and amortization to net income. Truist's management also adds back merger-

related and restructuring charges, incremental operating expenses related to the merger, and other selected items. Truist's management uses this measure in its analysis of the Corporation's Insurance

Holdings segment. Truist's management believes this measure provides a greater understanding of ongoing operations and enhances comparability of results with prior periods, as well as demonstrates the

effects of significant gains and charges.

23

681

704

127

32

24

183

8

4

195

27.7 %

$

$

Sept. 30

2021

28

652

680

111

31

31

173

2

3

178

26.2 %

TRUIST HH

A-16View entire presentation