First-Quarter 2023 Earnings Presentation

Flatbed Segment 1Q23 Summary Results

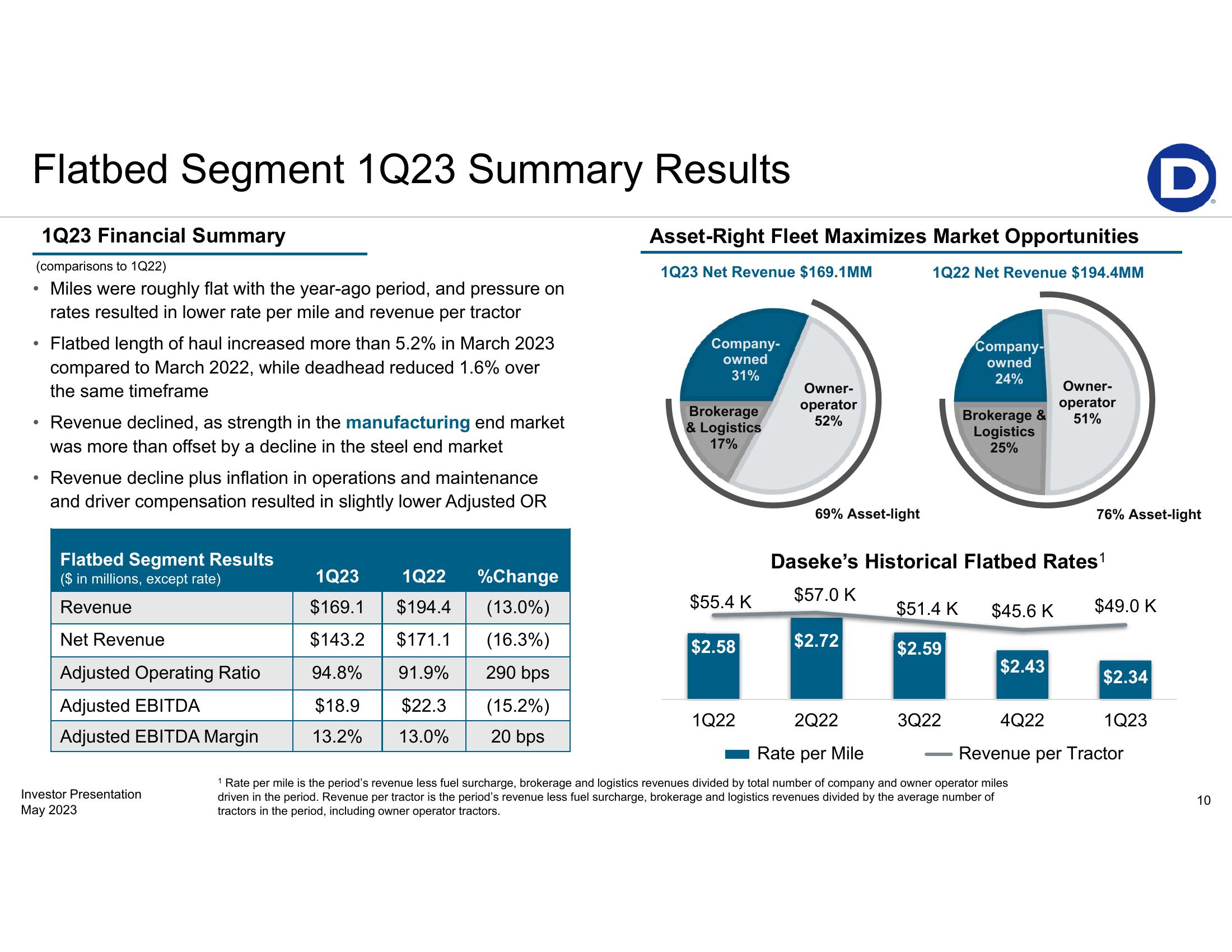

1Q23 Financial Summary

(comparisons to 1Q22)

Miles were roughly flat with the year-ago period, and pressure on

rates resulted in lower rate per mile and revenue per tractor

●

●

Flatbed length of haul increased more than 5.2% in March 2023

compared to March 2022, while deadhead reduced 1.6% over

the same timeframe

Revenue declined, as strength in the manufacturing end market

was more than offset by a decline in the steel end market

Revenue decline plus inflation in operations and maintenance

and driver compensation resulted in slightly lower Adjusted OR

Flatbed Segment Results

($ in millions, except rate)

Revenue

Net Revenue

Adjusted Operating Ratio

Adjusted EBITDA

Adjusted EBITDA Margin

Investor Presentation

May 2023

1Q23 1Q22 %Change

$169.1 $194.4 (13.0%)

$143.2 $171.1 (16.3%)

94.8%

91.9%

290 bps

$18.9

$22.3

(15.2%)

13.2%

13.0%

20 bps

Asset-Right Fleet Maximizes Market Opportunities

1Q22 Net Revenue $194.4MM

1Q23 Net Revenue $169.1MM

Company-

owned

31%

Brokerage

& Logistics

17%

$55.4 K

$2.58

1Q22

Owner-

operator

52%

69% Asset-light

$2.72

$51.4 K

$2.59

Company-

owned

24%

3Q22

Brokerage &

Logistics

25%

Daseke's Historical Flatbed Rates ¹

$57.0 K

2Q22

Rate per Mile

1 Rate per mile is the period's revenue less fuel surcharge, brokerage and logistics revenues divided by total number of company and owner operator miles

driven in the period. Revenue per tractor is the period's revenue less fuel surcharge, brokerage and logistics revenues divided by the average number of

tractors in the period, including owner operator tractors.

$2.43

Owner-

operator

51%

$45.6 K $49.0 K

4Q22

76% Asset-light

$2.34

D

1Q23

Revenue per Tractor

10View entire presentation