EVBox SPAC Presentation Deck

Transaction Summary

●

●

●

●

●

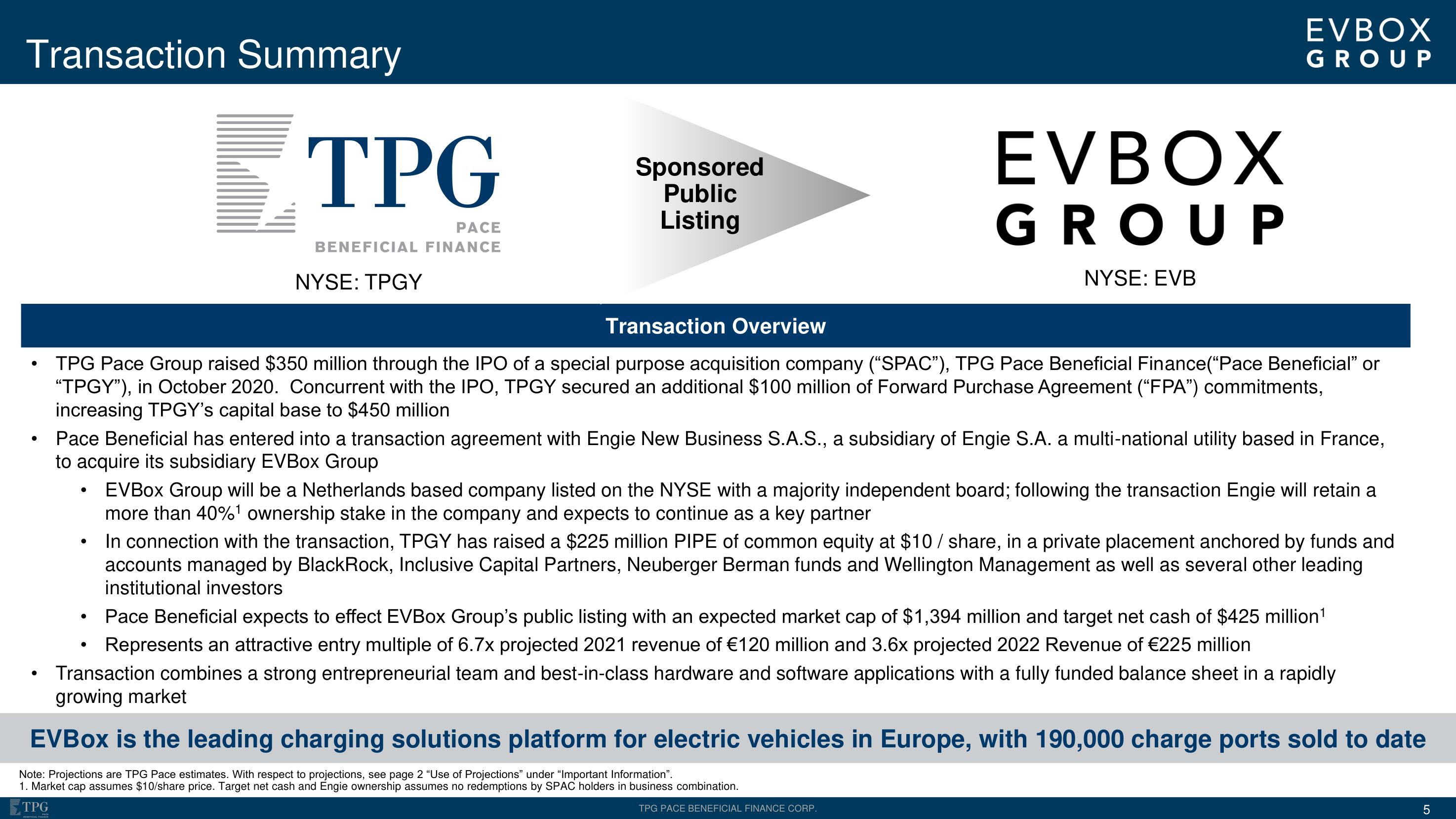

TPG

PACE

BENEFICIAL FINANCE

●

NYSE: TPGY

Transaction Overview

TPG Pace Group raised $350 million through the IPO of a special purpose acquisition company ("SPAC”), TPG Pace Beneficial Finance("Pace Beneficial" or

"TPGY"), in October 2020. Concurrent with the IPO, TPGY secured an additional $100 million of Forward Purchase Agreement ("FPA") commitments,

increasing TPGY's capital base to $450 million

●

Sponsored

Public

Listing

Pace Beneficial has entered into a transaction agreement with Engie New Business S.A.S., a subsidiary of Engie S.A. a multi-national utility based in France,

to acquire its subsidiary EVBox Group

EVBOX

GROUP

NYSE: EVB

EVBOX

GROUP

EVBox Group will be a Netherlands based company listed on the NYSE with a majority independent board; following the transaction Engie will retain a

more than 40%¹ ownership stake in the company and expects to continue as a key partner

Pace Beneficial expects to effect EVBox Group's public listing with an expected market cap of $1,394 million and target net cash of $425 million¹

Represents an attractive entry multiple of 6.7x projected 2021 revenue of €120 million and 3.6x projected 2022 Revenue of €225 million

Transaction combines a strong entrepreneurial team and best-in-class hardware and software applications with a fully funded balance sheet in a rapidly

growing market

In connection with the transaction, TPGY has raised a $225 million PIPE of common equity at $10 / share, in a private placement anchored by funds and

accounts managed by BlackRock, Inclusive Capital Partners, Neuberger Berman funds and Wellington Management as well as several other leading

institutional investors

TPG PACE BENEFICIAL FINANCE CORP.

EVBox is the leading charging solutions platform for electric vehicles in Europe, with 190,000 charge ports sold to date

Note: Projections are TPG Pace estimates. With respect to projections, see page 2 "Use of Projections" under "Important Information".

1. Market cap assumes $10/share price. Target net cash and Engie ownership assumes no redemptions by SPAC holders in business combination.

TPG

LO

5View entire presentation