LanzaTech SPAC Presentation Deck

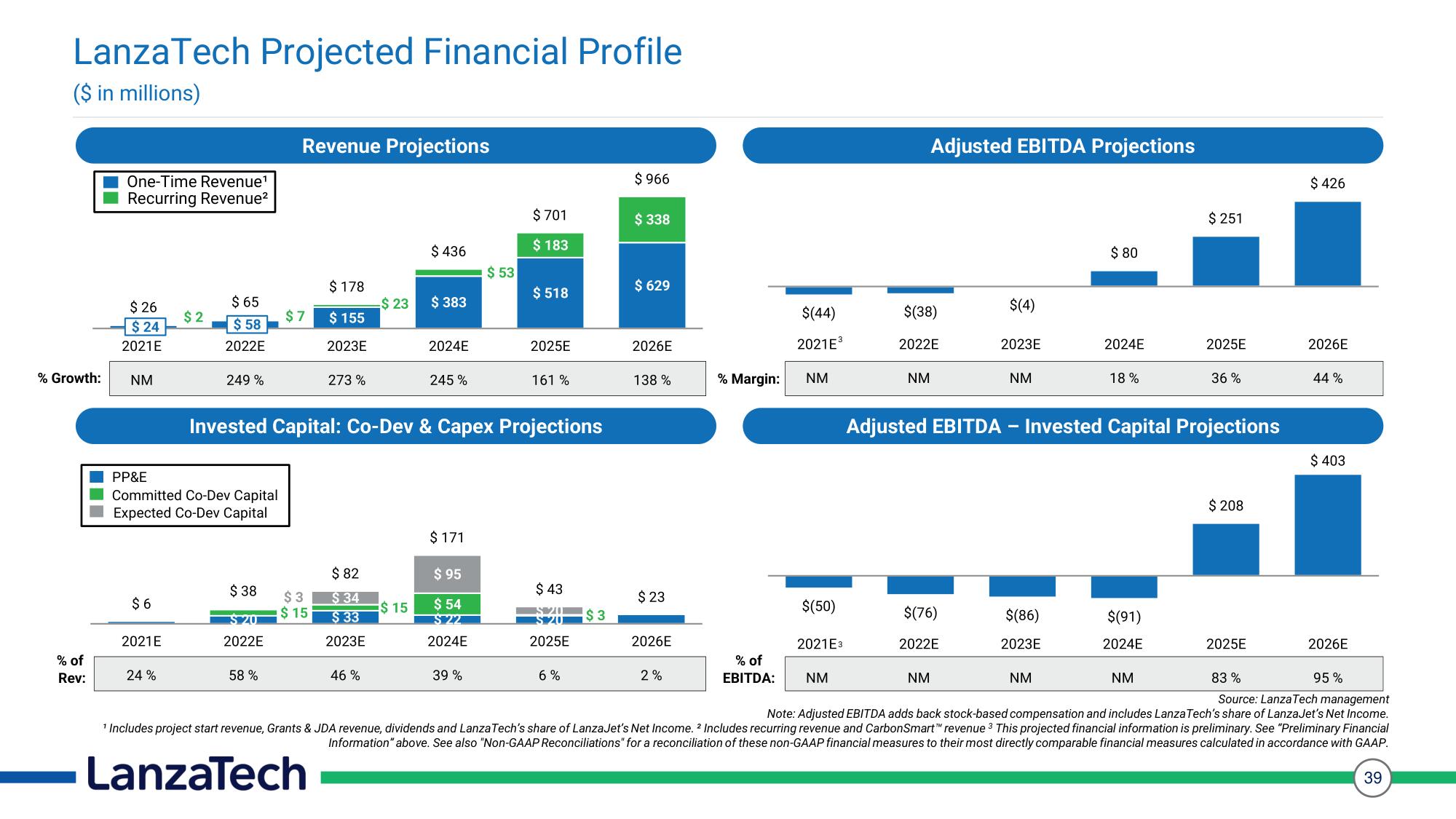

LanzaTech Projected Financial Profile

($ in millions)

% Growth:

% of

Rev:

One-Time Revenue¹

Recurring Revenue²

$ 26

$ 24

2021E

NM

$6

2021E

$2

$65

$58

2022E

PP&E

Committed Co-Dev Capital

Expected Co-Dev Capital

24%

249 %

$38

S 20

2022E

Revenue Projections

$7

58%

$ 178

$ 155

2023E

$3

$ 15

273 %

$82

$ 34

$ 33

2023E

$ 23

46 %

$ 436

$15

$ 383

2024E

Invested Capital: Co-Dev & Capex Projections

245 %

$ 171

$ 95

$ 54

S22

2024E

$ 53

$ 701

$ 183

39%

$ 518

2025E

161 %

$ 43

S 20

2025E

$3

6%

$ 966

$ 338

$ 629

2026E

138 %

$ 23

2026E

% Margin:

2%

% of

EBITDA:

$(44)

2021E³

NM

$(50)

2021E3

NM

$(38)

2022E

NM

Adjusted EBITDA Projections

$(76)

2022E

$(4)

NM

2023E

NM

-

$(86)

2023E

$ 80

Adjusted EBITDA Invested Capital Projections

2024E

NM

18%

$(91)

2024E

$ 251

2025E

NM

83 %

Source: LanzaTech management

Note: Adjusted EBITDA adds back stock-based compensation and includes Lanza Tech's share of LanzaJet's Net Income.

¹ Includes project start revenue, Grants & JDA revenue, dividends and Lanza Tech's share of LanzaJet's Net Income. 2 Includes recurring revenue and CarbonSmart™ revenue ³ This projected financial information is preliminary. See "Preliminary Financial

Information" above. See also "Non-GAAP Reconciliations" for a reconciliation of these non-GAAP financial measures to their most directly comparable financial measures calculated in accordance with GAAP.

39

LanzaTech

36 %

$208

2025E

$426

2026E

44%

$ 403

2026E

95%View entire presentation