Zegna SPAC Presentation Deck

5. Transaction structure and valuation

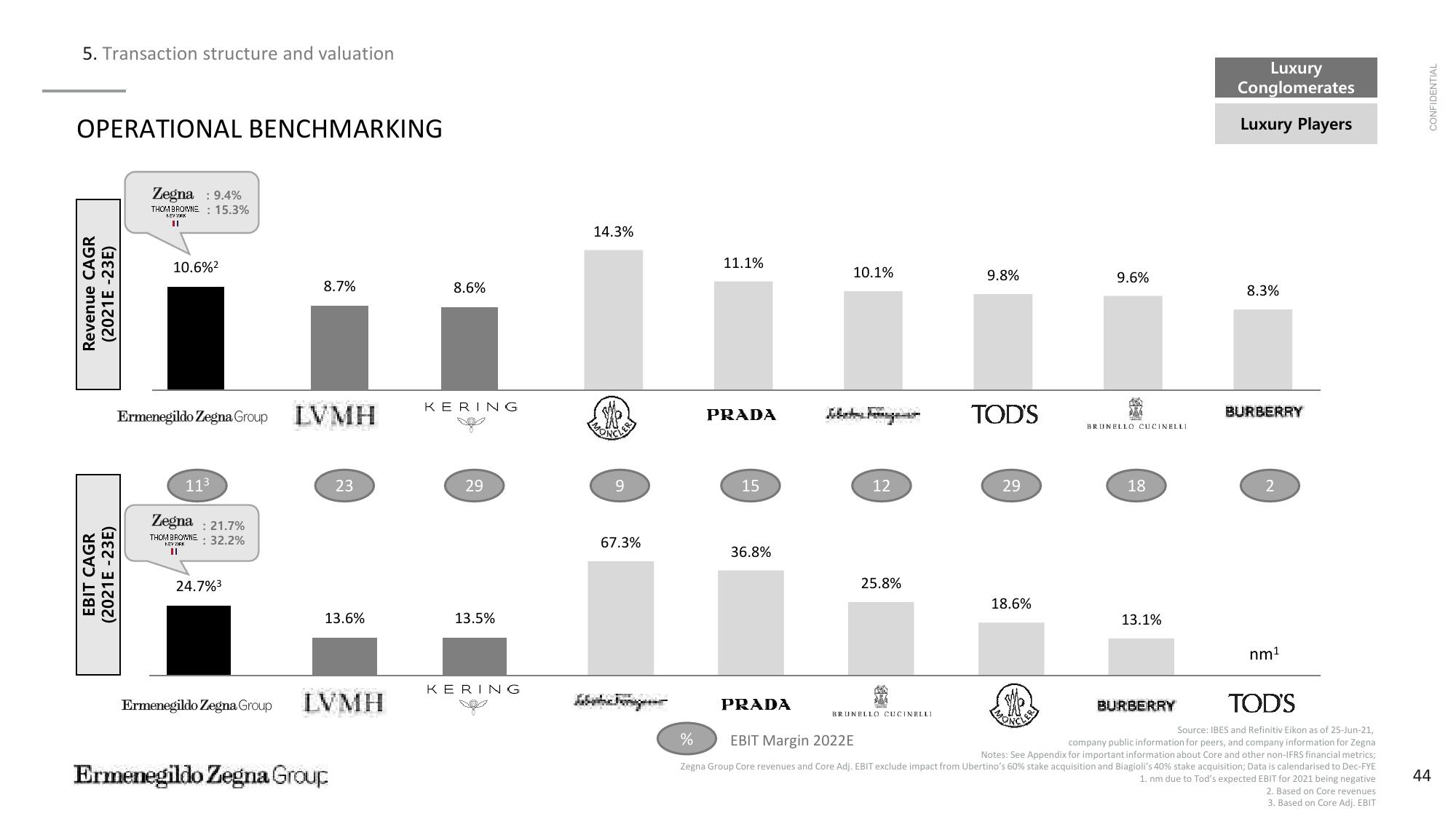

OPERATIONAL BENCHMARKING

Revenue CAGR

(2021E -23E)

EBIT CAGR

(2021E-23E)

Zegna : 9.4%

THOM BROWNE 15.3%

KEY YORK

II

10.6%²

Ermenegildo Zegna Group

11³

Zegna: 21.7%

THOM BROWNE: 32.2%

II

24.7%³

Ermenegildo Zegna Group

8.7%

LVMH

23

13.6%

LVMH

Ermenegildo Zegna Group

8.6%

KERING

29

13.5%

KERING

DO

14.3%

9

67.3%

11.1%

PRADA

15

36.8%

10.1%

PRADA

12

25.8%

9.8%

BRUNELLO CUCINELLI

TOD'S

29

18.6%

9.6%

BRUNELLO CUCINELLI

18

13.1%

Luxury

Conglomerates

BURBERRY

Luxury Players

8.3%

BURBERRY

TOD'S

Source: IBES and Refinitiv Eikon as of 25-Jun-21,

%

EBIT Margin 2022E

company public information for peers, and company information for Zegna

Notes: See Appendix for important information about Core and other non-IFRS financial metrics;

Zegna Group Core revenues and Core Adj. EBIT exclude impact from Ubertino's 60% stake acquisition and Biagioli's 40% stake acquisition; Data is calendarised to Dec-FYE

1. nm due to Tod's expected EBIT for 2021 being negative

2. Based on Core revenues

3. Based on Core Adj. EBIT

2

nm¹

CONFIDENTIAL

44View entire presentation