Q3 Fiscal Year 2023 Financial Results

MANAGED OPEX TO REFLECT CHALLENGING GLOBAL ENVIRONMENT

Net sales

Y/Y % chg

Y/Y % chg (CC)

Gross profit

% margin

Operating expense

% of sales

Operating income

% margin

Net income

% margin

Earnings per share

Diluted shares

Q3'23

1,270

(22%)

(17%)

482

37.9%

278

21.9%

204

16.1%

185

14.6%

$1.14

163

Q3'22

1,633

(2%)

(2%)

663

40.6%

361

22.1%

302

18.5%

263

16.1%

$1.55

170

Note: Numbers in $ millions except EPS and percentages. Diluted share count in millions.

Results are non-GAAP. Comparisons are Y/Y and in US$ unless otherwise specified.

Y/Y

(22%)

(27%)

(266 bps)

(23%)

(25 bps)

(32%)

(242 bps)

(29%)

(150 bps)

(26%)

(4%)

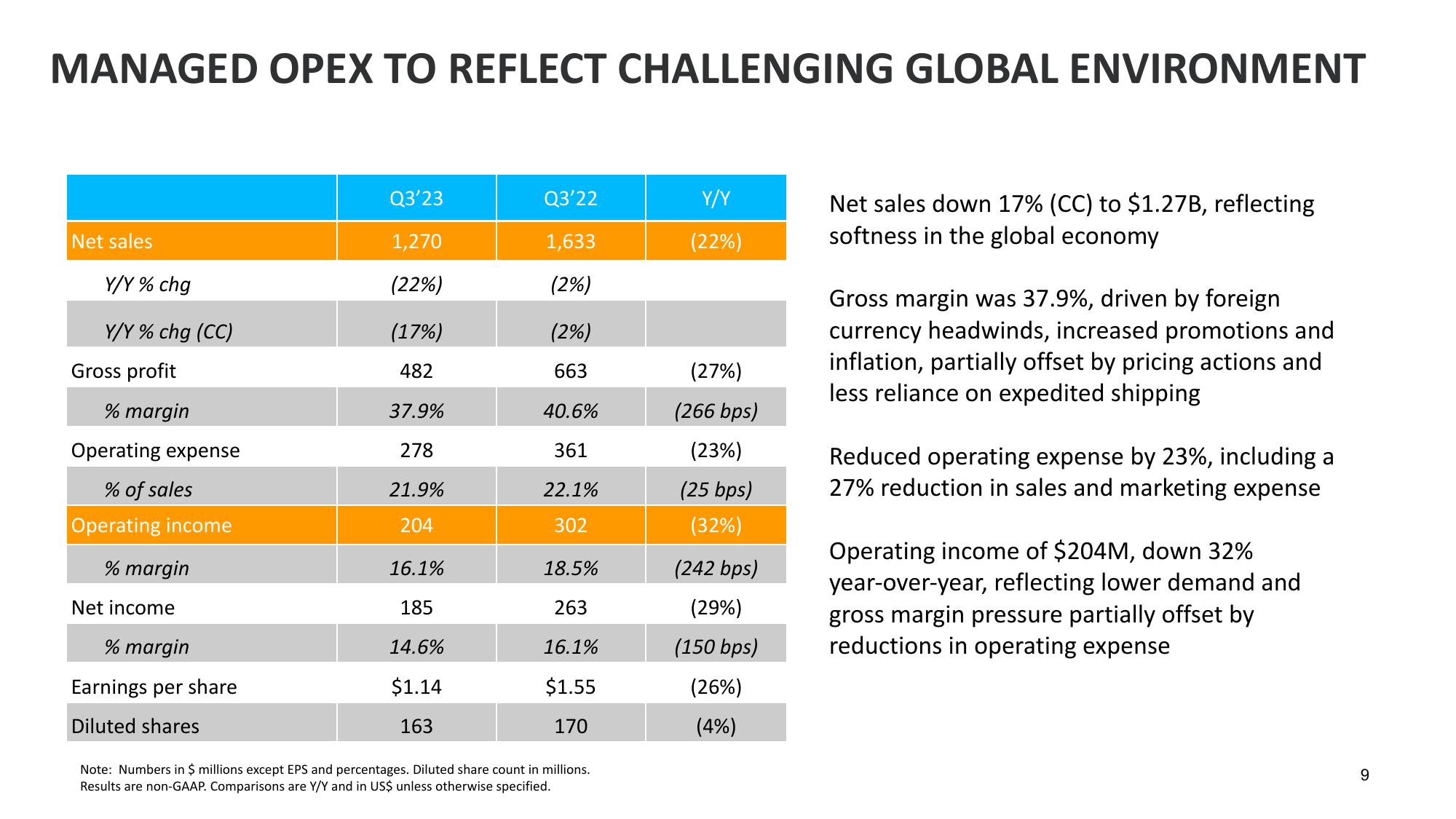

Net sales down 17% (CC) to $1.27B, reflecting

softness in the global economy

Gross margin was 37.9%, driven by foreign

currency headwinds, increased promotions and

inflation, partially offset by pricing actions and

less reliance on expedited shipping

Reduced operating expense by 23%, including a

27% reduction in sales and marketing expense

Operating income of $204M, down 32%

year-over-year, reflecting lower demand and

gross margin pressure partially offset by

reductions in operating expense

9View entire presentation