Otonomo SPAC Presentation Deck

Sources & Uses and Pro Forma Capitalization

in $MM except per share data

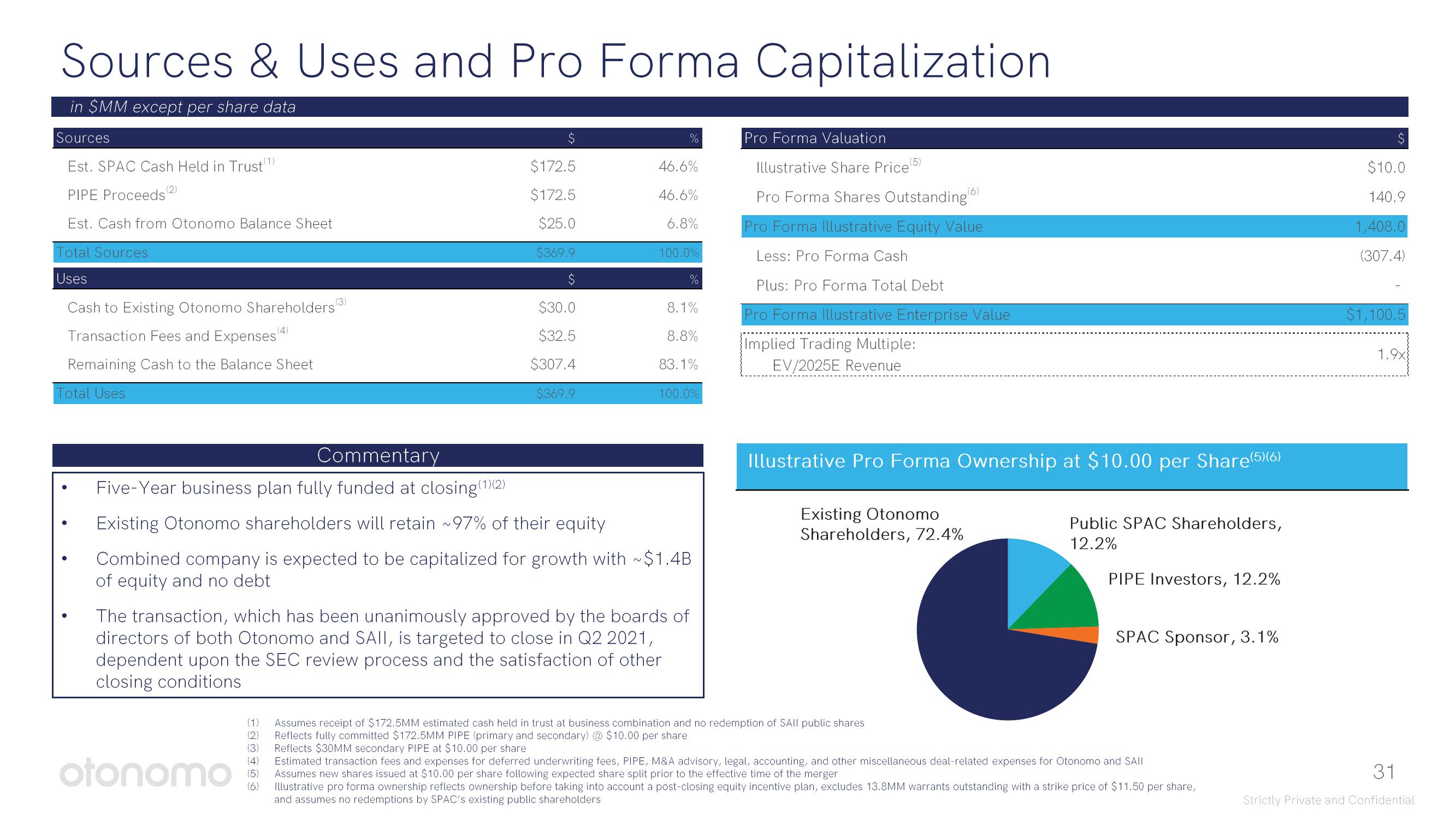

Sources

Est. SPAC Cash Held in Trust(1)

PIPE Proceeds

Est. Cash from Otonomo Balance Sheet

Total Sources

Uses

(2)

Cash to Existing Otonomo Shareholders (3)

(4)

Transaction Fees and Expenses

Remaining Cash to the Balance Sheet

Total Uses

$

otonomo

$172.5

$172.5

$25.0

$369.9

$

$30.0

$32.5

$307.4

$369.9

(1)

(2)

(3)

(4)

(5)

(6)

%

46.6%

46.6%

6.8%

100.0%

0/

%

8.1%

8.8%

83.1%

Commentary

Five-Year business plan fully funded at closing(1)(2)

Existing Otonomo shareholders will retain ~97% of their equity

Combined company is expected to be capitalized for growth with ~$1.4B

of equity and no debt

100.0%

The transaction, which has been unanimously approved by the boards of

directors of both Otonomo and SAII, is targeted to close in Q2 2021,

dependent upon the SEC review process and the satisfaction of other

closing conditions

Pro Forma Valuation

Illustrative Share Price

Pro Forma Shares Outstanding

Pro Forma Illustrative Equity Value

Less: Pro Forma Cash

Plus: Pro Forma Total Debt

Pro Forma Illustrative Enterprise Value

Implied Trading Multiple:

EV/2025E Revenue

(6)

Illustrative Pro Forma Ownership at $10.00 per Share(5)(6)

Existing Otonomo

Shareholders, 72.4%

Assumes receipt of $172.5MM estimated cash held in trust at business combination and no redemption of SAIl public shares

Reflects fully committed $172.5MM PIPE (primary and secondary) @ $10.00 per share

Reflects $30MM secondary PIPE at $10.00 per share

Public SPAC Shareholders,

12.2%

PIPE Investors, 12.2%

SPAC Sponsor, 3.1%

Estimated transaction fees and expenses for deferred underwriting fees, PIPE, M&A advisory, legal, accounting, and other miscellaneous deal-related expenses for Otonomo and SAII

Assumes new shares issued at $10.00 per share following expected share split prior to the effective time of the merger

Illustrative pro forma ownership reflects ownership before taking into account a post-closing equity incentive plan, excludes 13.8MM warrants outstanding with a strike price of $11.50 per share,

and assumes no redemptions by SPAC's existing public shareholders

$10.0

140.9

1,408.0

(307.4)

$1,100.5

1.9x

31

Strictly Private and ConfidentialView entire presentation