Silicon Valley Bank Results Presentation Deck

Continued strong SVB Leerink performance

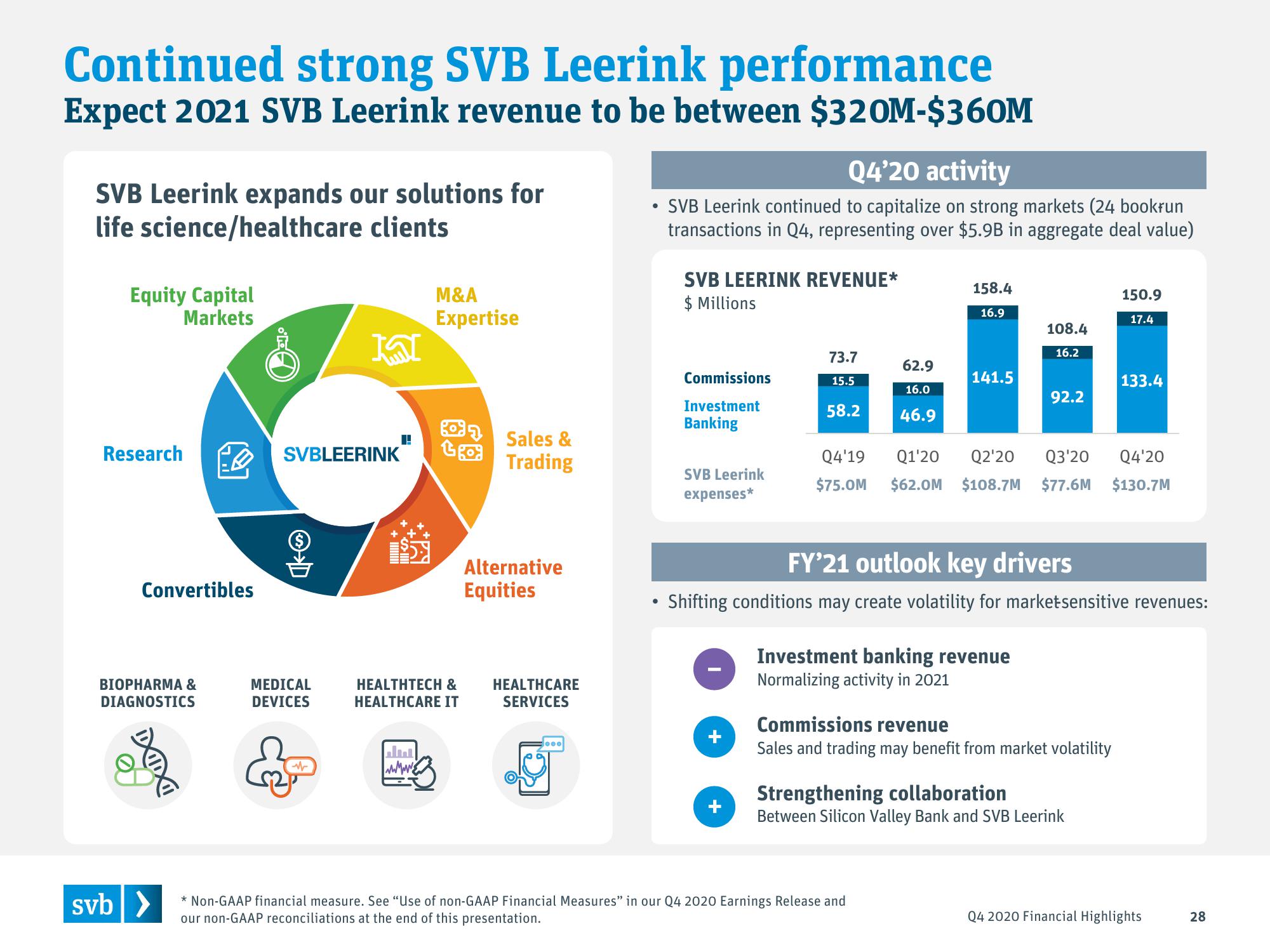

Expect 2021 SVB Leerink revenue to be between $320M-$360M

SVB Leerink expands our solutions for

life science/healthcare clients

Equity Capital

Markets

Research

Convertibles

BIOPHARMA &

DIAGNOSTICS

svb>

SVBLEERINK

MEDICAL

DEVICES

Ka

M

S

M&A

Expertise

Ju

www.s

Sales &

Go Trading

HEALTHTECH &

HEALTHCARE IT

Alternative

Equities

HEALTHCARE

SERVICES

●

Q4'20 activity

SVB Leerink continued to capitalize on strong markets (24 bookrun

transactions in Q4, representing over $5.9B in aggregate deal value)

SVB LEERINK REVENUE*

$ Millions

Commissions

Investment

Banking

SVB Leerink

expenses*

73.7

15.5

58.2

62.9

16.0

46.9

158.4

16.9

141.5

108.4

16.2

Q4'19 Q1'20 Q2'20 Q3'20

$75.0M $62.0M $108.7M $77.6M

Investment banking revenue

Normalizing activity in 2021

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and

our non-GAAP reconciliations at the end of this presentation.

92.2

FY'21 outlook key drivers

Shifting conditions may create volatility for market sensitive revenues:

Commissions revenue

Sales and trading may benefit from market volatility

Strengthening collaboration

Between Silicon Valley Bank and SVB Leerink

150.9

17.4

133.4

Q4'20

$130.7M

Q4 2020 Financial Highlights

28View entire presentation