Barclays Investment Banking Pitch Book

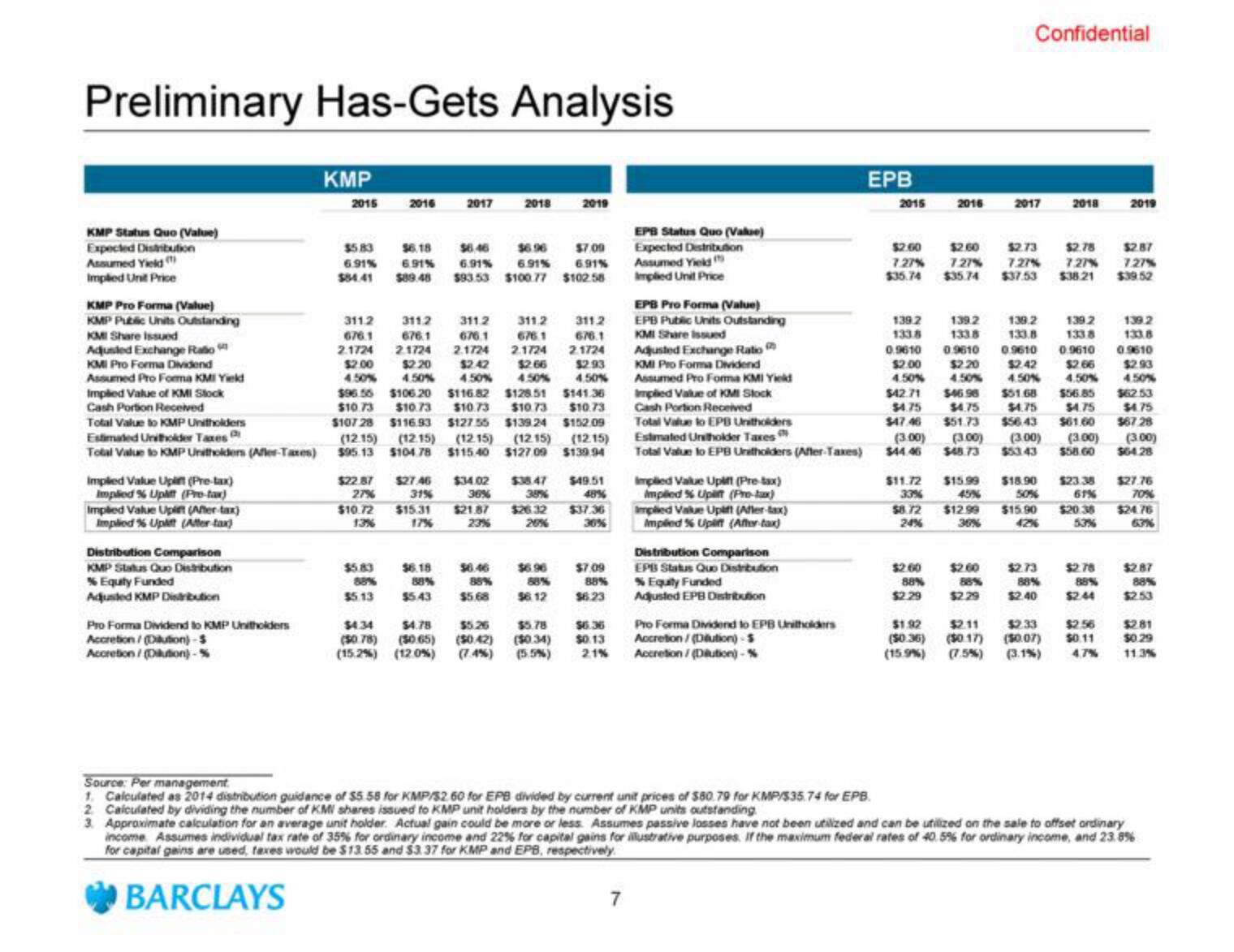

Preliminary Has-Gets Analysis

KMP Status Quo (Value)

Expected Distribution

Assumed Yield

Implied Unit Price

KMP Pro Forma (Value)

KMP Public Units Outstanding

KMI Share Issued

Adjusted Exchange Rabo

KMI Pro Forma Dividend

Assumed Pro Forma KMI Yield

Implied Value of KMI Stock

Cash Portion Received

Total Value to KMP Unitholders

Estimated Unitholder Taxes

Total Value to KMP Unitholders (Afler-Taxes)

Implied Value Uplit (Pre-tax)

Implied % Uplift (Pre-tax)

Implied Value Upit (After-tax)

Implied % Uplit (After-tax)

Distribution Comparison

KMP Status Quo Distribution

%Equity Funded

Adjusted KMP Distribution

Pro Forma Dividend to KMP Unitholders

Accretion/(Dilution)-$

Accretion/(Dilution) -%

KMP

2015

311.2

676.1

2.1724

2016

$22.87

27%

$10.72

13%

$6.18 $6.46 $6.96 $7.00

6.91% 6.91% 6.91%

$84.41 $89.48 $93.53 $100.77 $102.58

$5.83

6.91% 6.91%

$5.83

88%

$5.13

2017

311.2

$2.00

311.2 311.2 311.2

6761

676.1 676.1 676.1

2.1724 2.1724 2.1724 2.1724

$2.20 $2.42 $2.66 $2.93

4.50%

4.50% 4.50%

4.50%

$96.56 $106.20 $116.82 $128.51 $141.36

$10.73 $10.73 $10.73 $10.73 $10.73

$107 28

$116.93 $127.55 $139.24 $152.09

(12.15) (12.15) (12.15) (12.15) (12.15)

$95.13 $104.78 $115.40 $127.09 $139.94

$27.46 $34.02

31%

36%

$15.31 $21.87

23%

$6.18

$6.46

2018

85%

$5.43 $5.68

$4.34 $4.78 $5.26

($0.78) ($0.65) ($0.42)

(15.2%) (12.0%)

2019

$38.47 $49.51

38%

48%

$26.32 $37.36

20%

30%

$6.12

$7.09

88%

$6.23

$5.78 $6.36

($0.34) $0.13

(5.5%) 21%

EPB Status Quo (Value)

Expected Distribution

7

Assumed Yield

Implied Unit Price

EPB Pro Forma (Value)

EPB Public Units Outstanding

KMI Share issued

Adjusted Exchange Ratio

KMI Pro Forma Dividend

Assumed Pro Forma KMI Yield

Implied Value of KMI Stock

Cash Portion Received

Total Value to EPB Unitholders

Estimated Unitholder Taxes

Total Value to EPB Unitholders (After-Taxes)

Implied Value Uplit (Pre-tax)

Implied% Upit (Pro-tax)

Implied Value Uplift (After-tax)

Impled % Upin (After-tax)

Distribution Comparison

EPB Status Quo Distribution

%Equity Funded

Adjusted EPB Distribution

Pro Forma Dividend to EPB Unitholders

Accretion/(Dilution)-$

Accretion/(Dilution) -%

EPB

2015

$2.60

7.27 %

$35.74

$11.72

33%

$8.72

24%

2016

$2.60

88%

$2.29

Confidential

2017

$2.60 $2.73 $2.78

7.27% 7.27% 7.27%

$35.74

$37.53 $38.21

$2.60

139.2

133.8

139.2 139.2 139.2 139.2

133.8 133.8 133.8 133.8

0.9610 0.9610 0.9610 0.9610 0.9610

$2.00

$2.20

$2.42

$2.66 $2.93

4.50%

4.50% 4.50% 4.50% 4.50%

$42.71 $46.96 $51.68 $56.85 $62.53

$4.75 $4.75 $4.75 $4.75 $4.75

$47.46 $51.73 $56.43 $61.60 $67 28

(3.00) (3.00) (3.00) (3.00)

$44.46 $48.73 $53.43 $58.60

(3.00)

$64.28

$2.29

2018

$15.99 $18.90 $23.38

45%

61%

$12.99 $15.90 $20.35

30%

53%

$2.73

88%

$2.40

$2.78

88%

$2.44

2019

$1.92

$2.11

$2.56

($0.36) ($0.17)

$2.33

(50.07) $0.11

(15.9%) (7.5%) (3.1%) 4.7%

$2.87

7.27%

$39.52

$27.76

70%

$24.76

63%

$2.87

88%

$2.53

$2.81

$0.29

11.3%

Source: Per management

1. Calculated as 2014 distribution guidance of $5 58 for KMP/52 60 for EPB divided by current unit prices of $80.79 for KMP/S35.74 for EPB.

2. Calculated by dividing the number of KMI shares issued to KMP unit holders by the number of KMP units outstanding

3. Approximate calculation for an average unit holder. Actual gain could be more or less. Assumes passive losses have not been utilized and can be utilized on the sale to offset ordinary

income Assumes individual tax rate of 35% for ordinary income and 22% for capital gains for illustrative purposes. If the maximum federal rates of 40.5% for ordinary income, and 23.8%

for capital gains are used, faxes would be $13.55 and $3. 37 for KMP and EPB, respectively.

BARCLAYSView entire presentation