Tudor, Pickering, Holt & Co Investment Banking

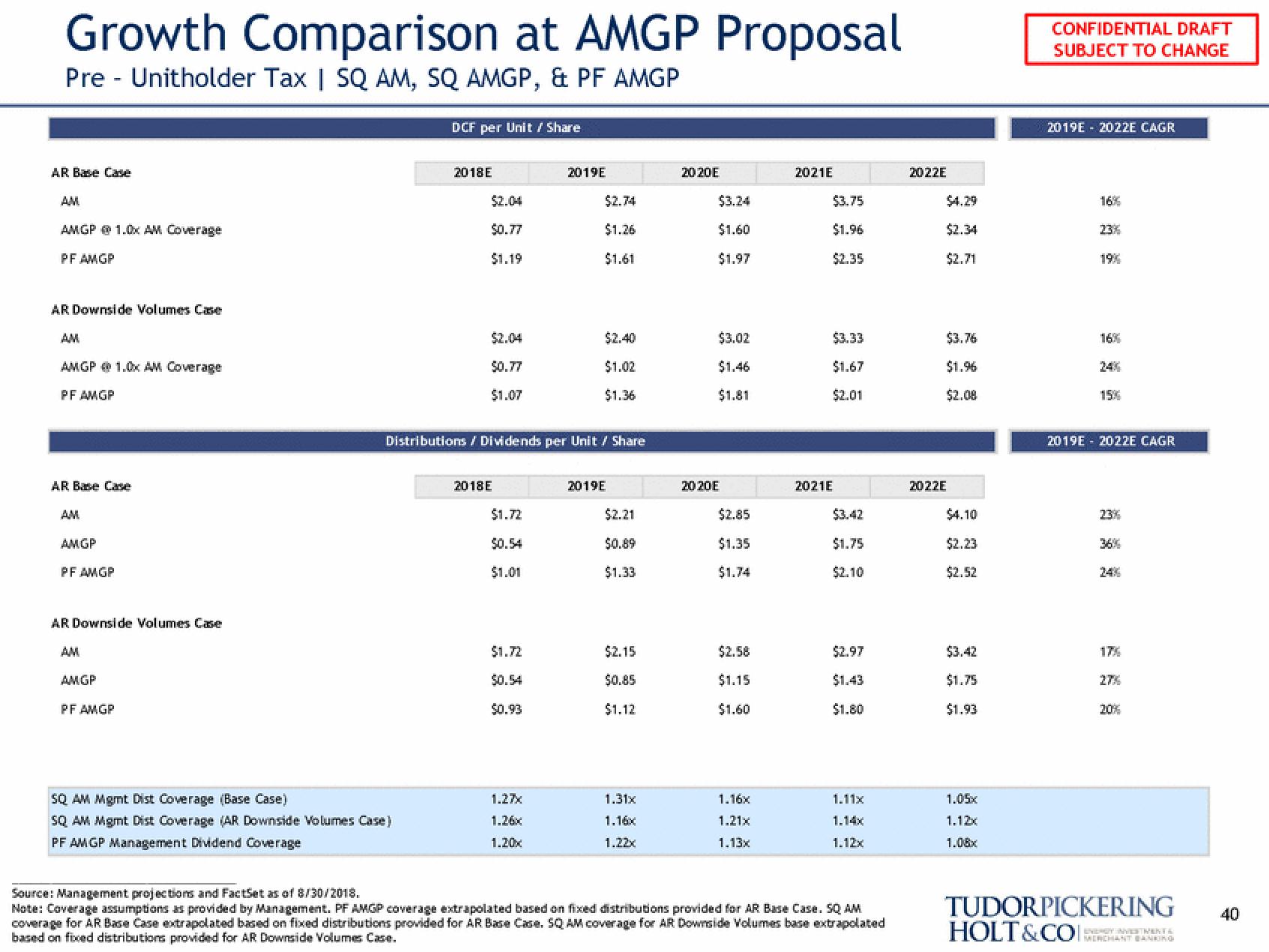

Growth Comparison at AMGP Proposal

Pre - Unitholder Tax | SQ AM, SQ AMGP, & PF AMGP

AR Base Case

AM

AMGP @ 1.0x AM Coverage

PF AMGP

AR Downside Volumes Case

AM

AMGP 1.0x AM Coverage

PF AMGP

AR Base Case

AMGP

PF AMGP

AR Downside Volumes Case

AMGP

PF AMGP

DCF per Unit / Share

SQ AM Mgmt Dist Coverage (Base Case)

SQ AM Mgmt Dist Coverage (AR Downside Volumes Case)

PF AMGP Management Dividend Coverage

2018E

$0.77

$1.19

$0.77

$1.07

2018E

Distributions / Dividends per Unit / Share

$1.72

$0.54

$1.01

$1.72

$0.93

2019E

1.27x

1.26x

1.20x

$2.74

$1.26

$1.61

$2.40

$1.02

$1.36

2019E

$2.21

$0.89

$1.33

$2.15

$0.85

$1.12

1.31x

1.16x

1.22x

20 20 E

$3.24

$1.60

$1.97

$3.02

$1.46

$1.81

20 20 E

$2.85

$1.35

$1.74

$2.58

$1.15

$1.60

1.16x

1.21x

1.13x

2021E

$3.75

$1.96

$2.35

$3.33

$1.67

$2.01

2021E

$3.42

$1.75

$2.10

$2.97

$1.43

$1.80

1.11x

1.14x

1.12x

Source: Management projections and FactSet as of 8/30/2018.

Note: Coverage assumptions as provided by Management. PF AMGP coverage extrapolated based on fixed distributions provided for AR Base Case. SQ AM

coverage for AR Base Case extrapolated based on fixed distributions provided for AR Base Case. SQ AM coverage for AR Downside Volumes base extrapolated

based on fixed distributions provided for AR Downside Volumes Case.

2022E

$4.29

$2.34

$2.71

$3.76

$1.96

$2.08

2022E

$4.10

$2.23

$2.52

$3.42

$1.75

$1.93

1.05x

1.12x

1.08x

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2019E - 2022E CAGR

16%

23%

19%

16%

15%

2019E - 2022E CAGR

23%

24%

17%

27%

20%

TUDORPICKERING

HOLT&CO

MERCHANT BANKING

40View entire presentation