Sterling Results Presentation Deck

13

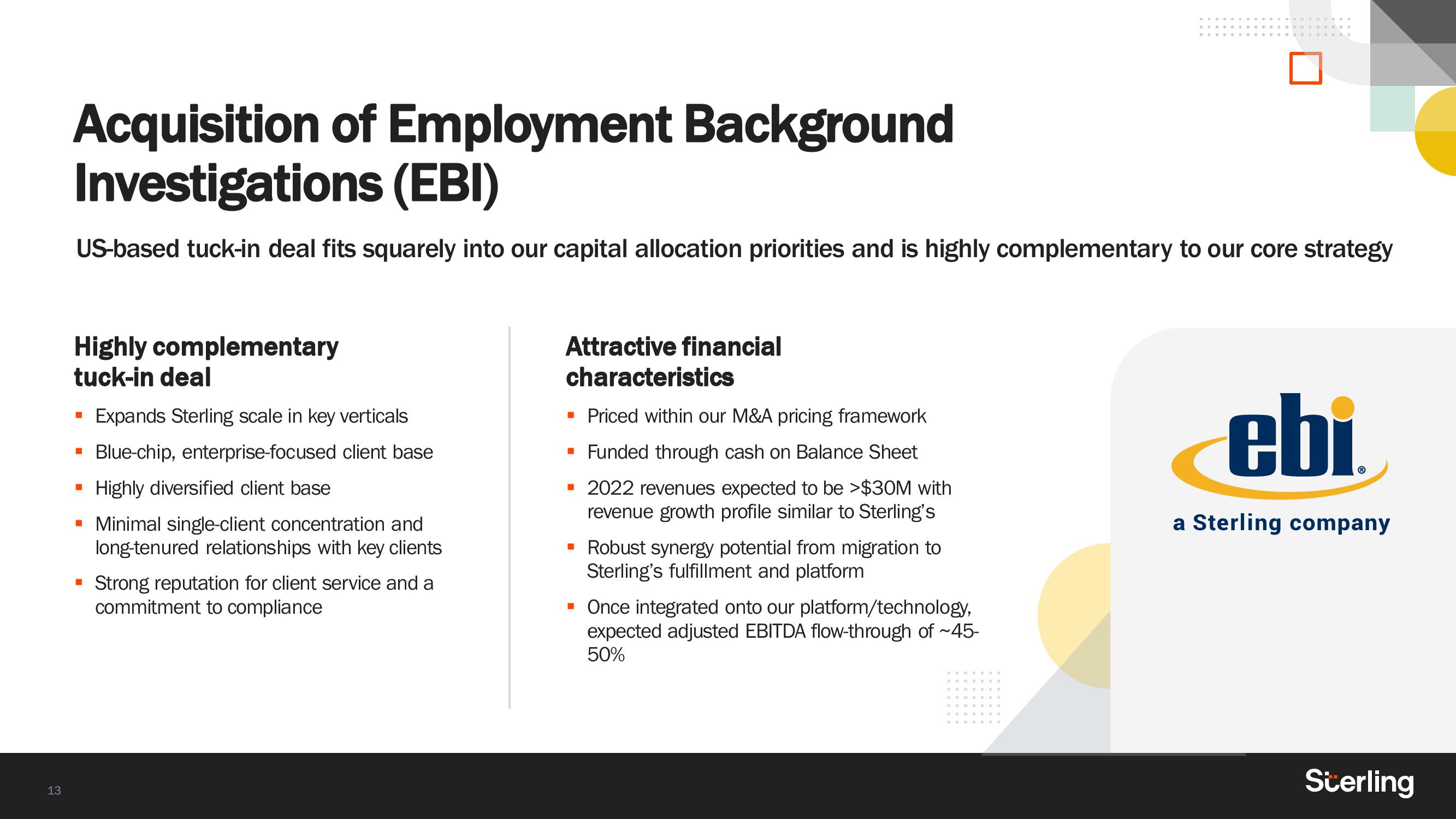

Acquisition of Employment Background

Investigations (EBI)

US-based tuck-in deal fits squarely into our capital allocation priorities and is highly complementary to our core strategy

Highly complementary

tuck-in deal

Expands Sterling scale in key verticals

Blue-chip, enterprise-focused client base

Highly diversified client base

▪ Minimal single-client concentration and

long-tenured relationships with key clients

■

■

■

Strong reputation for client service and a

commitment to compliance

Attractive financial

characteristics

▪ Priced within our M&A pricing framework

▪ Funded through cash on Balance Sheet

▪ 2022 revenues expected to be >$30M with

revenue growth profile similar to Sterling's

▪ Robust synergy potential from migration to

Sterling's fulfillment and platform

▪ Once integrated onto our platform/technology,

expected adjusted EBITDA flow-through of ~45-

50%

B

eb

a Sterling company

SterlingView entire presentation