Zegna SPAC Presentation Deck

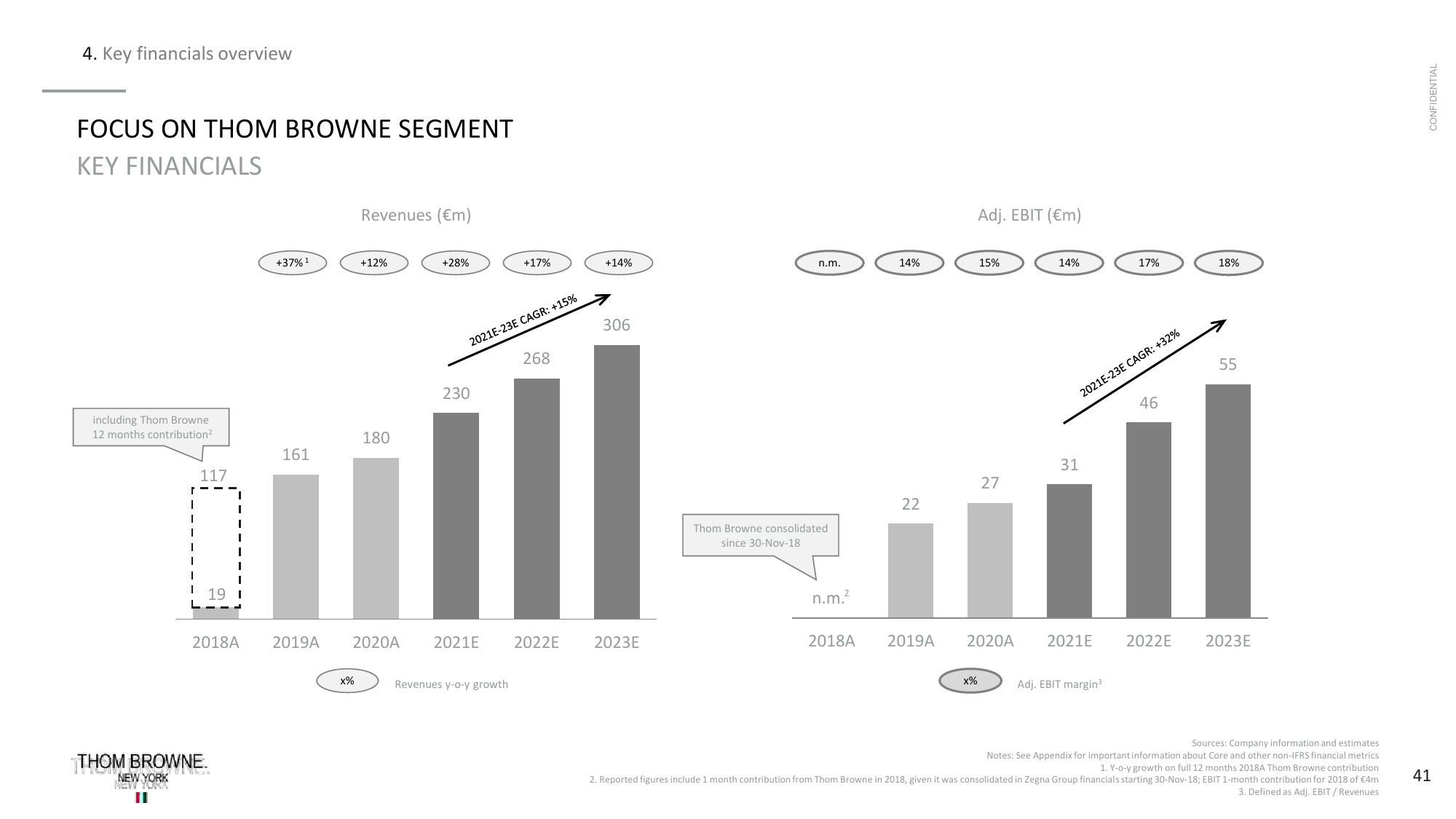

4. Key financials overview

FOCUS ON THOM BROWNE SEGMENT

KEY FINANCIALS

including Thom Browne

12 months contribution²

117

NEW YORK

NEW YORKA

19

2018A

THOM BROWNE.

TO

VINS

+37% ¹

161

2019A

Revenues (€m)

x%

+12%

180

+28%

2021E-23E CAGR: +15%

230

2020A 2021E

+17%

Revenues y-o-y growth

268

2022E

+14%

306

2023E

n.m.

Thom Browne consolidated

since 30-Nov-18.

n.m.²

14%

22

2018A 2019A

Adj. EBIT (€m)

15%

x%

27

14%

2021E-23E CAGR: +32%

31

2020A 2021E

17%

Adj. EBIT margin³

46

2022E

18%

55

2023E

Sources: Company information and estimates

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Y-o-y growth on full 12 months 2018A Thom Browne contribution

2. Reported figures include 1 month contribution from Thom Browne in 2018, given it was consolidated in Zegna Group financials starting 30-Nov-18; EBIT 1-month contribution for 2018 of €4m

3. Defined as Adj. EBIT / Revenues

CONFIDENTIAL

41View entire presentation