Citi Investment Banking Pitch Book

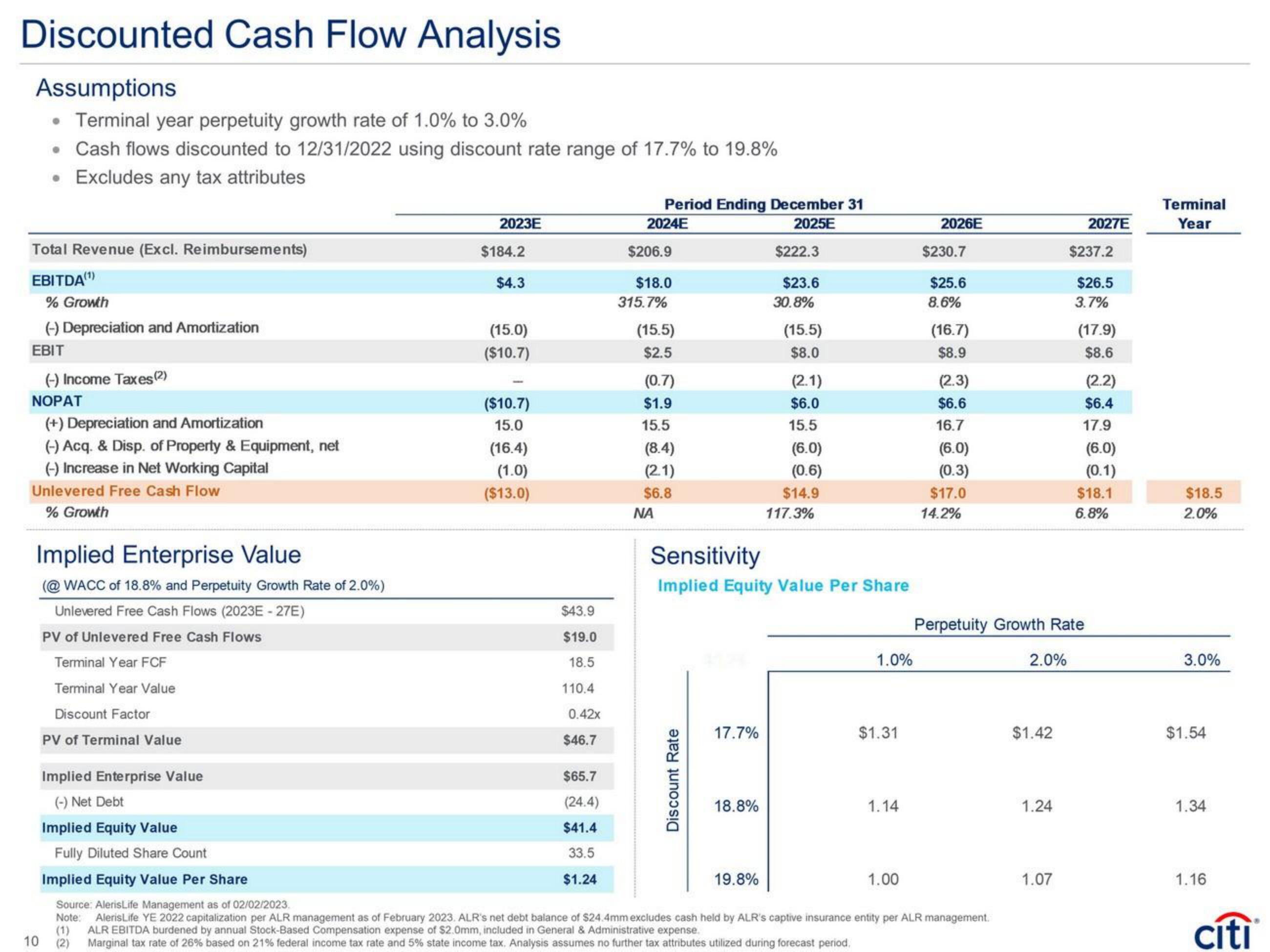

Discounted Cash Flow Analysis

Assumptions

• Terminal year perpetuity growth rate of 1.0% to 3.0%

• Cash flows discounted to 12/31/2022 using discount rate range of 17.7% to 19.8%

• Excludes any tax attributes

Total Revenue (Excl. Reimbursements)

EBITDA(¹)

% Growth

(-) Depreciation and Amortization

EBIT

(-) Income Taxes (2)

NOPAT

(+) Depreciation and Amortization

(-) Acq. & Disp. of Property & Equipment, net

(-) Increase in Net Working Capital

Unlevered Free Cash Flow

% Growth

Implied Enterprise Value

(@WACC of 18.8% and Perpetuity Growth Rate of 2.0%)

Unlevered Free Cash Flows (2023E-27E)

PV of Unlevered Free Cash Flows

Terminal Year FCF

Terminal Year Value

Discount Factor

PV of Terminal Value

2023E

$184.2

$4.3

(15.0)

($10.7)

($10.7)

15.0

(16.4)

(1.0)

($13.0)

$43.9

$19.0

18.5

110.4

0.42x

$46.7

Period Ending December 31

2024E

2025E

$65.7

(24.4)

$41.4

33.5

$1.24

$206.9

$18.0

315.7%

(15.5)

$2.5

(0.7)

$1.9

15.5

(8.4)

(2.1)

$6.8

ΝΑ

Discount Rate

17.7%

$222.3

$23.6

18.8%

30.8%

Sensitivity

Implied Equity Value Per Share

19.8%

(15.5)

$8.0

(2.1)

$6.0

15.5

(6.0)

(0.6)

$14.9

117.3%

1.0%

$1.31

1.14

2026E

1.00

$230.7

$25.6

8.6%

Implied Enterprise Value

(-) Net Debt

Implied Equity Value

Fully Diluted Share Count

Implied Equity Value Per Share

Source: AlerisLife Management as of 02/02/2023.

Note: Aleris Life YE 2022 capitalization per ALR management as of February 2023. ALR's net debt balance of $24.4mm excludes cash held by ALR's captive insurance entity per ALR management.

(1) ALR EBITDA burdened by annual Stock-Based Compensation expense of $2.0mm, included in General & Administrative expense.

10 (2)

Marginal tax rate of 26% based on 21% federal income tax rate and 5% state income tax. Analysis assumes no further tax attributes utilized during forecast period.

(16.7)

$8.9

(2.3)

$6.6

16.7

(6.0)

(0.3)

$17.0

14.2%

2.0%

Perpetuity Growth Rate

$1.42

1.24

1.07

2027E

$237.2

$26.5

3.7%

(17.9)

$8.6

(2.2)

$6.4

17.9

(6.0)

(0.1)

$18.1

6.8%

Terminal

Year

$18.5

2.0%

3.0%

$1.54

1.34

1.16

citiView entire presentation