FY 2017 Second Quarter Earnings Call

Non-GAAP financial measurements

ADIENT

>

>

>

>

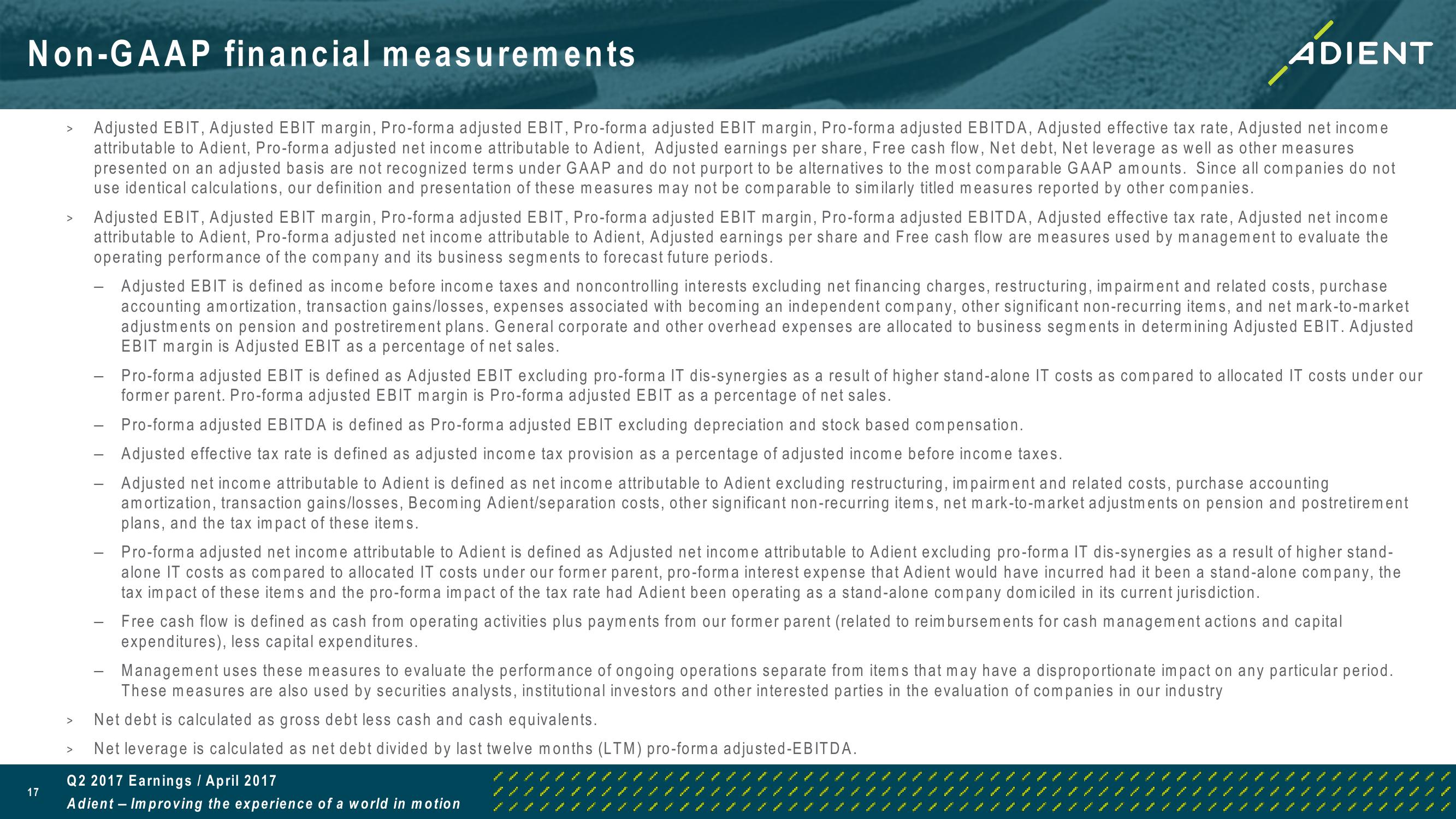

Adjusted EBIT, Adjusted EBIT margin, Pro-forma adjusted EBIT, Pro-forma adjusted EBIT margin, Pro-forma adjusted EBITDA, Adjusted effective tax rate, Adjusted net income

attributable to Adient, Pro-forma adjusted net income attributable to Adient, Adjusted earnings per share, Free cash flow, Net debt, Net leverage as well as other measures

presented on an adjusted basis are not recognized terms under GAAP and do not purport to be alternatives to the most comparable GAAP amounts. Since all companies do not

use identical calculations, our definition and presentation of these measures may not be comparable to similarly titled measures reported by other companies.

Adjusted EBIT, Adjusted EBIT margin, Pro-forma adjusted EBIT, Pro-forma adjusted EBIT margin, Pro-forma adjusted EBITDA, Adjusted effective tax rate, Adjusted net income

attributable to Adient, Pro-forma adjusted net income attributable to Adient, Adjusted earnings per share and Free cash flow are measures used by management to evaluate the

operating performance of the company and its business segments to forecast future periods.

-

Adjusted EBIT is defined as income before income taxes and noncontrolling interests excluding net financing charges, restructuring, impairment and related costs, purchase

accounting amortization, transaction gains/losses, expenses associated with becoming an independent company, other significant non-recurring items, and net mark-to-market

adjustments on pension and postretirement plans. General corporate and other overhead expenses are allocated to business segments in determining Adjusted EBIT. Adjusted

EBIT margin is Adjusted EBIT as a percentage of net sales.

Pro-forma adjusted EBIT is defined as Adjusted EBIT excluding pro-forma IT dis-synergies as a result of higher stand-alone IT costs as compared to allocated IT costs under our

former parent. Pro-forma adjusted EBIT margin is Pro-forma adjusted EBIT as a percentage of net sales.

Pro-forma adjusted EBITDA is defined as Pro-forma adjusted EBIT excluding depreciation and stock based compensation.

- Adjusted effective tax rate is defined as adjusted income tax provision as a percentage of adjusted income before income taxes.

-

-

-

Adjusted net income attributable to Adient is defined as net income attributable to Adient excluding restructuring, impairment and related costs, purchase accounting

amortization, transaction gains/losses, Becoming Adient/separation costs, other significant non-recurring items, net mark-to-market adjustments on pension and postretirement

plans, and the tax impact of these items.

Pro-forma adjusted net income attributable to Adient is defined as Adjusted net income attributable to Adient excluding pro-forma IT dis-synergies as a result of higher stand-

alone IT costs as compared to allocated IT costs under our former parent, pro-forma interest expense that Adient would have incurred had it been a stand-alone company, the

tax impact of these items and the pro-forma impact of the tax rate had Adient been operating as a stand-alone company domiciled in its current jurisdiction.

Free cash flow is defined as cash from operating activities plus payments from our former parent (related to reimbursements for cash management actions and capital

expenditures), less capital expenditures.

Management uses these measures to evaluate the performance of ongoing operations separate from items that may have a disproportionate impact on any particular period.

These measures are also used by securities analysts, institutional investors and other interested parties in the evaluation of companies in our industry

Net debt is calculated as gross debt less cash and cash equivalents.

Net leverage is calculated as net debt divided by last twelve months (LTM) pro-forma adjusted-EBITDA.

Q2 2017 Earnings / April 2017

17

Adient - Improving the experience of a world in motionView entire presentation