CURO Group Holdings Credit Presentation Deck

CURO's Strategic Transformation

CCURO

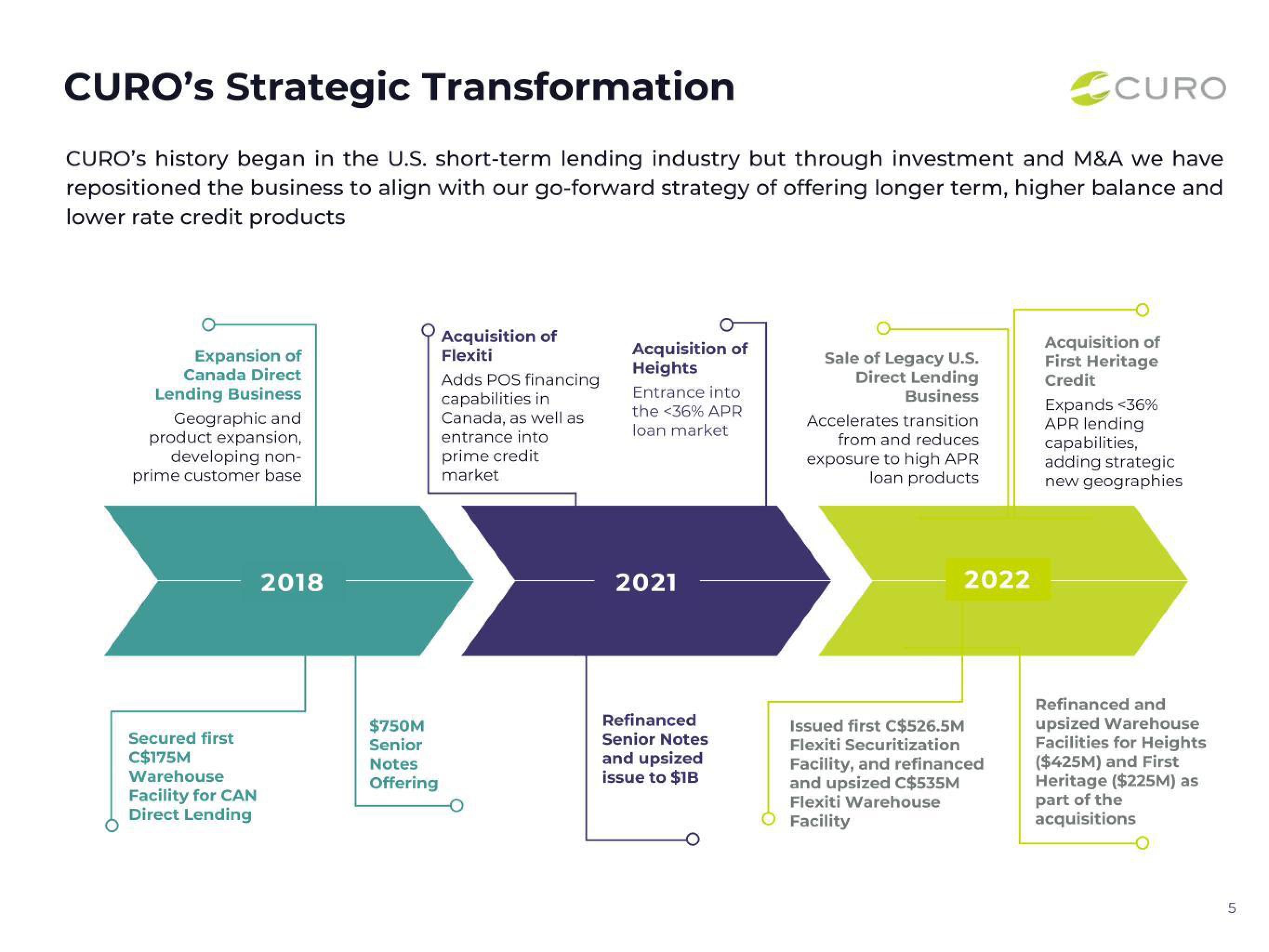

CURO's history began in the U.S. short-term lending industry but through investment and M&A we have

repositioned the business to align with our go-forward strategy of offering longer term, higher balance and

lower rate credit products

Expansion of

Canada Direct

Lending Business

Geographic and

product expansion,

developing non-

prime customer base

Secured first

C$175M

Warehouse

Facility for CAN

Direct Lending

2018

$750M

Senior

Notes

Offering

Acquisition of

Flexiti

Adds POS financing

capabilities in

Canada, as well as

entrance into

prime credit

market

Acquisition of

Heights

Entrance into

the <36% APR

loan market

2021

Refinanced

Senior Notes

and upsized

issue to $1B

Sale of Legacy U.S.

Direct Lending

Business

Accelerates transition

from and reduces

exposure to high APR

loan products

2022

Issued first C$526.5M

Flexiti Securitization

Facility, and refinanced

and upsized C$535M

Flexiti Warehouse

Facility

Acquisition of

First Heritage

Credit

Expands <36%

APR lending

capabilities,

adding strategic

new geographies

Refinanced and

upsized Warehouse

Facilities for Heights

($425M) and First

Heritage ($225M) as

part of the

acquisitions

5View entire presentation