First Citizens BancShares Results Presentation Deck

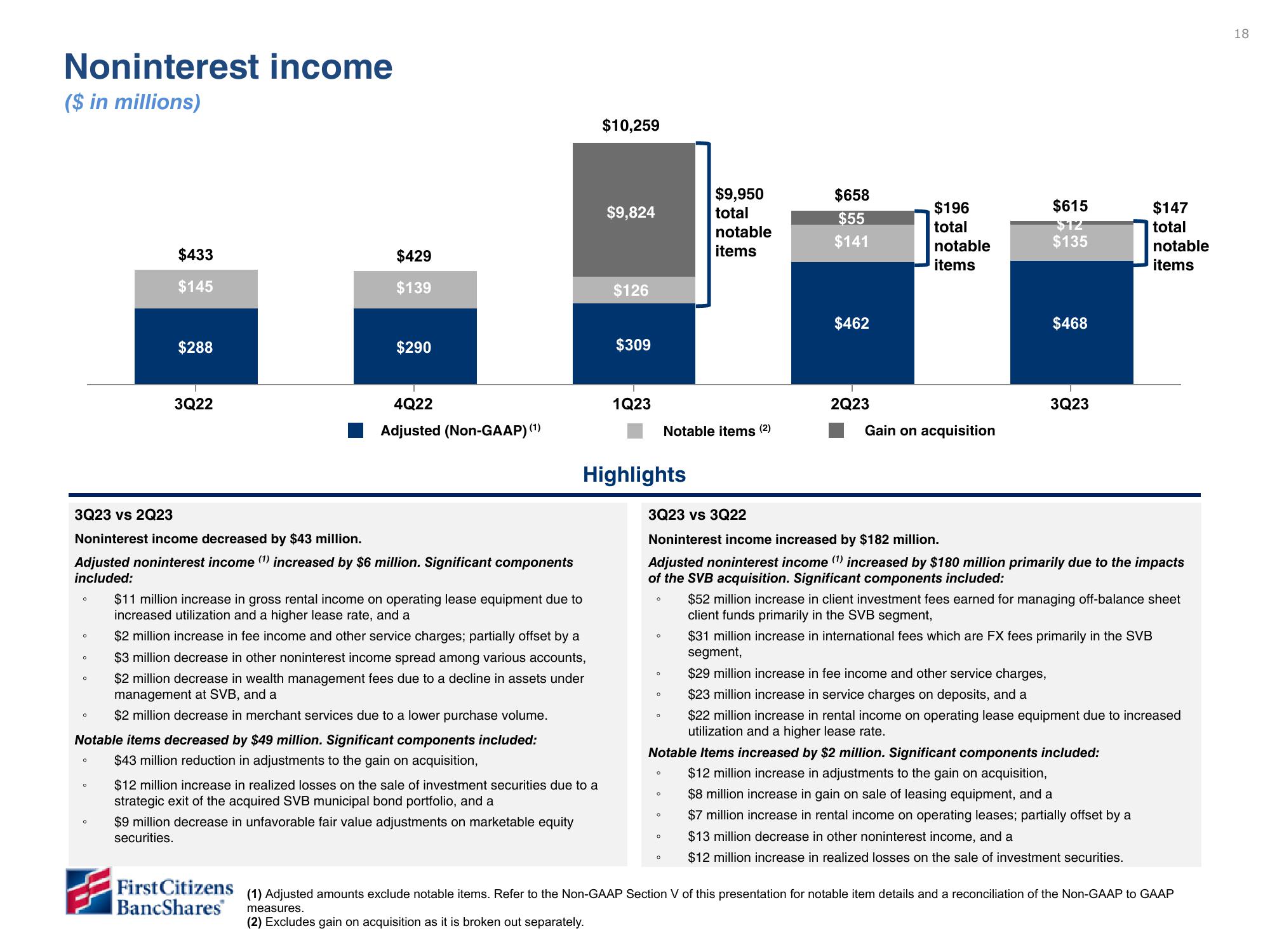

Noninterest income

($ in millions)

0

0

o

0

$433

$145

3Q23 vs 2Q23

Noninterest income decreased by $43 million.

Adjusted noninterest income (¹) increased by $6 million. Significant components

included:

O

$288

0

3Q22

$429

$139

$290

4Q22

Adjusted (Non-GAAP) (¹)

$11 million increase in gross rental income on operating lease equipment due to

increased utilization and a higher lease rate, and a

Notable items decreased by $49 million. Significant components included:

$43 million reduction in adjustments to the gain on acquisition,

$2 million increase in fee income and other service charges; partially offset by a

$3 million decrease in other noninterest income spread among various accounts,

$2 million decrease in wealth management fees due to a decline in assets under

management at SVB, and a

$2 million decrease in merchant services due to a lower purchase volume.

First Citizens

BancShares

$12 million increase in realized losses on the sale of investment securities due to a

strategic exit of the acquired SVB municipal bond portfolio, and a

$9 million decrease in unfavorable fair value adjustments on marketable equity

securities.

$10,259

$9,824

$126

$309

1Q23

Highlights

O

0

$9,950

total

0

notable

items

Notable items (2)

0

$658

$55

$141

$462

2Q23

$196

total

notable

items

Gain on acquisition

$615

$12

$135

$468

3Q23 vs 3Q22

Noninterest income increased by $182 million.

Adjusted noninterest income (¹) increased by $180 million primarily due to the impacts

of the SVB acquisition. Significant components included:

3Q23

Notable Items increased by $2 million. Significant components included:

$12 million increase in adjustments to the gain on acquisition,

$8 million increase in gain on sale of leasing equipment, and a

$7 million increase in rental income on operating leases; partially offset by a

$13 million decrease in other noninterest income, and a

$12 million increase in realized losses on the sale of investment securities.

$147

total

notable

items

$52 million increase in client investment fees earned for managing off-balance sheet

client funds primarily in the SVB segment,

$31 million increase in international fees which are FX fees primarily in the SVB

segment,

$29 million increase in fee income and other service charges,

$23 million increase in service charges on deposits, and a

$22 million increase in rental income on operating lease equipment due to increased

utilization and a higher lease rate.

(1) Adjusted amounts exclude notable items. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP

measures.

(2) Excludes gain on acquisition as it is broken out separately.

18View entire presentation