Planet SPAC Presentation Deck

Proposed Transaction Summary

($ in millions, except per share amounts)

Key Transaction Terms

■

▪

■

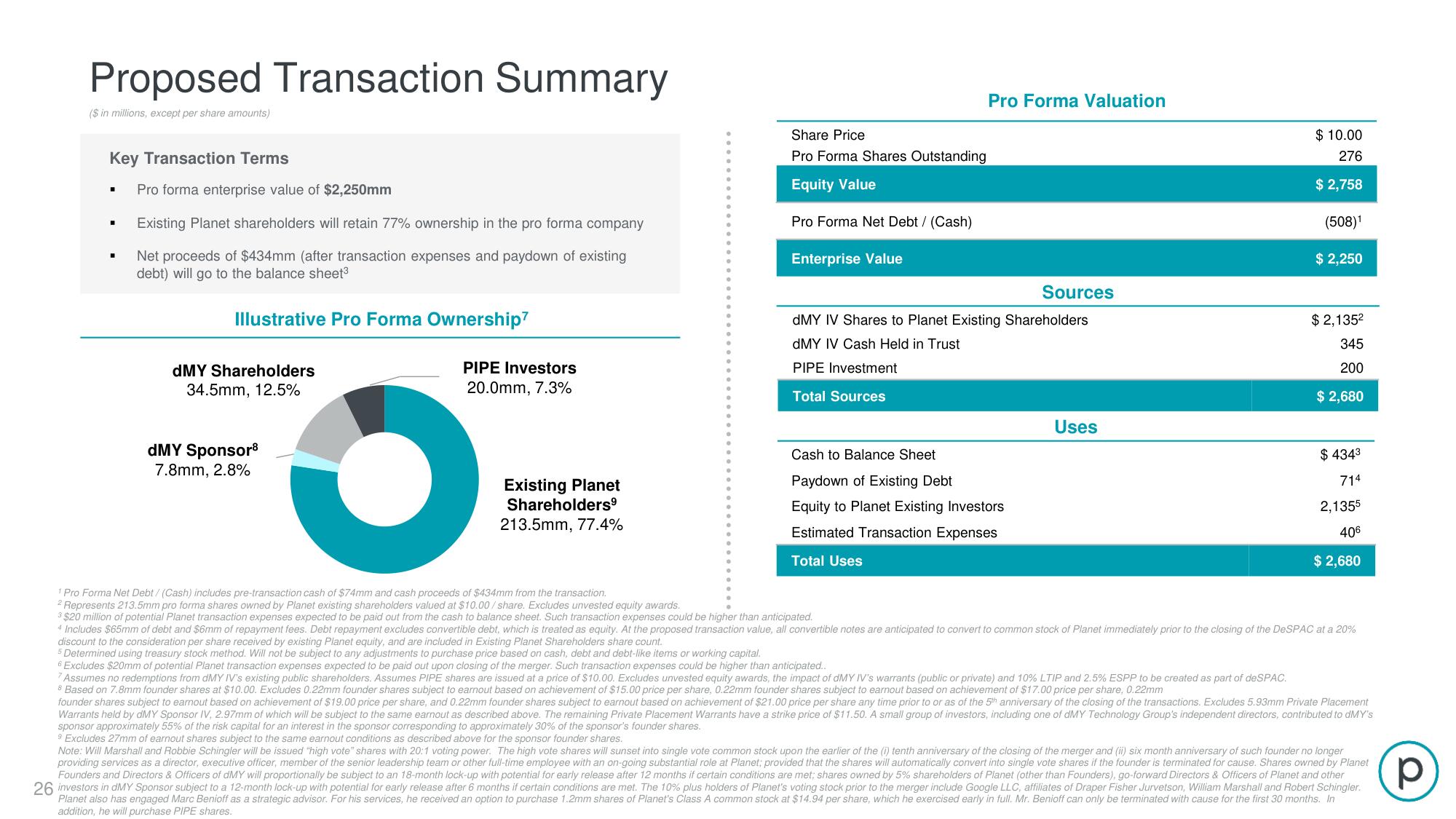

Pro forma enterprise value of $2,250mm

Existing Planet shareholders will retain 77% ownership in the pro forma company

Net proceeds of $434mm (after transaction expenses and paydown of existing

debt) will go to the balance sheet³

Illustrative Pro Forma Ownership?

dMY Shareholders

34.5mm, 12.5%

dMY Sponsor

7.8mm, 2.8%

PIPE Investors

20.0mm, 7.3%

O

Existing Planet

Shareholders⁹

213.5mm, 77.4%

Share Price

Pro Forma Shares Outstanding

Equity Value

Pro Forma Net Debt / (Cash)

Enterprise Value

Pro Forma Valuation

dMY IV Shares to Planet Existing Shareholders

dMY IV Cash Held in Trust

PIPE Investment

Total Sources

Cash to Balance Sheet

Paydown of Existing Debt

Equity to Planet Existing Investors

Estimated Transaction Expenses

Total Uses

1 Pro Forma Net Debt / (Cash) includes pre-transaction cash of $74mm and cash proceeds of $434mm from the transaction.

2 Represents 213.5mm pro forma shares owned by Planet existing shareholders valued at $10.00/share. Excludes unvested equity awards.

3 $20 million of potential Planet transaction expenses expected to be paid out from the cash to balance sheet. Such transaction expenses could be higher than anticipated.

Sources

Uses

$10.00

276

$ 2,758

(508)¹

$2,250

$ 2,135²

345

200

$ 2,680

$ 434³

714

2,1355

406

$ 2,680

* Includes $65mm of debt and $6mm of repayment fees. Debt repayment excludes convertible debt, which is treated as equity. At the proposed transaction value, all convertible notes are anticipated to convert to common stock of Planet immediately prior to the closing of the DeSPAC at a 20%

discount to the consideration per share received by existing Planet equity, and are included in Existing Planet Shareholders share count.

5 Determined using treasury stock method. Will not be subject to any adjustments to purchase price based on cash, debt and debt-like items or working capital.

6 Excludes $20mm of potential Planet transaction expenses expected to be paid out upon closing of the merger. Such transaction expenses could be higher than anticipated..

Assumes no redemptions from dMY IV's existing public shareholders. Assumes PIPE shares are issued at a price of $10.00. Excludes unvested equity awards, the impact of dMY IV's warrants (public or private) and 10% LTIP and 2.5% ESPP to be created as part of deSPAC.

8 Based on 7.8mm founder shares at $10.00. Excludes 0.22mm founder shares subject to earnout based on achievement of $15.00 price per share, 0.22mm founder shares subject to earnout based on achievement of $17.00 price per share, 0.22mm

founder shares subject to earnout based on achievement of $19.00 price per share, and 0.22mm founder shares subject to earnout based on achievement of $21.00 price per share any time prior to or as of the 5th anniversary of the closing of the transactions. Excludes 5.93mm Private Placement

Warrants held by dMY Sponsor IV, 2.97mm of which will be subject to the same earnout as described above. The remaining Private Placement Warrants have a strike price of $11.50. A small group of investors, including one of dMY Technology Group's independent directors, contributed to dMY's

sponsor approximately 55% of the risk capital for an interest in the sponsor corresponding to approximately 30% of the sponsor's founder shares.

9 Excludes 27mm of earnout shares subject to the same earnout conditions as described above for the sponsor founder shares.

Note: Will Marshall and Robbie Schingler will be issued "high vote" shares with 20:1 voting power. The high vote shares will sunset into single vote common stock upon the earlier of the (1) tenth anniversary of the closing of the merger and (ii) six month anniversary of such founder no longer

providing services as a director, executive officer, member of the senior leadership team or other full-time employee with an on-going substantial role at Planet; provided that the shares will automatically convert into single vote shares if the founder is terminated for cause. Shares owned by Planet

Founders and Directors & Officers of dMY will proportionally be subject to an 18-month lock-up with potential for early release after 12 months if certain conditions are met; shares owned by 5% shareholders of Pianet (other than Founders), go-forward Directors & Officers of Planet and other

26 investors in dMY Sponsor subject to a 12-month lock-up with potential for early release after 6 months if certain conditions are met. The 10% plus holders of Planet's voting stock prior to the merger include Google LLC, affiliates of Draper Fisher Jurvetson, William Marshall and Robert Schingler.

Planet also has engaged Marc Benioff as a strategic advisor. For his services, he received an option to purchase 1.2mm shares of Planet's Class A common stock at $14.94 per share, which he exercised early in full. Mr. Benioff can only be terminated with cause for the first 30 months. In

addition, he will purchase PIPE shares.

рView entire presentation