Revitalize P&G Together

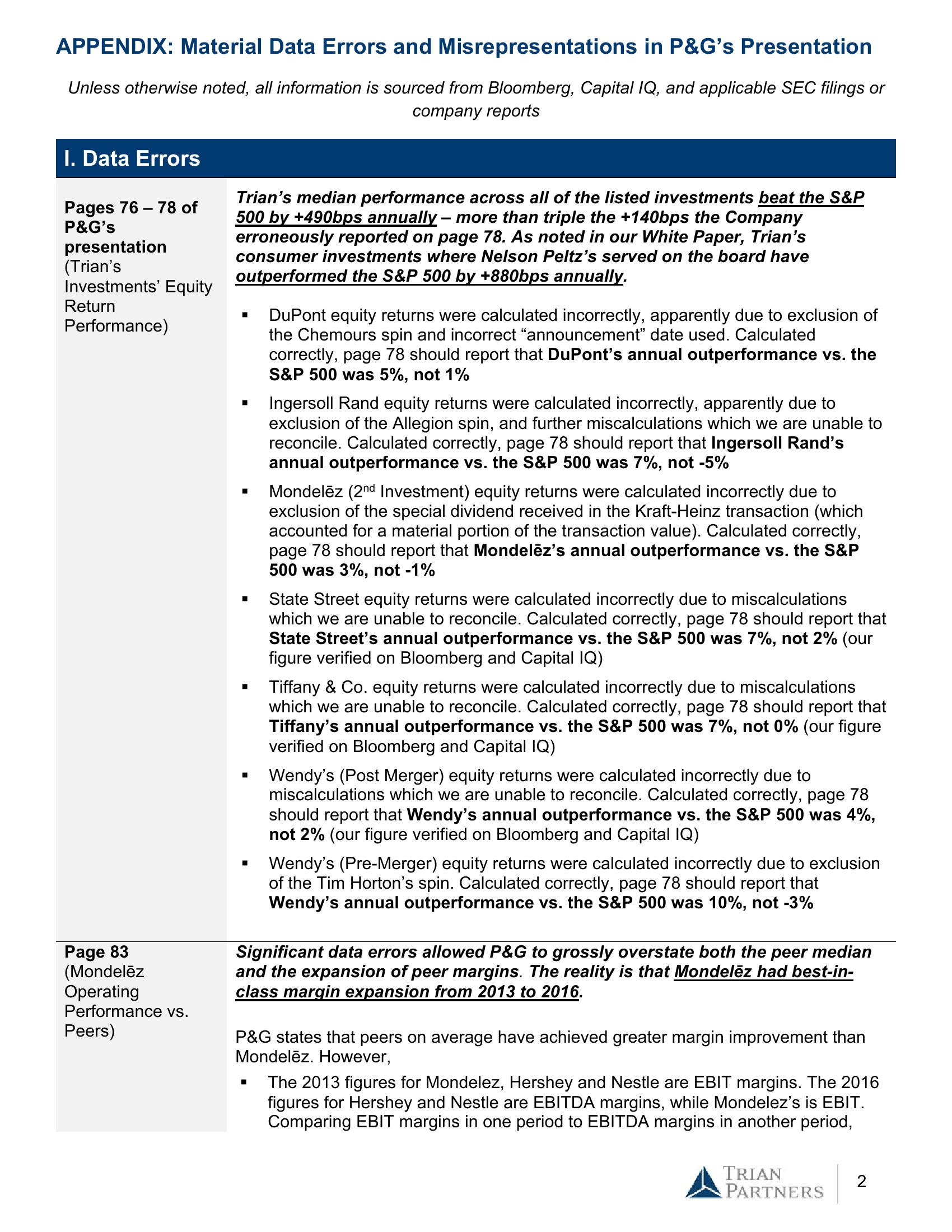

APPENDIX: Material Data Errors and Misrepresentations in P&G's Presentation

Unless otherwise noted, all information is sourced from Bloomberg, Capital IQ, and applicable SEC filings or

company reports

I. Data Errors

Pages 76 - 78 of

P&G's

presentation

(Trian's

Investments' Equity

Return

Performance)

Page 83

(Mondelēz

Operating

Performance vs.

Peers)

Trian's median performance across all of the listed investments beat the S&P

500 by +490bps annually - more than triple the +140bps the Company

erroneously reported on page 78. As noted in our White Paper, Trian's

consumer investments where Nelson Peltz's served on the board have

outperformed the S&P 500 by +880bps annually.

■

■

DuPont equity returns were calculated incorrectly, apparently due to exclusion of

the Chemours spin and incorrect "announcement" date used. Calculated

correctly, page 78 should report that DuPont's annual outperformance vs. the

S&P 500 was 5%, not 1%

Ingersoll Rand equity returns were calculated incorrectly, apparently due to

exclusion of the Allegion spin, and further miscalculations which we are unable to

reconcile. Calculated correctly, page 78 should report that Ingersoll Rand's

annual outperformance vs. the S&P 500 was 7%, not -5%

■

Mondelēz (2nd Investment) equity returns were calculated incorrectly due to

exclusion of the special dividend received in the Kraft-Heinz transaction (which

accounted for a material portion of the transaction value). Calculated correctly,

page 78 should report that Mondelēz's annual outperformance vs. the S&P

500 was 3%, not -1%

State Street equity returns were calculated incorrectly due to miscalculations

which we are unable to reconcile. Calculated correctly, page 78 should report that

State Street's annual outperformance vs. the S&P 500 was 7%, not 2% (our

figure verified on Bloomberg and Capital IQ)

Tiffany & Co. equity returns were calculated incorrectly due to miscalculations

which we are unable to reconcile. Calculated correctly, page 78 should report that

Tiffany's annual outperformance vs. the S&P 500 was 7%, not 0% (our figure

verified on Bloomberg and Capital IQ)

Wendy's (Post Merger) equity returns were calculated incorrectly due to

miscalculations which we are unable to reconcile. Calculated correctly, page 78

should report that Wendy's annual outperformance vs. the S&P 500 was 4%,

not 2% (our figure verified on Bloomberg and Capital IQ)

Wendy's (Pre-Merger) equity returns were calculated incorrectly due to exclusion

of the Tim Horton's spin. Calculated correctly, page 78 should report that

Wendy's annual outperformance vs. the S&P 500 was 10%, not -3%

Significant data errors allowed P&G to grossly overstate both the peer median

and the expansion of peer margins. The reality is that Mondelēz had best-in-

class margin expansion from 2013 to 2016.

P&G states that peers on average have achieved greater margin improvement than

Mondelēz. However,

The 2013 figures for Mondelez, Hershey and Nestle are EBIT margins. The 2016

figures for Hershey and Nestle are EBITDA margins, while Mondelez's is EBIT.

Comparing EBIT margins in one period to EBITDA margins in another period,

TRIAN

PARTNERS

2View entire presentation