Experian Investor Presentation Deck

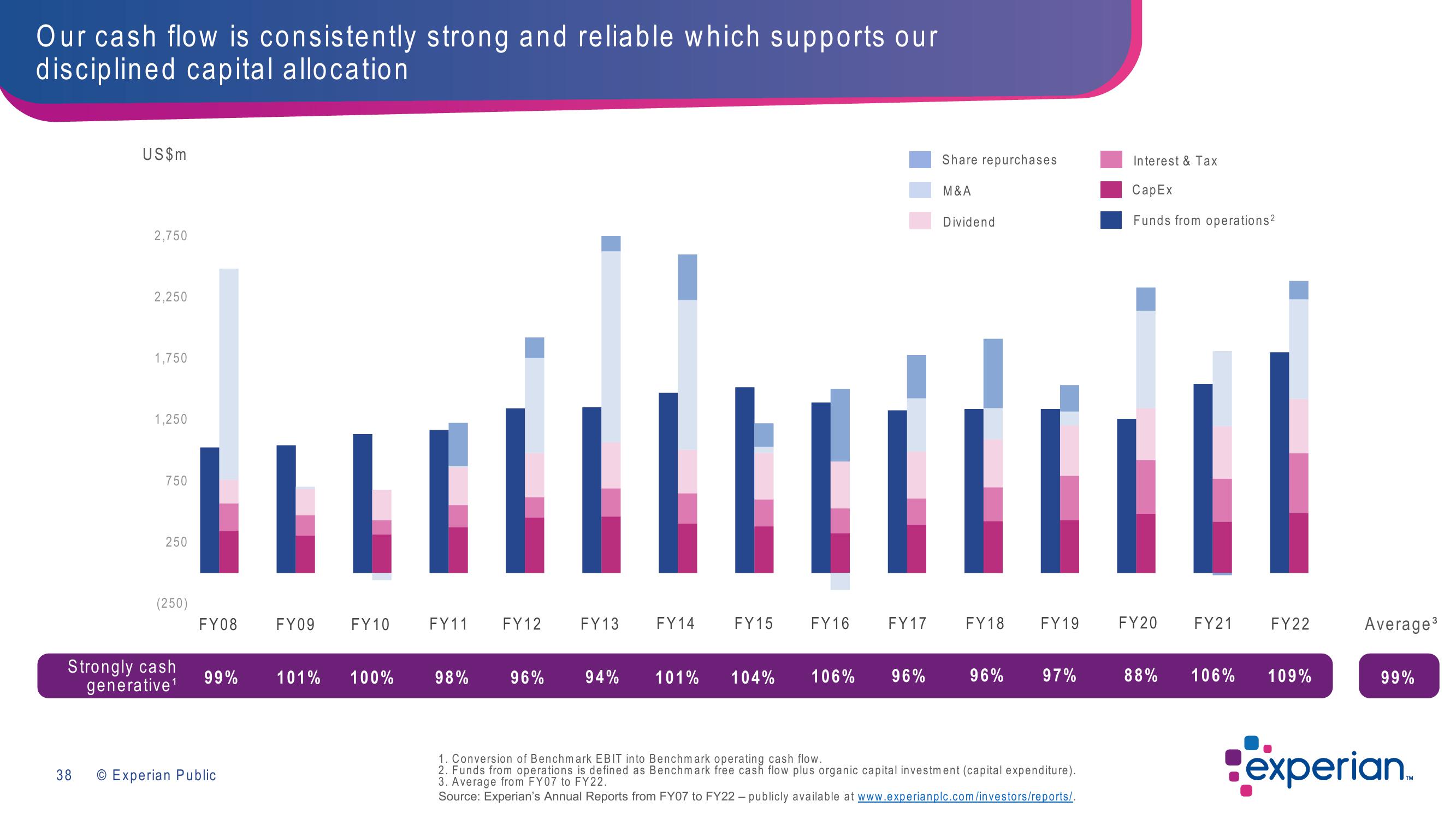

Our cash flow is consistently strong and reliable which supports our

disciplined capital allocation

US$m

38

2,750

2,250

1,750

1,250

750

250

(250)

Strongly cash

generative¹

FY08

99%

O Experian Public

FY09

FY10

101% 100%

FY11

98%

FY12

96%

FY13

94%

FY14

101%

FY15

I

FY16

FY17

104% 106% 96%

Share repurchases

M&A

Dividend

FY18 FY19

96% 97%

1. Conversion of Benchmark EBIT into Benchmark operating cash flow.

2. Funds from operations is defined as Benchmark free cash flow plus organic capital investment (capital expenditure).

3. Average from FY07 to FY22.

Source: Experian's Annual Reports from FY07 to FY22 - publicly available at www.experianplc.com/investors/reports/.

Interest & Tax

Cap Ex

Funds from operations²

FY20

88%

FY21

FY22

106% 109%

Average³

99%

experianView entire presentation