Pathward Financial Results Presentation Deck

●

PAYMENTS BUSINESS UPDATE

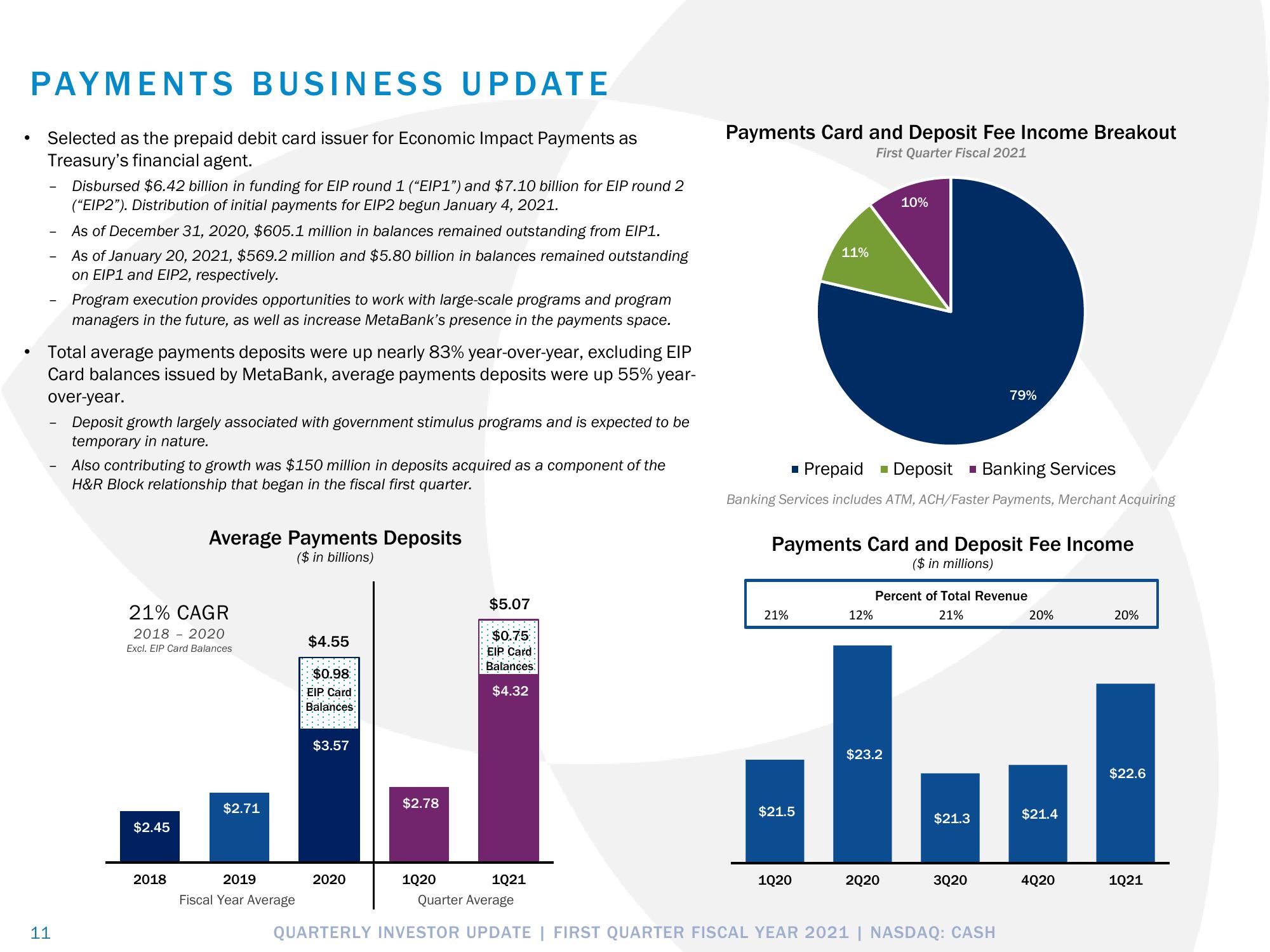

Selected as the prepaid debit card issuer for Economic Impact Payments as

Treasury's financial agent.

Disbursed $6.42 billion in funding for EIP round 1 ("EIP1") and $7.10 billion for EIP round 2

("EIP2"). Distribution of initial payments for EIP2 begun January 4, 2021.

11

As of December 31, 2020, $605.1 million in balances remained outstanding from EIP1.

As of January 20, 2021, $569.2 million and $5.80 billion in balances remained outstanding

on EIP1 and EIP2, respectively.

Program execution provides opportunities to work with large-scale programs and program

managers in the future, as well as increase MetaBank's presence in the payments space.

Total average payments deposits were up nearly 83% year-over-year, excluding EIP

Card balances issued by MetaBank, average payments deposits were up 55% year-

over-year.

Deposit growth largely associated with government stimulus programs and is expected to be

temporary in nature.

Also contributing to growth was $150 million in deposits acquired as a component of the

H&R Block relationship that began in the fiscal first quarter.

21% CAGR

2018 2020

Excl. EIP Card Balances

$2.45

Average Payments Deposits

($ in billions)

2018

$2.71

2019

Fiscal Year Average

$4.55

$0.98

EIP. Card

Balances

$3.57

$2.78

2020

$5.07

$0.75

EIP Card:

Balances:

$4.32

1Q20

Payments Card and Deposit Fee Income Breakout

First Quarter Fiscal 2021

21%

11%

■ Prepaid ■ Deposit Banking Services

Banking Services includes ATM, ACH/Faster Payments, Merchant Acquiring

$21.5

Payments Card and Deposit Fee Income

($ in millions)

1020

12%

10%

1021

Quarter Average

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

$23.2

Percent of Total Revenue

21%

2020

79%

$21.3

3Q20

20%

$21.4

4Q20

20%

$22.6

1021View entire presentation