Coppersmith Presentation to Alere Inc Stockholders

PAGE 6 |

COPPERSMITH

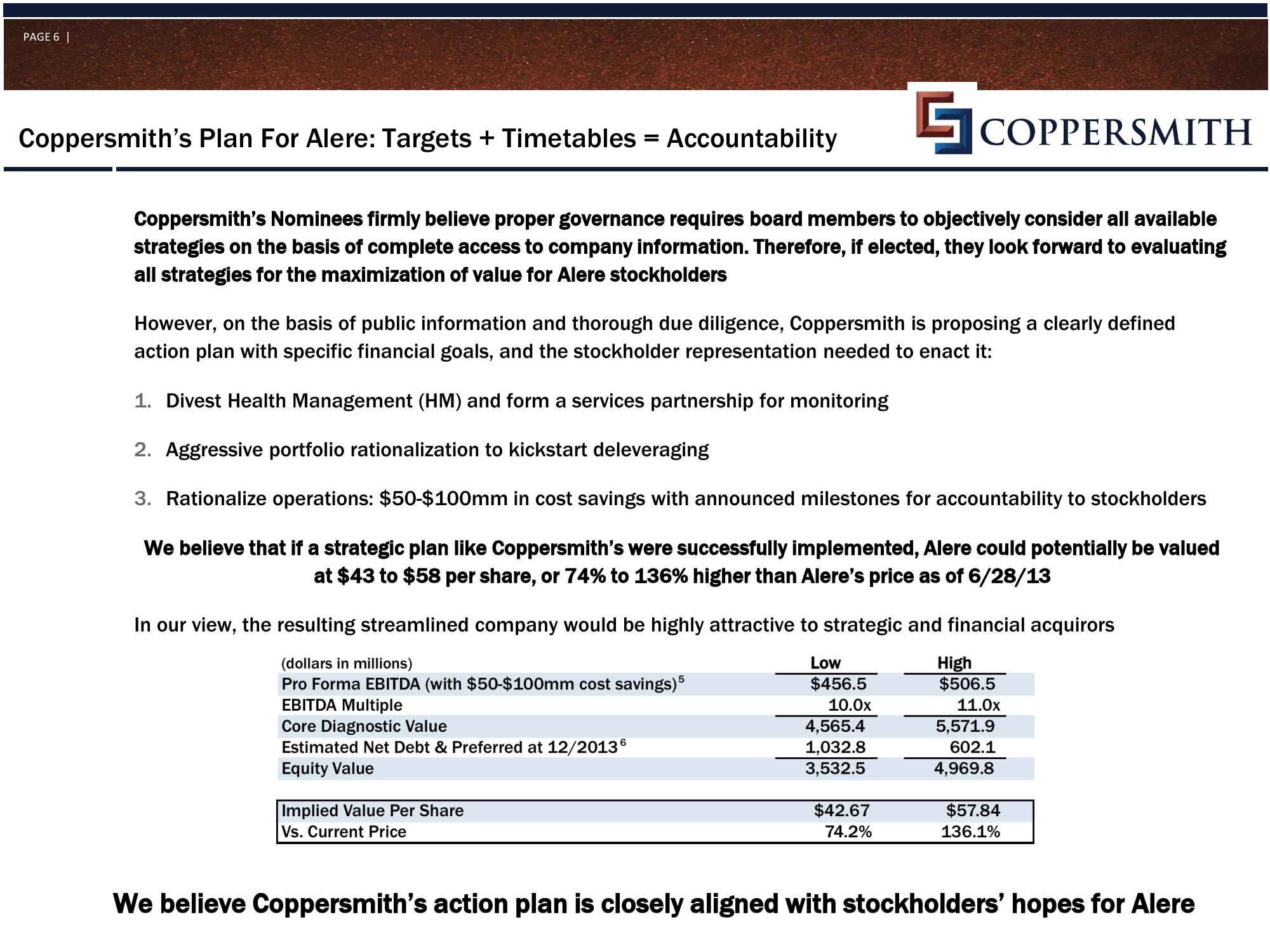

Coppersmith's Nominees firmly believe proper governance requires board members to objectively consider all available

strategies on the basis of complete access to company information. Therefore, if elected, they look forward to evaluating

all strategies for the maximization of value for Alere stockholders

Coppersmith's Plan For Alere: Targets + Timetables = Accountability

However, on the basis of public information and thorough due diligence, Coppersmith is proposing a clearly defined

action plan with specific financial goals, and the stockholder representation needed to enact it:

1. Divest Health Management (HM) and form a services partnership for monitoring

2. Aggressive portfolio rationalization to kickstart deleveraging

3. Rationalize operations: $50-$100mm in cost savings with announced milestones for accountability to stockholders

We believe that if a strategic plan like Coppersmith's were successfully implemented, Alere could potentially be valued

at $43 to $58 per share, or 74% to 136% higher than Alere's price as of 6/28/13

In our view, the resulting streamlined company would be highly attractive to strategic and financial acquirors

(dollars in millions)

Low

$456.5

Pro Forma EBITDA (with $50-$100mm cost savings)5

EBITDA Multiple

10.0x

Core Diagnostic Value

Estimated Net Debt & Preferred at 12/20136

Equity Value

Implied Value Per Share

Vs. Current Price

4,565.4

1,032.8

3,532.5

$42.67

74.2%

High

$506.5

11.0x

5,571.9

602.1

4,969.8

$57.84

136.1%

We believe Coppersmith's action plan is closely aligned with stockholders' hopes for AlereView entire presentation