MoneyLion SPAC Presentation Deck

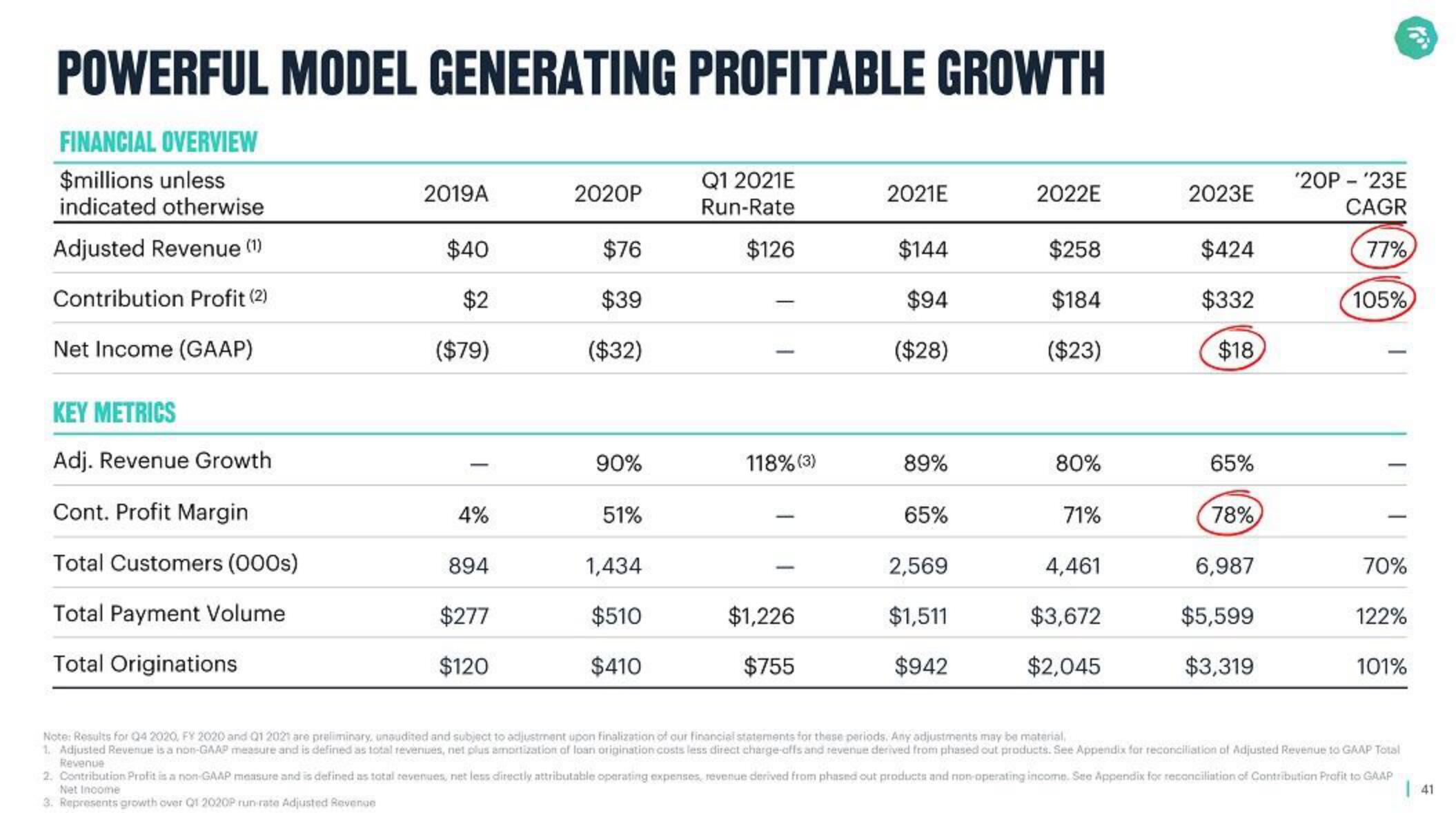

POWERFUL MODEL GENERATING PROFITABLE GROWTH

FINANCIAL OVERVIEW

$millions unless

indicated otherwise

Adjusted Revenue (1)

Contribution Profit (2)

Net Income (GAAP)

KEY METRICS

Adj. Revenue Growth

Cont. Profit Margin

Total Customers (000s)

Total Payment Volume

Total Originations

2019A

$40

$2

($79)

4%

894

$277

$120

2020P

$76

$39

($32)

90%

51%

1,434

$510

$410

Q1 2021E

Run-Rate

$126

118% (3)

$1,226

$755

2021E

$144

$94

($28)

89%

65%

2,569

$1,511

$942

2022E

$258

$184

($23)

80%

71%

4,461

$3,672

$2,045

2023E

$424

$332

$18

65%

78%

6,987

$5,599

$3,319

'20P - '23E

CAGR

77%

105%

70%

122%

101%

Note: Results for Q4 2020, FY 2020 and Q1 2021 are preliminary, unaudited and subject to adjustment upon finalization of our financial statements for these periods. Any adjustments may be material,

1. Adjusted Revenue is a non-GAAP measure and is defined as total revenues, net plus amortization of loan origination costs less direct charge-affs and revenue derived from phased out products. See Appendix for reconciliation of Adjusted Revenue to GAAP Total

Revenue

ll

2. Contribution Profit is a non-GAAP measure and is defined as total revenues, net less directly attributable operating expenses, revenue derived from phased out products and non-operating income. See Appendix for reconciliation of Contribution Profit to GAAP

Net Income

| 41

3. Represents growth over Q1 2020P run rate Adjusted RevengeView entire presentation