Kore Investor Presentation Deck

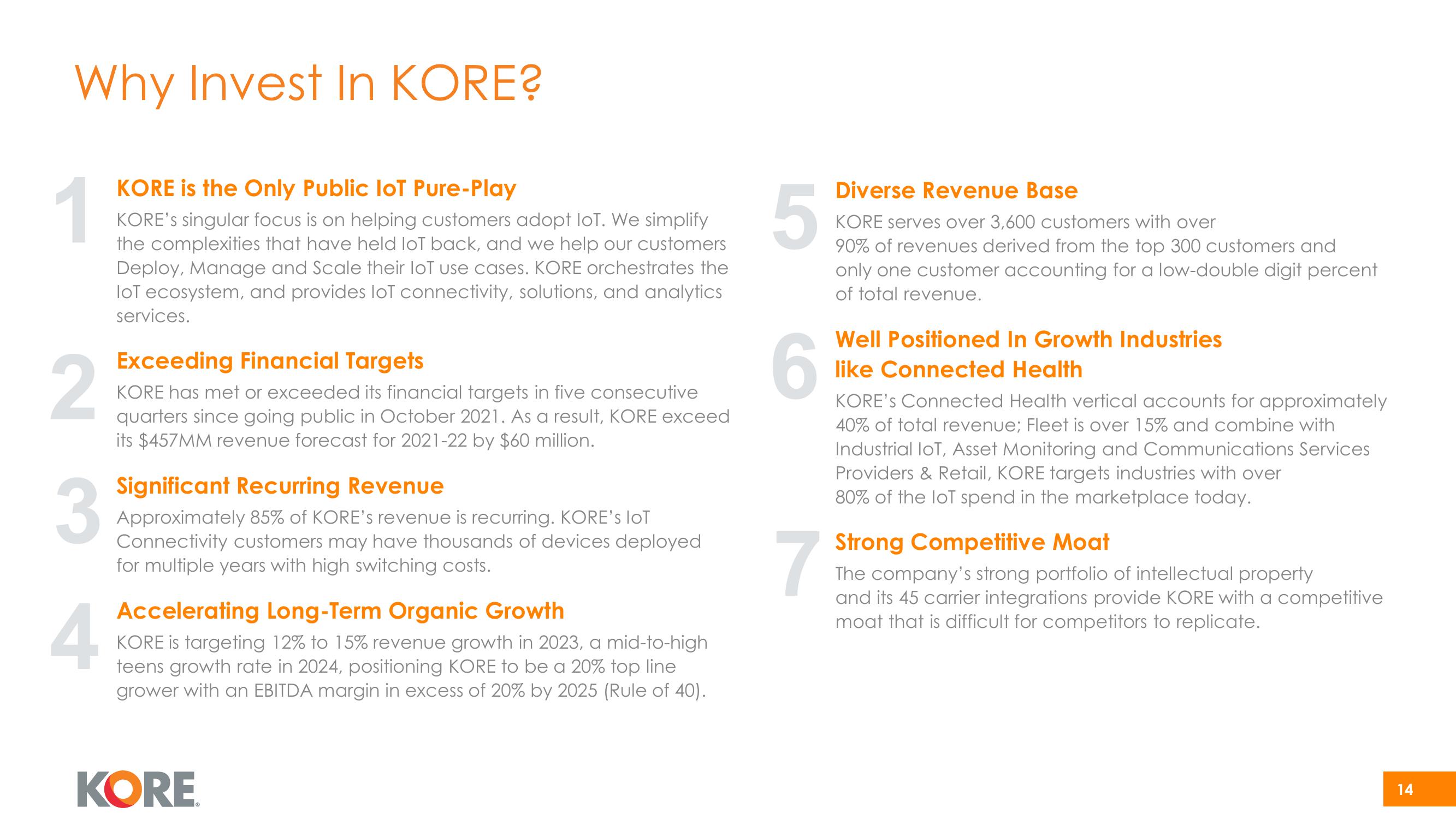

Why Invest In KORE?

1

2

3

4

KORE is the Only Public loT Pure-Play

KORE's singular focus is on helping customers adopt loT. We simplify

the complexities that have held loT back, and we help our customers

Deploy, Manage and Scale their loT use cases. KORE orchestrates the

IoT ecosystem, and provides loT connectivity, solutions, and analytics

services.

Exceeding Financial Targets

KORE has met or exceeded its financial targets in five consecutive

quarters since going public in October 2021. As a result, KORE exceed

its $457MM revenue forecast for 2021-22 by $60 million.

Significant Recurring Revenue

Approximately 85% of KORE's revenue is recurring. KORE's loT

Connectivity customers may have thousands of devices deployed

for multiple years with high switching costs.

Accelerating Long-Term Organic Growth

KORE is targeting 12% to 15% revenue growth in 2023, a mid-to-high

teens growth rate in 2024, positioning KORE to be a 20% top line

grower with an EBITDA margin in excess of 20% by 2025 (Rule of 40).

KORE

5

6

7

Diverse Revenue Base

KORE serves over 3,600 customers with over

90% of revenues derived from the top 300 customers and

only one customer accounting for a low-double digit percent

of total revenue.

Well Positioned In Growth Industries

like Connected Health

KORE's Connected Health vertical accounts for approximately

40% of total revenue; Fleet is over 15% and combine with

Industrial IoT, Asset Monitoring and Communications Services

Providers & Retail, KORE targets industries with over

80% of the loT spend in the marketplace today.

Strong Competitive Moat

The company's strong portfolio of intellectual property

and its 45 carrier integrations provide KORE with a competitive

moat that is difficult for competitors to replicate.

14View entire presentation