Metals Company SPAC

BETTER METALS FOR EVs

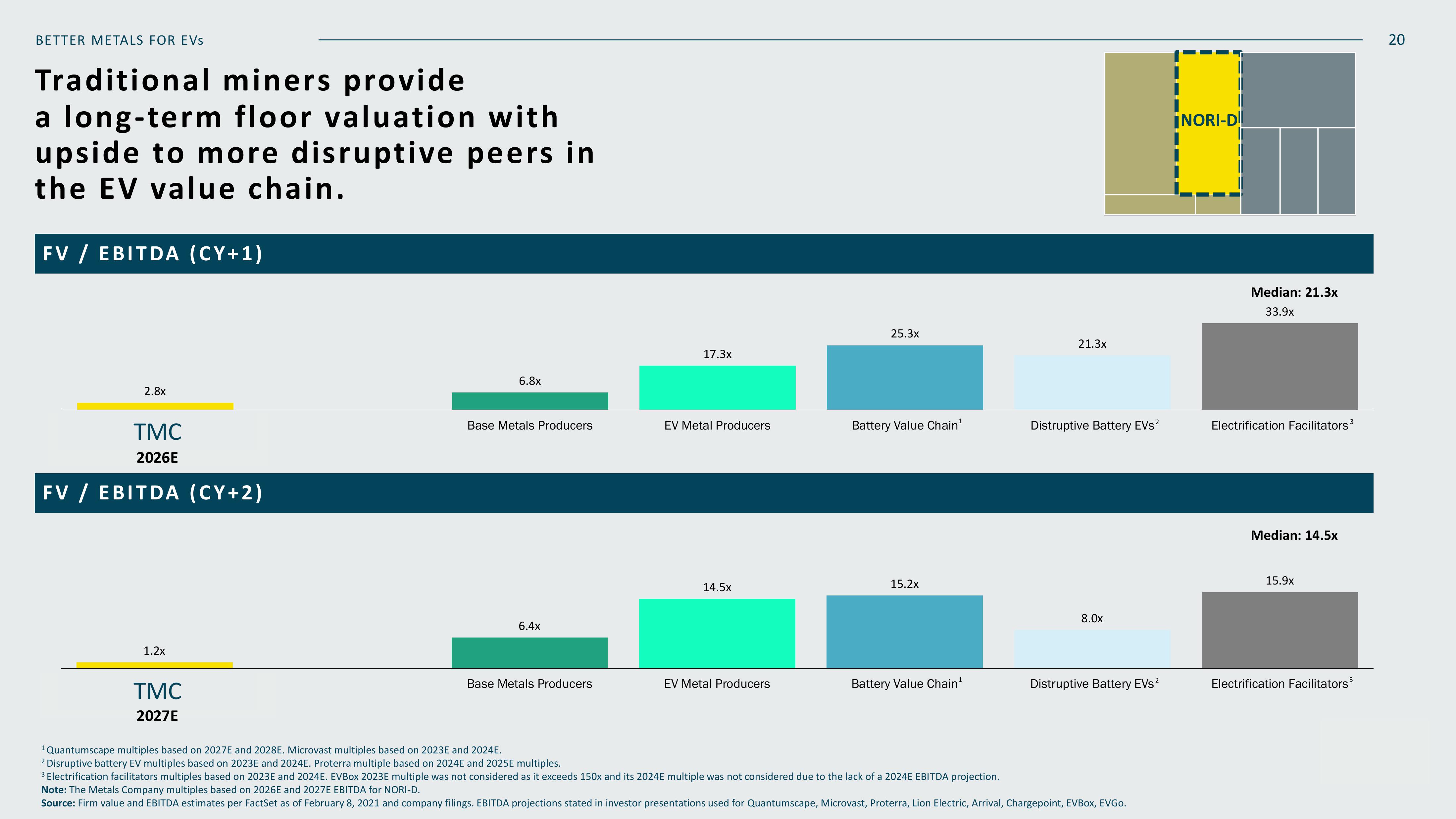

Traditional miners provide

a long-term floor valuation with

upside to more disruptive peers in

the EV value chain.

FV / EBITDA (CY+1)

2.8x

TMC

2026E

FV / EBITDA (CY+2)

1.2x

TMC

2027E

6.8x

Base Metals Producers

6.4x

Base Metals Producers

17.3x

EV Metal Producers

14.5×

EV Metal Producers

25.3x

Battery Value Chain¹

15.2x

Battery Value Chain¹

21.3x

Distruptive Battery EVS²

8.0x

Distruptive Battery EVS²

¹ Quantumscape multiples based on 2027E and 2028E. Microvast multiples based on 2023E and 2024E.

2 Disruptive battery EV multiples based on 2023E and 2024E. Proterra multiple based on 2024E and 2025E multiples.

3 Electrification facilitators multiples based on 2023E and 2024E. EVBox 2023E multiple was not considered as it exceeds 150x and its 2024E multiple was not considered due to the lack of a 2024E EBITDA projection.

Note: The Metals Company multiples based on 2026E and 2027E EBITDA for NORI-D.

Source: Firm value and EBITDA estimates per FactSet as of February 8, 2021 and company filings. EBITDA projections stated in investor presentations used for Quantumscape, Microvast, Proterra, Lion Electric, Arrival, Chargepoint, EVBox, EVGO.

INORI-D

||

|

||

Median: 21.3x

33.9x

Electrification Facilitators ³

Median: 14.5x

15.9x

Electrification Facilitators³

20View entire presentation