Tudor, Pickering, Holt & Co Investment Banking

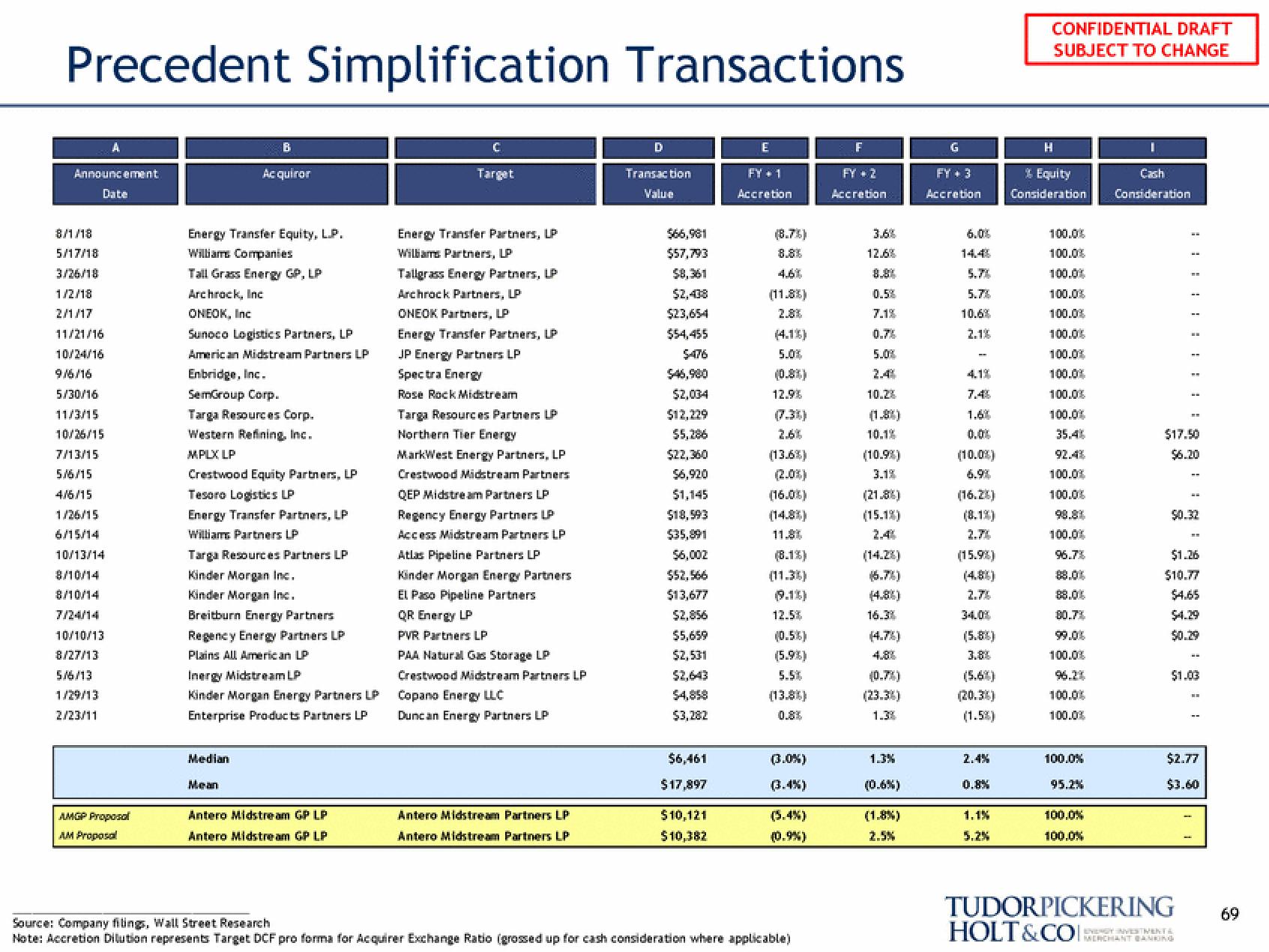

Precedent Simplification Transactions

Announcement

Date

8/1/18

5/17/18

3/26/18

1/2/18

2/1/17

11/21/16

10/24/16

9/6/16

5/30/16

11/3/15

10/26/15

7/13/15

5/6/15

4/6/15

1/26/15

6/15/14

10/13/14

8/10/14

8/10/14

7/24/14

A

10/10/13

8/27/13

5/6/13

1/29/13

2/23/11

AMGP Proposal

AM Proposal

Energy Transfer Equity, L.P.

William Companies

Tall Grass Energy GP, LP

Archrock, Inc.

ONEOK, Inc

Sunoco Logistics Partners, LP

American Midstream Partners LP

Enbridge, Inc.

SemGroup Corp.

Acquiror

Targa Resources Corp.

Western Refining, Inc.

MPLX LP

Crestwood Equity Partners, LP

Tesoro Logistics LP

Energy Transfer Partners, LP

Williams Partners LP

Targa Resources Partners LP

Kinder Morgan Inc.

Kinder Morgan Inc.

Breitburn Energy Partners

Regency Energy Partners LP

ains All American LP

Inergy Midstream LP

Kinder Morgan Energy Partners LP

Enterprise Products Partners LP

Median

Mean

Antero Midstream GP LP

Antero Midstream GP LP

C

Target

Energy Transfer Partners, LP

Williams Partners, LP

Tallgrass Energy Partners, LP

Archrock Partners, LP

ONEOK Partners, LP

Energy Transfer Partners, LP

JP Energy Partners LP

Spectra Energy

Rose Rock Midstream

Targa Resources Partners LP

Northern Tier Energy

MarkWest Energy Partners, LP

Crestwood Midstream Partners

QEP Midstream Partners LP

Regency Energy Partners LP

Access Midstream Partners LP

Atlas Pipeline Partners LP

Kinder Morgan Energy Partners

El Paso Pipeline Partners

QR Energy LP

PVR Partners LP

PAA Natural Stor LP

Crestwood Midstream Partners LP

Copano Energy LLC

Duncan Energy Partners LP

Antero Midstream Partners LP

Antero Midstream Partners LP

D

Transaction

Value

$66,981

$57,793

$2,438

$23,654

$54,455

$46,980

$2,004

$12,229

$5,286

$22,360

$6,920

$1,145

$18,993

$35,891

$6,002

$52,566

$13,677

$2,856

$5,659

$2,643

$4,858

$3,282

$6,461

$17,897

$10,121

$10,382

E

FY + 1

Accretion

(8.7%)

(11.8%)

2.8%

5.0%

(0.8%)

12.9%

(7.3%)

(13.6%)

(16.0%)

11.80

(8.1%)

(11.3%)

(9.1%)

12.5%

(0.5%)

(5.9%)

5.5%.

(13.8%)

0.8%

(3.0%)

(3.4%)

(5.4%)

(0.9%)

Source: Company filings, Wall Street Research

Note: Accretion Dilution represents Target DCF pro forma for Acquirer Exchange Ratio (grossed up for cash consideration where applicable)

F

FY + 2

Accretion

3.6%

12.6%

0.5%

7.1%

0.7%

5.0%

10.2%

10.1%

(10.9%)

3.1%

(21.8%)

(15.1%)

(14.2%)

(6.7%)

(4.8%)

16.3%

(0.7%)

(23.3%)

1.3%

1.3%

(0.6%)

(1.8%)

2.5%

G

FY+ 3

Accretion

6.0%

5.7%

5.7%

10.6%

2.1%

4.1%

7.4%

1.6%

0.0%

(10.0%)

6.9%

(16.25)

2.7%

(15.9%)

(4.8%)

2.7%

34.0%

(5.8%)

(5.6%)

(20.3%)

(1.5%)

2.4%

0.8%

1.1%

5.2%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

H

% Equity

Consideration

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

100.0%

35.46

92.48

100.0%

100.0%

100.0%

96.7%

80.7%

100.0%

96.20

100.0%

100.0%

100.0%

95.2%

100.0%

100.0%

|

Cash

Consideration

$17.50

$6.20

$0.32

$1.26

$10.77

$4.65

$4.29

$0.29

---

$1.03

$2.77

$3.60

TUDORPICKERING

HOLT&COI:

ENERGY INVESTIMENTA

MERCHANT BANKING

69View entire presentation