MariaDB SPAC Presentation Deck

TRANSACTION SUMMARY

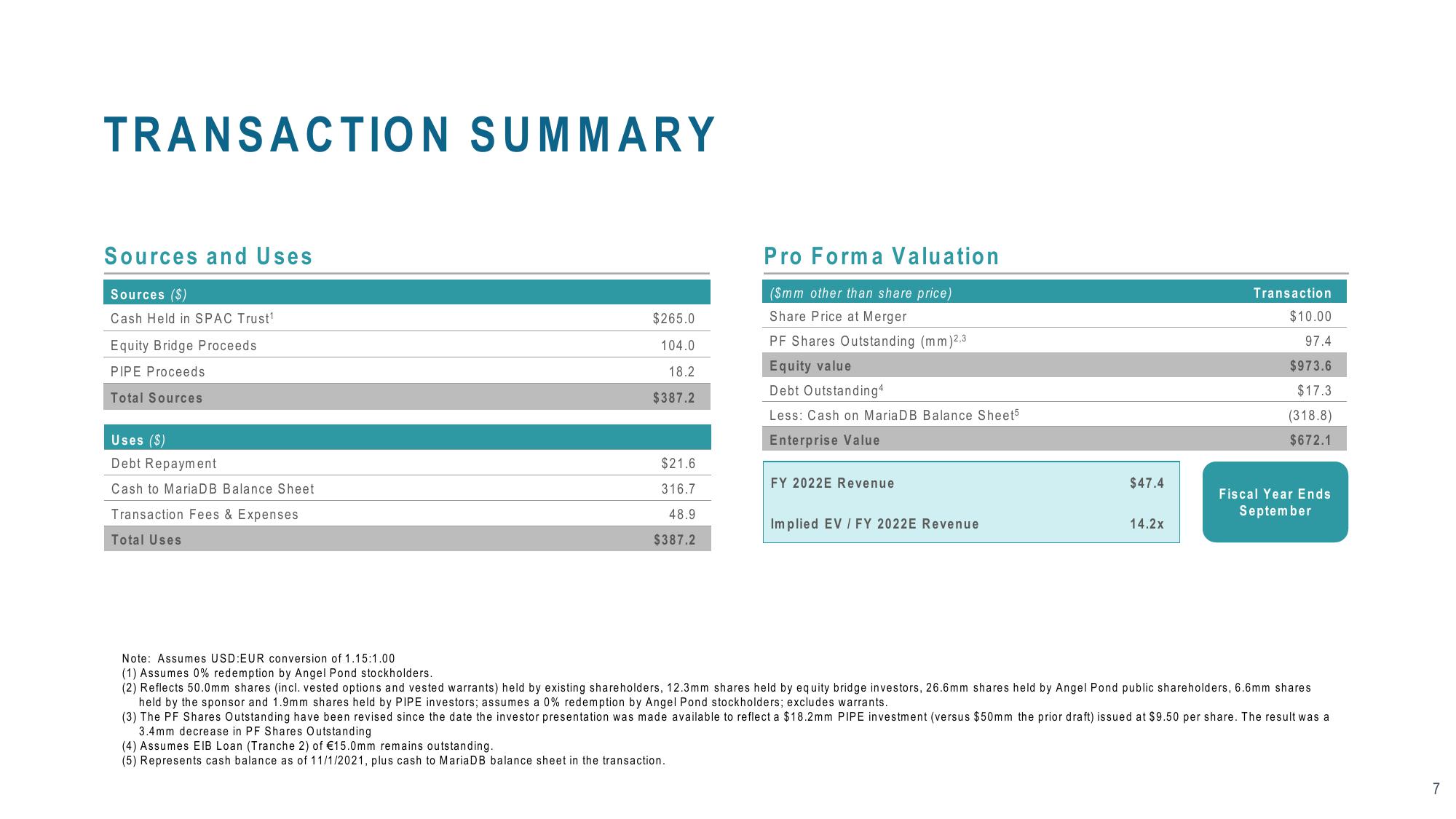

Sources and Uses

Sources ($)

Cash Held in SPAC Trust¹

Equity Bridge Proceeds

PIPE Proceeds

Total Sources

Uses ($)

Debt Repayment

Cash to MariaDB Balance Sheet

Transaction Fees & Expenses

Total Uses

$265.0

104.0

18.2

$387.2

$21.6

316.7

48.9

$387.2

Pro Forma Valuation

($mm other than share price)

Share Price at Merger

PF Shares Outstanding (mm)2,3

(4) Assumes EIB Loan (Tranche 2) of €15.0mm remains outstanding.

(5) Represents cash balance as of 11/1/2021, plus cash to MariaDB balance sheet in the transaction.

Equity value

Debt Outstanding4

Less: Cash on MariaDB Balance Sheet5

Enterprise Value

FY 2022E Revenue

Implied EV / FY 2022E Revenue

$47.4

14.2x

Transaction

$10.00

97.4

$973.6

$17.3

(318.8)

$672.1

Fiscal Year Ends

September

Note: Assumes USD:EUR conversion of 1.15:1.00

(1) Assumes 0% redemption by Angel Pond stockholders.

(2) Reflects 50.0mm shares (incl. vested options and vested warrants) held by existing shareholders, 12.3mm shares held by equity bridge investors, 26.6mm shares held by Angel Pond public shareholders, 6.6mm shares

held by the sponsor and 1.9mm shares held by PIPE investors; assumes a 0% redemption by Angel Pond stockholders; excludes warrants.

(3) The PF Shares Outstanding have been revised since the date the investor presentation was made available to reflect a $18.2mm PIPE investment (versus $50mm the prior draft) issued at $9.50 per share. The result was a

3.4mm decrease in PF Shares Outstanding

7View entire presentation