Nexters SPAC Presentation Deck

Transaction overview

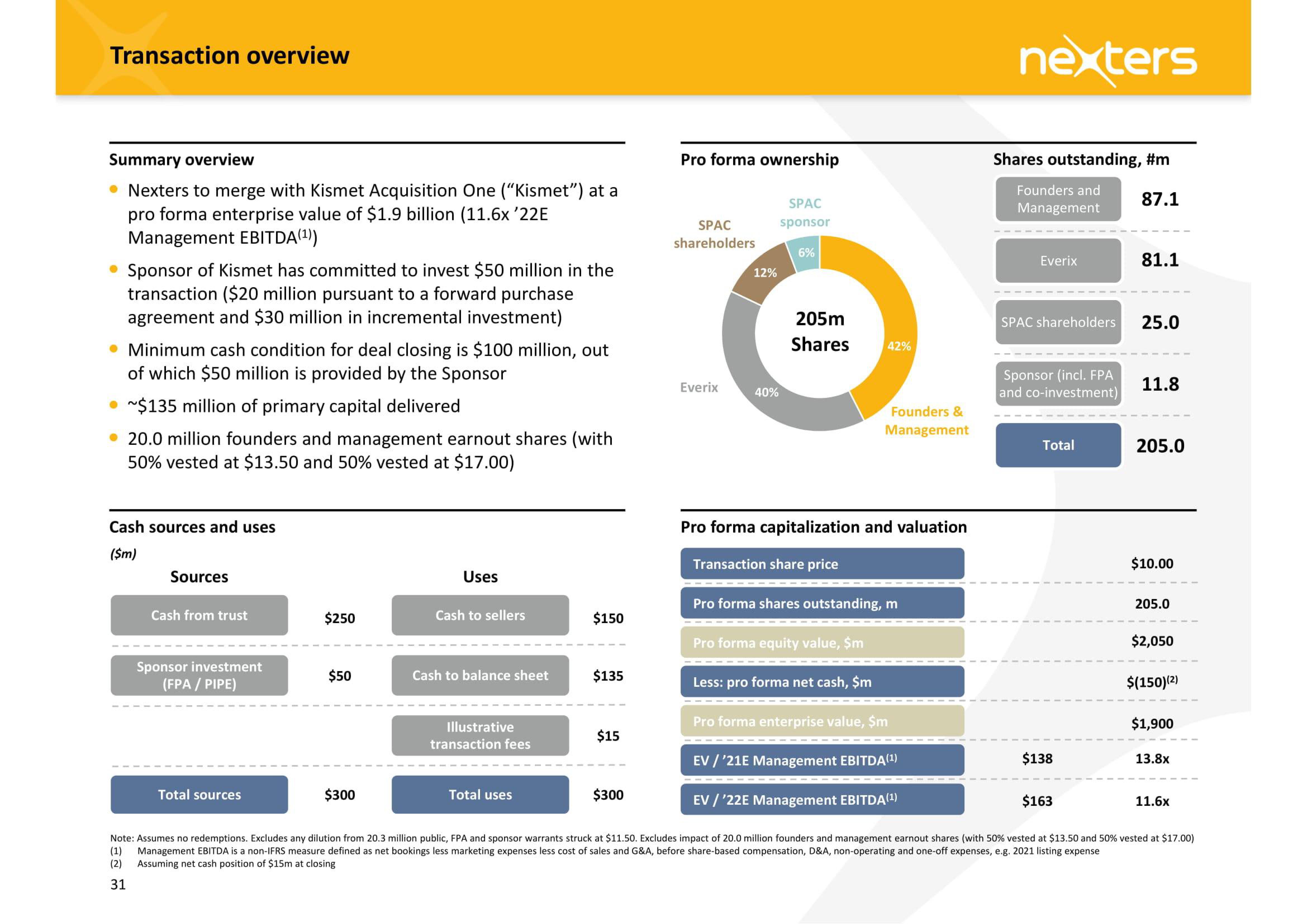

Summary overview

• Nexters to merge with Kismet Acquisition One ("Kismet") at a

pro forma enterprise value of $1.9 billion (11.6x '22E

Management EBITDA(¹))

• Sponsor of Kismet has committed to invest $50 million in the

transaction ($20 million pursuant to a forward purchase

agreement and $30 million in incremental investment)

• Minimum cash condition for deal closing is $100 million, out

of which $50 million is provided by the Sponsor

~$135 million of primary capital delivered

• 20.0 million founders and management earnout shares (with

50% vested at $13.50 and 50% vested at $17.00)

Cash sources and uses

($m)

Sources

Cash from trust

Sponsor investment

(FPA / PIPE)

$250

Total sources

$50

Uses

$300

Cash to sellers

Cash to balance sheet

Illustrative

transaction fees

$150

Total uses

$135

$15

Pro forma ownership

SPAC

sponsor

$300

SPAC

shareholders

Everix

12%

40%

6%

205m

Shares

42%

Pro forma capitalization and valuation

Transaction share price

Pro forma equity value, $m

Founders &

Management

Pro forma shares outstanding, m

Less: pro forma net cash, $m

nexters

Shares outstanding, #m

Founders and

Management

87.1

Everix

SPAC shareholders

Sponsor (incl. FPA

and co-investment)

Total

81.1

$138

25.0

Pro forma enterprise value, $m

EV /'21E Management EBITDA (¹)

EV /'22E Management EBITDA (¹)

$163

Note: Assumes no redemptions. Excludes any dilution from 20.3 million public, FPA and sponsor warrants struck at $11.50. Excludes impact of 20.0 million founders and management earnout shares (with 50% vested at $13.50 and 50% vested at $17.00)

(1) Management EBITDA is a non-IFRS measure defined as net bookings less marketing expenses less cost of sales and G&A, before share-based compensation, D&A, non-operating and one-off expenses, e.g. 2021 listing expense

(2) Assuming net cash position of $15m at closing

31

11.8

205.0

$10.00

205.0

$2,050

$(150) (²)

$1,900

13.8x

11.6xView entire presentation