First Merchants Results Presentation Deck

Non-GAAP

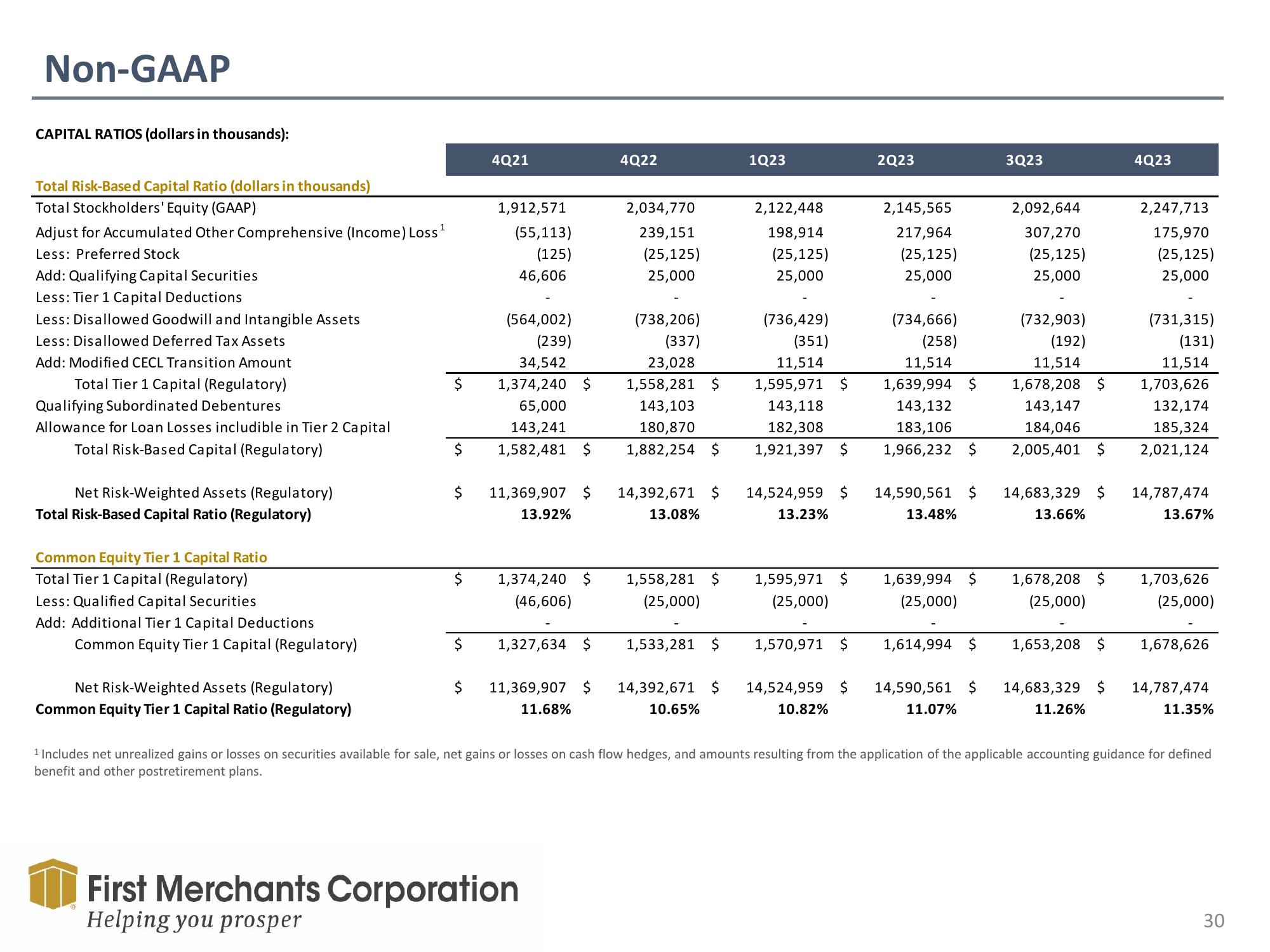

CAPITAL RATIOS (dollars in thousands):

Total Risk-Based Capital Ratio (dollars in thousands)

Total Stockholders' Equity (GAAP)

Adjust for Accumulated Other Comprehensive (Income) Loss ¹

Less: Preferred Stock

Add: Qualifying Capital Securities

Less: Tier 1 Capital Deductions

Less: Disallowed Goodwill and Intangible Assets

Less: Disallowed Deferred Tax Assets

Add: Modified CECL Transition Amount

Total Tier 1 Capital (Regulatory)

Qualifying Subordinated Debentures

Allowance for Loan Losses includible in Tier 2 Capital

Total Risk-Based Capital (Regulatory)

Net Risk-Weighted Assets (Regulatory)

Total Risk-Based Capital Ratio (Regulatory)

Common Equity Tier 1 Capital Ratio

Total Tier 1 Capital (Regulatory)

Less: Qualified Capital Securities

Add: Additional Tier 1 Capital Deductions

Common Equity Tier 1 Capital (Regulatory)

Net Risk-Weighted Assets (Regulatory)

Common Equity Tier 1 Capital Ratio (Regulatory)

$

$

$

4Q21

$

1,912,571

(55,113)

(125)

46,606

$ 11,369,907 $

13.92%

(564,002)

(239)

34,542

1,374,240 $

65,000

143,241

1,582,481 $

1,374,240 $

(46,606)

1,327,634 $

11,369,907 $

11.68%

4Q22

First Merchants Corporation

Helping you prosper

2,034,770

239,151

(25,125)

25,000

(738,206)

(337)

23,028

1,558,281 $

143,103

180,870

1,882,254 $

14,392,671 $

13.08%

1,558,281

(25,000)

$

1,533,281 $

1Q23

2,122,448

198,914

(25,125)

25,000

(736,429)

(351)

11,514

1,595,971 $

143,118

182,308

1,921,397 $

14,524,959 $

13.23%

1,595,971 $

(25,000)

1,570,971 $

14,392,671 $ 14,524,959 $

10.65%

10.82%

2Q23

2,145,565

217,964

(25,125)

25,000

(734,666)

(258)

11,514

1,639,994 $

143,132

183,106

1,966,232 $

14,590,561 $

13.48%

1,639,994 $

(25,000)

1,614,994 $

14,590,561 $

11.07%

3Q23

2,092,644

307,270

(25,125)

25,000

(732,903)

(192)

11,514

1,678,208 $

143,147

184,046

2,005,401 $

14,683,329 $

13.66%

1,678,208 $

(25,000)

1,653,208 $

14,683,329 $

11.26%

4Q23

2,247,713

175,970

(25,125)

25,000

(731,315)

(131)

11,514

1,703,626

132,174

185,324

2,021,124

14,787,474

13.67%

1,703,626

(25,000)

1,678,626

14,787,474

11.35%

¹ Includes net unrealized gains or losses on securities available for sale, net gains or losses on cash flow hedges, and amounts resulting from the application of the applicable accounting guidance for defined

benefit and other postretirement plans.

30View entire presentation